As we recently explained, you’ll have to deal with a few problems when using ETFs to “buy oil”. But if you want to juice your returns further using levered ETFs, you’re going to run into even more issues.

In general, investors should avoid trading any instrument they haven’t thoroughly researched and understood. This includes ETFs, both levered and unlevered. Sure these trading vehicles seem simple enough, but do you really know what’s going on beneath the hood? Have you read the prospectus? Probably not. Who reads directions anyway right?

Well… ETFs are more complicated than that IKEA desk you put together last weekend. The “directions” are actually important. All 190-pages of them…

But don’t worry. We read them so you don’t have to. After watching investors go nutty in the oil markets via levered ETFs, we thought it prudent to dissect the popular triple-levered oil ETN — UWTI. We want to make sure you know exactly what you’re getting into before you play with this particular kind of fire.

First off, trading vehicles like UWTI are not actually ETFs. They’re ETNs. ETNs are “exchange traded notes” — which are senior, unsecured debt securities that a bank issues.

Here’s a quick review of what these debt terms mean:

- Senior — The first tranche of debt a company has to pay out of it goes out of business.

- Unsecured — A loan not backed by an underlying asset.

These notes are tied to the performance of a benchmark which the bank promises to pay the investor minus fees.

UWTI is Credit Suisse’s 3x levered-long crude oil ETN. It tracks the daily movements of the S&P GSCI® Crude Oil Index while paying three times the index’s daily gain or loss. If the oil index jumps 1%, UWTI should rally about 3%. If the oil index falls 1%, then UWTI drops 3%.

Oil is pretty volatile already, but throw 3x-leverage on top and you’re in for a wild ride. The returns become more unpredictable than Kanye West. That’s what you get when trading something like UWTI.

This unpredictability stems from something called volatility drag.

Vol drag is a fancy quant term used to explain the effects of negative compounding. This phenomenon actually occurs in all price series, but its effects are exacerbated and easier to see in a levered ETN like UWTI.

Vol drag is pretty simple to understand. All you need to know is that a loss hurts more than a comparative gain.

Imagine you start with $100 in your account. You make 10% this week and lose 10% the next. This means your account would shoot to $110, and then drop to $99. The result is a net-loss. Contrary to what many believe, you do not end up breakeven at $100 again. You can thank negative compounding for that.

The more price shoots up, down, and up again, the more you lose to vol drag. Now apply 3x leverage to everything and the downside becomes even worse.

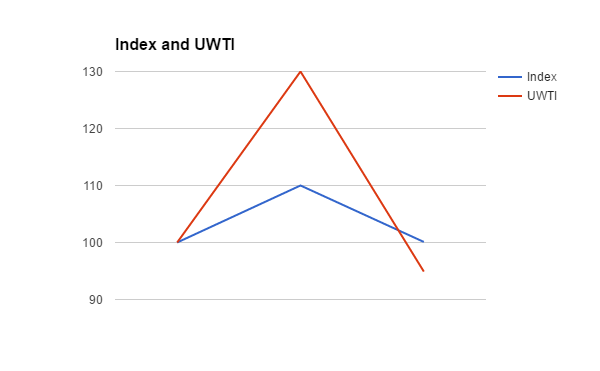

Using the 3x-levered UWTI as an example, let’s say the oil index starts at $100, gains 10% one day and then loses 9% the next. This means UWTI would gain 30% on day 1 and then fall 27%. Let’s assume that UWTI is also priced at $100 a share. The chart below shows the final values of both:

The oil index ends up where it started. But UWTI falls lower than both the index and its own original value! UWTI’s leverage causes the underperformance which compounds overtime and kills total returns.

Investors in these levered vehicles fail to realize that they’re not just betting on the price of oil. They’re also making a bet on realized volatility. Realized volatility is another fancy quant term that measures how much price oscillates up and down. The more price oscillates, the higher the realized vol. And higher realized vol means more vol drag, which as we saw above, is no good for returns.

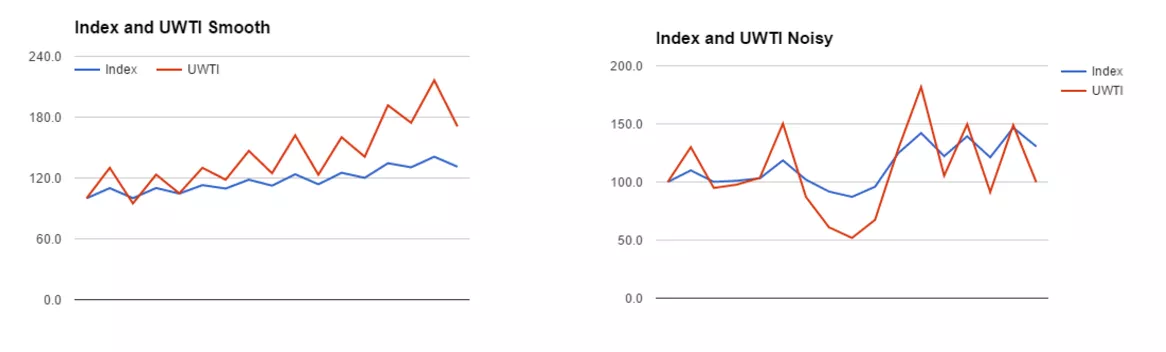

If oil rises smoothly without much fluctuation, then UWTI will greatly outperform the index. But if the path higher is noisy with wild oscillations, UWTI suffers from major vol drag and underperforms. You can see this in the graphs below:

The oil index ends up where it started. But UWTI falls lower than both the index and its own original value! UWTI’s leverage causes the underperformance which compounds overtime and kills total returns.

Investors in these levered vehicles fail to realize that they’re not just betting on the price of oil. They’re also making a bet on realized volatility. Realized volatility is another fancy quant term that measures how much price oscillates up and down. The more price oscillates, the higher the realized vol. And higher realized vol means more vol drag, which as we saw above, is no good for returns.

If oil rises smoothly without much fluctuation, then UWTI will greatly outperform the index. But if the path higher is noisy with wild oscillations, UWTI suffers from major vol drag and underperforms. You can see this in the graphs below:

Both examples show the oil index going from 100 to about 131. But the paths are completely different.

In the graph on the left, the index finishes at 131 in a smooth “drip drip” fashion. UWTI finishes around 171. Index 31% gain. UWTI 71% gain. Time to pop the bubbly!

On the right, the index finishes at 131 as well, but the path looks more like a roller coaster. In contrast to the smooth scenario, UWTI finishes around 100. The index gains 31%, while UWTI gains 0%. So even though the oil index finished higher, UWTI made NO money at all. No bubbly this time. Cheap whisky out of a brown paper bag is more appropriate…

And now you see the problem with levered ETFs. If the price path is volatile, you end up with terrible results, even if you were ultimately right on the direction of the index!

And what about if you’re wrong and the oil index finishes lower? Well then your savings will take a beating so bad that your spouse will up and leave you.

Vol drag isn’t some big secret either. The administrators of the UWTI ETN actually talk about it in the prospectus. But of course no one reads it…

“Daily rebalancing will impair the performance of the ETNs if the applicable Index experiences volatility from day to day and such performance will be dependent on the path of daily returns during the holder’s holding period. At higher ranges of volatility, there is a significant chance of a complete loss of the value of the ETNs even if the performance of the applicable Index is flat.”

If you want survive in these markets then stick with trading outright oil futures rather than UWTI, DWTI, or even USO. There’s really no need to screw around with these leveraged ETFs/ETNs.

For more information about trading oil futures for beginners, please click here.