Last week, there were three IPOs to successfully price, which seemed liked an onslaught of new deals, considering how dormant the IPO market has been this year. Nevertheless, this was a step in the right direction, especially since two of those IPOs saw fairly strong demand.

One of those IPOs that had a solid debut was MGM Growth Properties (MGP), a spin-off from MGM Resorts (MGM), which will now take ownership of nine Las Vegas resorts and three others outside of Las Vegas. Specifically, its 50 million share IPO priced at the high end of expectations at $21 and opened for trading at $22.75, good for an 8% pop.

MGP’s positive start could be a good omen for another IPO this week: Red Rock Resorts (RRR), a resort casino owner with heavy exposure to an improving economic backdrop in Las Vegas. The company is looking to sell 27.3 million shares within a range of $18-$21 for total gross proceeds of $531.4 million, at the mid-point. The deal, led by Deutsche Bank, JP Morgan, BofA Merrill Lynch, and Goldman Sachs, is expected to price on April 26 and open for trading on April 27.

For investors considering an investment in RRR, MGP’s success should provide some comfort. However, these two IPOs have some significant differences. In some ways, like RRR’s off-the-strip resorts, its deal seems to lie in the shadows of MGP due to the unfavorable structure of the IPO itself.

RRR Deals a Bad Hand to New Investors

The structure of this IPO looks like a pretty raw deal for investors. Here’s why. To begin with, while the company is selling a majority of the shares, the proceeds will not be used for anything that helps the business. Instead, most of the money will be funneled to Station LLC to pay a portion of the consideration for the Fertitta Entertainment Acquisition.

This is complex, but, essentially, this is the background of how this IPO transaction will work. On April 30, 2012, Station Holdco and Fertitta Entertainment (brothers Frank & Lorenzo Fertitta are owners of Fertitta Entertainment) came under the common control of the brothers, who collectively own more than 50% of the voting and economic interests. Then, in October 2015, Station LLC entered into an agreement to purchase all of the outstanding membership interests of Fertitta Entertainment (aka, the Fertitta Entertainment Acquisition), which constitutes the acquisition of an entity under common control.

Now, in connection with this IPO, RRR will consummate the Fertitta Entertainment Acquisition for a purchase price of $460 million, less other considerations. The purchase will be paid to entities that are affiliated with Frank and Lorenzo Fertitta, and another entity owned by current and former employees of Fertitta Entertainment. Basically, in a very roundabout way, the IPO is just a vehicle for the Fertitta’s to cash out on its investment.

But that’s not all. There will be a dual share structure, with Class A shares being offered in the IPO, but, no Class B shares being offered. Those shares hold ten votes per share. And, you guessed it, the Fertitta’s will own those shares. So, like a magician, the brothers will make a bundle of money by off-loading the Fertitta Entertainment enterprise, but, will still continue to have majority control of RRR because of the Class B shares.

The “Local’s Casino”

During its IPO road show presentation, RRR’s CEO described the company as the “Cheers” of the casino industry — a place where “everybody knows your name.” That family type of atmosphere was what its original founders envisioned back in 1976 when it opened its first property, simply called The Casino (now known as Palace Station), just off the strip in Las Vegas.

Instead of relying on the more fickle and unpredictable tourist, the company instead decided to cater to the workers on the strip and in Las Vegas, seeking repeat business from loyal customers.

It operates 21 casino resort properties, of which 19 are located in the Las Vegas area. The company made it a point in both its road show and its prospectus to note that about 90% of the Las Vegas population lives within five miles of one of its properties. A few of its largest in the Las Vegas area include Red Rock, Green Valley Ranch, Palace Station, Boulder Station, Texas Station, Sunset Station, and Santa Fe Station.

Outside of Vegas, RRR also manages Gun Lake Casino in Michigan and Graton Resort & Casino in California, which are Native American owned properties. Its properties also span across different price points, with some luxury resorts (Red Rock, Green Valley Ranch), mixed in with moderate (the “Station” group) and a couple value type resorts. This gives it portfolio some diversity in terms of its customer base.

Looking ahead, the company has multiple expansion projects planned that should boost its revenue and cash flow. This will come in two forms: 1). expanding at select existing properties, and 2). brand new developments in different markets. For the former, RRR has planned expansion projects at Red Rock, Palace Station, and Sunset Station.

Additionally, in its Native American casino business, the company has a $175 million, 200 luxury room expansion project at Graton Resort that’s expected to be completed this fall, as well as an $85 million expansion project expected in the summer of 2017 for Gun Lake.

Financial Review

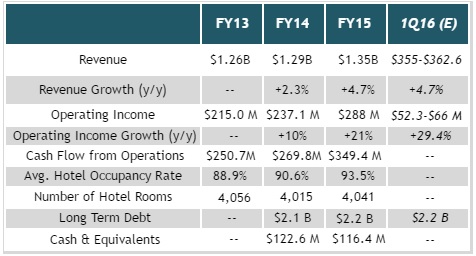

With low single digit revenue growth, RRR is not a topline growth story. Its pedestrian revenue growth may be enough to steer away some growth-oriented investors, but, there’s more to consider as RRR shines in other areas.

For instance, the company is doing a very impressive job of flowing that revenue growth down the income statement. As the table above illustrates, operating income growth has been strong, and has been on the rise. The metric that RRR’s management likes to focus on is Adjusted EBITDA margin, which it says are the highest in the industry.

In fact, over the past five years, Adjusted EBITDA has improved by 900 basis points to 33%. This compares very favorably to its closest competitor, Boyd Gaming (BYD), with Adjusted EBITDA margin of 26%.

Another standout metric is its cash flow from operations, jumping from $250.7 million in FY13 to $349.4 million last year. Its confidence in its cash flow generating capabilities will allow it to offer a quarterly dividend of $0.10/share for an annualized yield of 2%.

That payout would likely be more, if not for the huge amount of debt on the balance sheet. In FY15, RRR dished out $144.3 million in interest expense. Its debt is an area of concern because it has over $215 million in long term debt coming due next year.

Looking further out, it has a whopping $1.33 billion due in 2020, that most almost certainly will need to be restructured.

Conclusion

RRR is an IPO I have mixed feelings on, but, I do believe the fundamentals skew to the positive side. Furthermore, the deal has tier one firms behind it, matching the quality of how its operations are managed.

The company is getting more out of less revenue growth than virtually any IPO I have analyzed. That speaks volumes about the effectiveness of its management team and the cost controls it has put into place.

Also on the positive side is RRR’s cash flow generating ability, and the growth in cash flows over the past few years. This has enabled it to expand and improve upon its existing properties, pay down some debt, and allow it to offer a dividend — albeit, a fairly modest one.

What gives me cause for concern, though, is how this deal is being structured as a means to pay-out the owners, via the Fertitta Entertainment Acquisition, while ensuring that they maintain control over RRR. What’s really hard to swallow is that the company is sitting on about $2.2 billion in debt, with a huge chunk of that coming due over the next few years. So, the company certainly could have used the IPO proceeds to pay down some of that debt.

To conclude, if it weren’t for the how this IPO was structured, I would be even more bullish on it given that the fundamentals look good overall.