As traders, we make our living each and everyday trying to find the best trading opportunities. For some, daily profits are the lifeblood of their existence not just feeding the ego but also paying the rent, putting food on the table and paying the bills. This of course is the wrong approach for anyone who really chooses this career, as the timeframe chosen is critical as is the amount of capital in reserve. Most of us realize the best possible position is to be well-capitalized, have expenses in reserve and come in each day without the daily pressure of needing to make your ‘nut’.

But what about the times when the market dictates you do absolutely nothing? Does the trader who needs to make a living acknowledge when this is appropriate, or continues to trade when results are unlikely to be positive – pushing on a string. Currently, volatility indices are still in relatively low territory, still under 16%. This smacks of complacency of course, and is a danger sign. We are still in a stock picker’s market, but there are some cracks showing.

Why so much complacency after a 3% drop from the mid-April highs? Market player have become conditioned to expect the Fed and other central bankers to come in and ‘save the day’ when markets swoon. That is the observation of many data points, but is truly the ‘lazy man’s approach to analysis. The ‘Fed put’ on the market is alive and well, they will save the markets every time, right? That happened just recently.

We are only a few months removed when we witnessed the markets falling hard, the worst six week start ever for a calendar year in history. While it was certainly opportunistic to play for some downside or pick up bargains in the January hail storm, it was best served just to wait it out until it passed. Our first instinct is always to dive in and grab stocks or options that drop sharply, but not knowing where that bottom lies is akin to grabbing at falling knives – you’ll get bloodied.

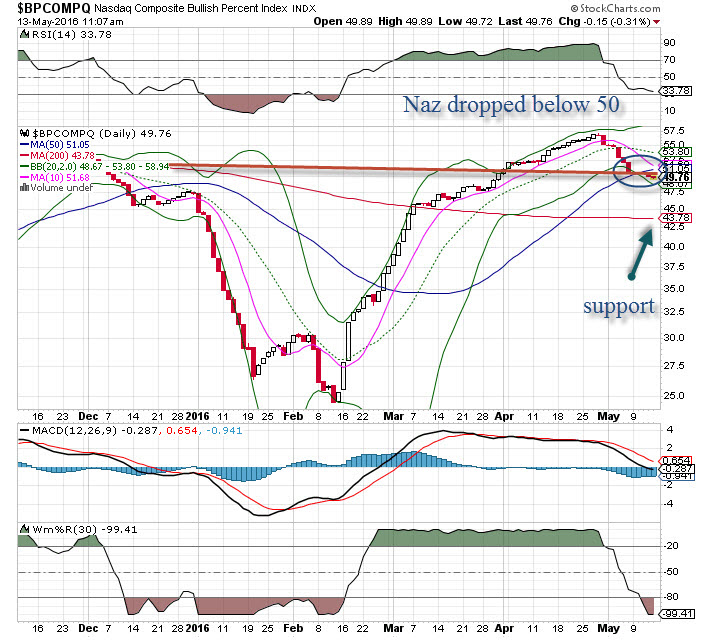

So, while today we are not in that situation we do have some warning signs. Breadth figures have come back from elevated level in early April, when we saw some outstanding numbers. Put/call ratios have become elevated once again as players are buying protection, but then the VIX is not portraying very wide move on the horizon. However, the oscillators are very oversold and about to flash a reversal buy signal. The bullish percent index for the Nasdaq fell below 50 (a key level), a red flag – while the SPX and NYSE are still well above that key marker. The most important indicator is price action – which has been poor for a couple of weeks. Price rules the day, while volume tells us the market is still under distribution. Hence, a very mixed but murky picture.

At this point, we would be served best preserving our capital and waiting for the clouds to clear. While we are often late to the party because of the speed this market it seems being patient and waiting for the right pitch is the right move here. The market won’t take off without us.