The US stock market continues to be resilient and push upward. On Tuesday, equities closed on the highs +1.2%. So, what could derail US equities from breaking out to new highs? Weak US economics? Probably not. Considering that we are in the bad news = good news environment. Poor US economics have translated into the US Fed pushing off interest rate hikes to a later date. Case in point, last Friday a weaker than expected jobs reports (Nonfarm payrolls = 160k vs expected 200k) drove the S&P to rally 1% from the premarket lows as the possibility of a Jun rate hike diminished.

One area that could derail US Equities is China. The Shanghai and Hong Kong markets have been fairly quiet in 2016 but the China related ETFs are starting to see outflows. Over the last month China ETFs have lost -$935M in assets. For example, take a look at the chart of the outstanding shares of the FXI (iShares China Large-Cap ETF) below so see the recent increase in ETF redemptions.

FXI – outstanding shares

Source: Bloomberg

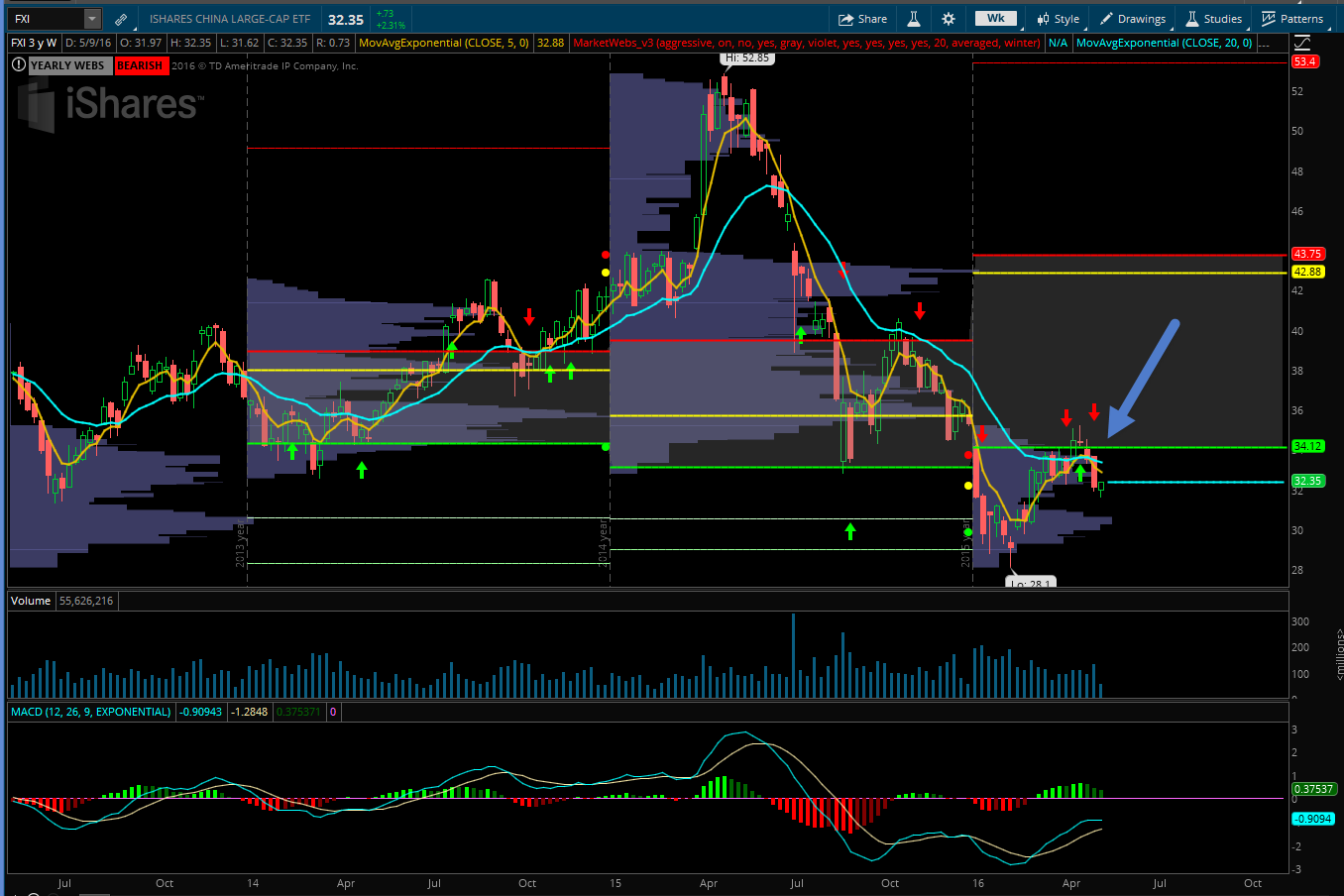

In addition, the technicals in the FXI ETF are weak. Recently, the ETF tried to regain the Value Area on the weekly chart and failed. See below.

FXI – weekly chart

With more China economics this week including Industrial Production and Retail Sales I think it makes sense to add a bearish trade in the FXI ETF.

The Tribeca Trade Group Trade Idea:

– Purchase the FXI June 31 puts @ $0.56 (closing mark from 5/10)

Disclosure: I currently have a short position in the FXI ETF

Follow @cfromhertz on twitter for the latest trends in ETFs and Equity Options.