EURUSD, as expected moved lower last week. It closed at 1.1307 on Friday. I expect this market to keep going lower for now but the downside should be limited. Looking at speculative positions I see this market might be turning bullish in the long term.

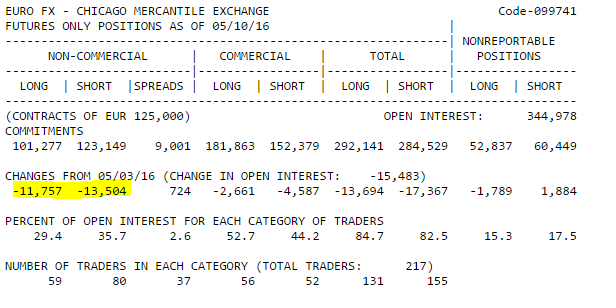

This week, speculators reduced their shorts by another 13K and their longs by 11K.

This group have been dumping their short positions since December last year. At the peak in November 2015, they held 261K shorts and only 80K longs.

This week, their total short potions stand at 123K and their longs are at 101K.

The gap (as seen in the screenshot below) is now almost closed. We have not seen this dynamic for a very long time.

With the low probability of FED raising rates this year indicated by FED WATCH, this market could be turning bullish very soon.

I would like to wait another few week and see speculators adding longs more aggressively.

Once this is the case, I will be looking out for bullish reversals on daily charts to position on the long side of this market for the long term.

To learn how you can cut your trading losses in half and get on the path to profitability, visit Humble Traders – www.humbletraders.com