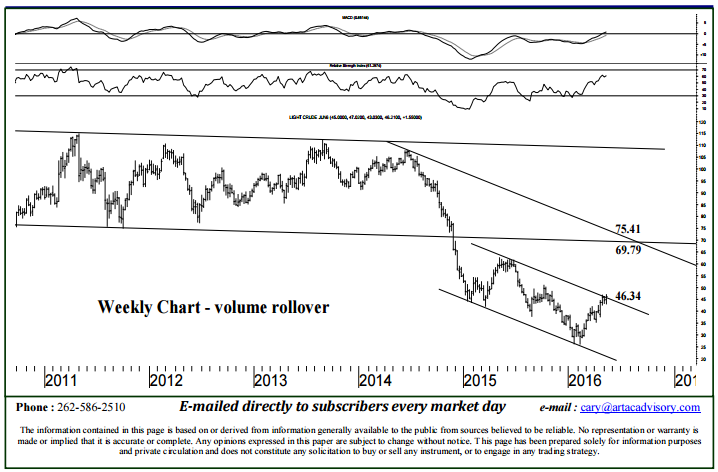

Please note today’s technical levels begins July 2016 contract analysis.

SHORT-TERM (today 5 days out) For Wednesday, 48.75 can contain session weakness, 49.22 in reach and likely to contain initial strength, beyond which 50.83 is attainable intraday, likely to contain session strength. A settlement today about 50.83 indicates 53.21 within several days, targeted resistance able to contain strength through next week. Downside today, breaking/opening below 48.75 allows 47.54 intraday, while closing below 48.75 should yield 46.34-42 by Friday’s close, a meaningful range of support able to contain selling into later year and above which a long-term buy signal remains “in the works” – confirmed Friday.

MID (2-3 wks) & LONG TERM (2-3 ms )

Long-term resistance in the 46.34-49 region (page 2) can contain strength through the balance of the year, below which the market’s dynamic remains heavy over this time horizon, 33.44 expected within 3-5 weeks, a retest of this year’s 26.05 low within several months. On the other hand, a weekly settlement Friday above 46.34 (and above 1% margin of 46.80 for buy signal clarity) indicates a good 2016 low, 54.86 then expected within 2-3 weeks, 69.79 within 5-8 months, the start of a wide yet narrowing range of long-term resistance up to 75.41 able to contain strength through 2017.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE