The Canadian Dollar is relatively more sheltered from the “inverse effect” that causes other heavily traded currencies to decline when the U.S. Dollar rallies. For that reason, we are tempering our generally bearish forex view with a special caveat for the Canadian Dollar. It should decline, but not as forcefully as we expect other currencies to decline.

The long-term Elliott wave pattern in the Canadian Dollar vs. the U.S. Dollar also highlights why this may be so. The entire structure from 2008 appears corrective, but it is unclear whether the last move should consist of three waves (already complete) or five waves (not yet complete).*

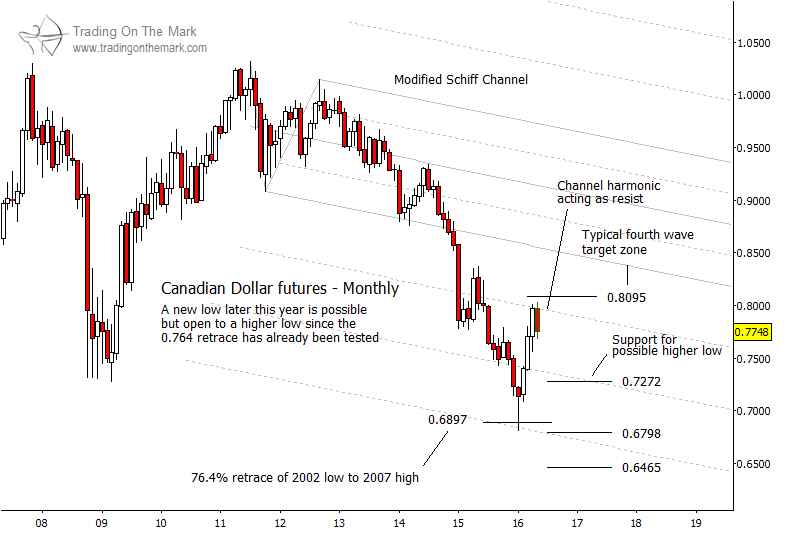

One point in favor of the large correction being complete is that price found support near the 150% extension of the modified Schiff channel shown on the monthly chart. The same area represented a Fibonacci 76.4% retracement of the Canadian Dollar’s advance during the prior decade. If the large correction is complete, then we might expect a downward retracement from the present area to find support near 0.7272 before bouncing higher.

On the other hand, if price is tracing a still incomplete five-wave structure down from its 2011 high, then supports near 0.6798 or 0.6465 could serve as targets. In that scenario, we would view the present high as some stage of a developing fourth wave in the downward sequence.

* While there is not room here to discuss the nuanced differences between the more bearish and the less bearish wave counts, we will discuss the pattern further at our website later this week. Follow us on Twitter or facebook to receive a notification when the extended discussion is posted.