Our fundamental premise in trading the commodity markets is that the commercial traders, in this case, the miners and the end users of the commodity, know that commodity’s value better than anyone else. If not individually, at least, collectively. Therefore, our methodology is based upon selectively following the commercial trader population. This week, we’ll discuss their actions in gold, silver, platinum and copper and explain the psychological battle traders face.

Twenty-five years of trading has taught me three things. First, find a premise that works. Second know your timeframe. Finally, have a short memory. Our methodology showed the building commercial trader net positions in the metals markets late in 2015 and January of this year. We used the late-year sell-off against an increasingly bullish commercial net position to buy into the markets at a general discount. The early 2016 rally was a boon to our February but, our analysis of the commercial trader behavior suggested this rally wouldn’t last.

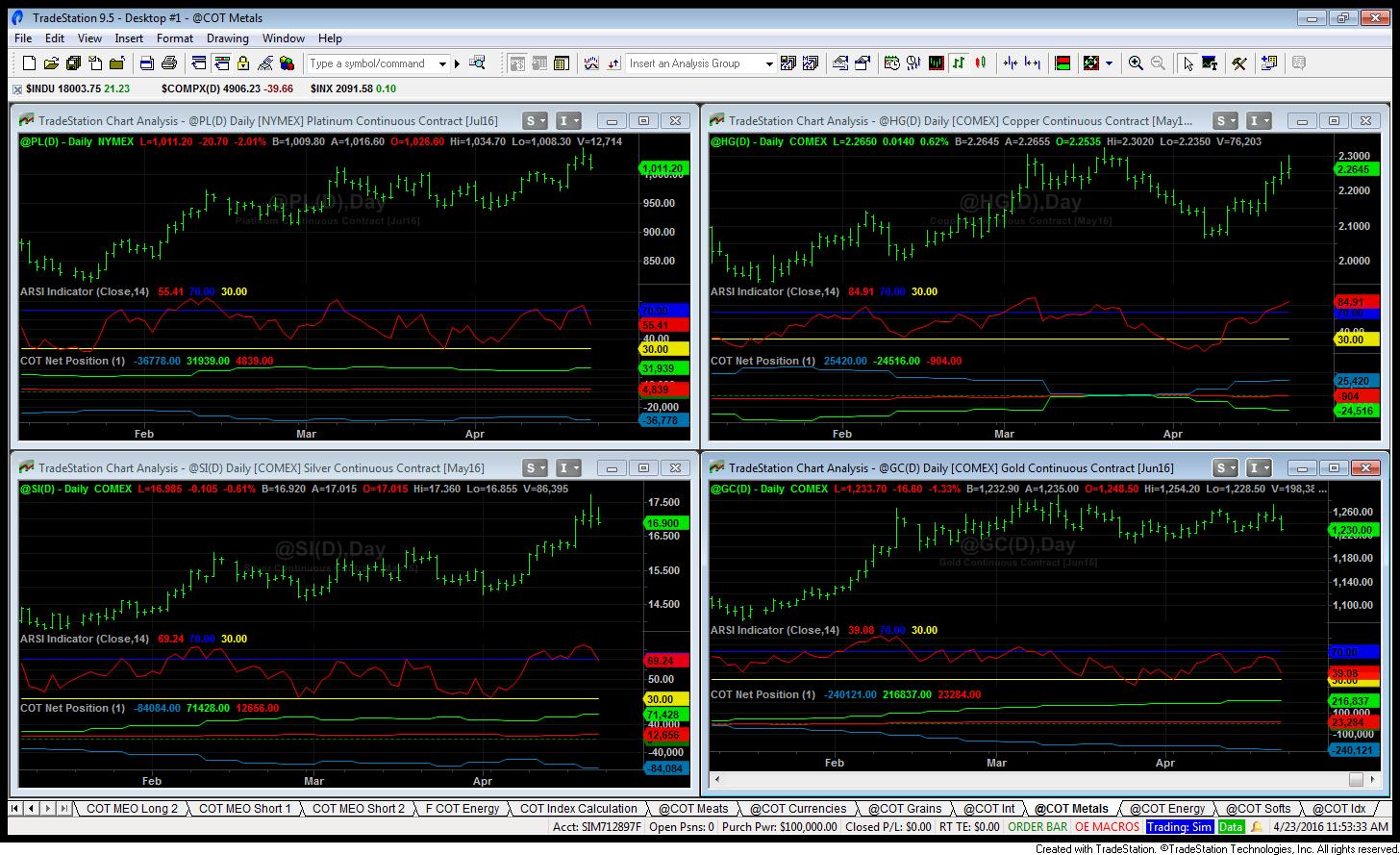

You’ll notice in all three charts except copper that commercial traders began hedging their forward production on this rally at a much faster rate than end-line consumers were locking in future production inputs at the recently elevated prices. Furthermore, the selling that began in early February still continues. The pronounced commercial selling has put us on the lookout for Commitments of Traders sell signals since early March. This resulted in losing silver and platinum trades but was profitable in gold. The important feature here is the timing. We didn’t buy silver at $14.50 and sell it above $17. We bought the metals low. Sold them on the early rally. Lost on two out of three recent shorts and are now setup to re-sell gold, silver and platinum for our third round of trades in the metals already this year.

Some notes from our March 23rd letter. (Updates in parentheses.)

Gold

Large speculators reached their largest net long position since 2012 last week. This is another classic example of speculators having their largest positions on at the most inopportune moments. (Now since August 2011)

The large speculator position was more than offset by corresponding commercial trader selling as commercial traders have sold nearly 100k contracts during last week’s congestion. (Now the most bearish since November 2012)

Lastly, commercial traders controlled more than 50% of the total open interest. Their behavior compared quite favorably to the October sell-off analog. (Unchanged)

Platinum

Speculators tried to stem platinum’s decline dating back to the June sell-off, which saw them set a record long (and wrong) position.

Last week, we saw commercial traders take control of the market’s open interest just as it did in gold.

Lastly, the commercial traders’ surpassed their short position total from the recent October highs. This indicated their willingness to sell more at lower prices, which is obviously very bearish. (Their selling has continued and their net position is nearly 10% more bearish, now)

Silver

Commercial traders, as determined by their net position, have not been this bearish on silver since 2008. Remember, silver traded from $21 per ounce all the way down to $8 and change before the 2011 rally. (They set a new record short total last week!)

By comparison, the large spec position at the October highs was the largest it had been in more than 10 years. It has been proven over and over again and again, the market punishes the greedy. Speculative traders are greedy by nature or, they wouldn’t be trading commodities in the first place. (Now the biggest since 2005!)

Obviously, we think the precious metal markets are heading lower. How low? Who knows? We think the trends on the included charts would be a good place to start. However, the goal is to be profitable. We’ll trade them all and manage the positions. We don’t expect to hit homeruns in a methodology that rarely holds a trade more than two weeks. The common phrase nowadays is, “knowing one’s lane.” I’m a swing trader who takes his cues from the people who only have to analyze one market; theirs. Furthermore, I keep my risk small and I don’t overstay my welcome….just don’t tell the grain markets as we try and get ourselves reversed to the short side there as well.

We offer both mechanical and discretionary trading signals based on the Commitments of Traders reports. Visit CotSignals.com for examples of each across all 36 markets we follow.