Over the last week we have seen one traditional Retail company after another get smoked as earnings reports from M, JWN, DDS, KSS, JCP and today TGT have been weaker than what street has been expecting. The result has been many of these traditional retailers have taken out the October lows.

Who could be the next name in the group to fall? Today we are seeing heavy short dated put activity in BBY (Best Buy Co.). BBY reports earnings on 5/24 and most of the put activity has been concentrated in the weekly 5/27 options which covers this earnings report. So, it appears there is speculation on a weaker than expected earnings report form BBY.

Source: Bloomberg

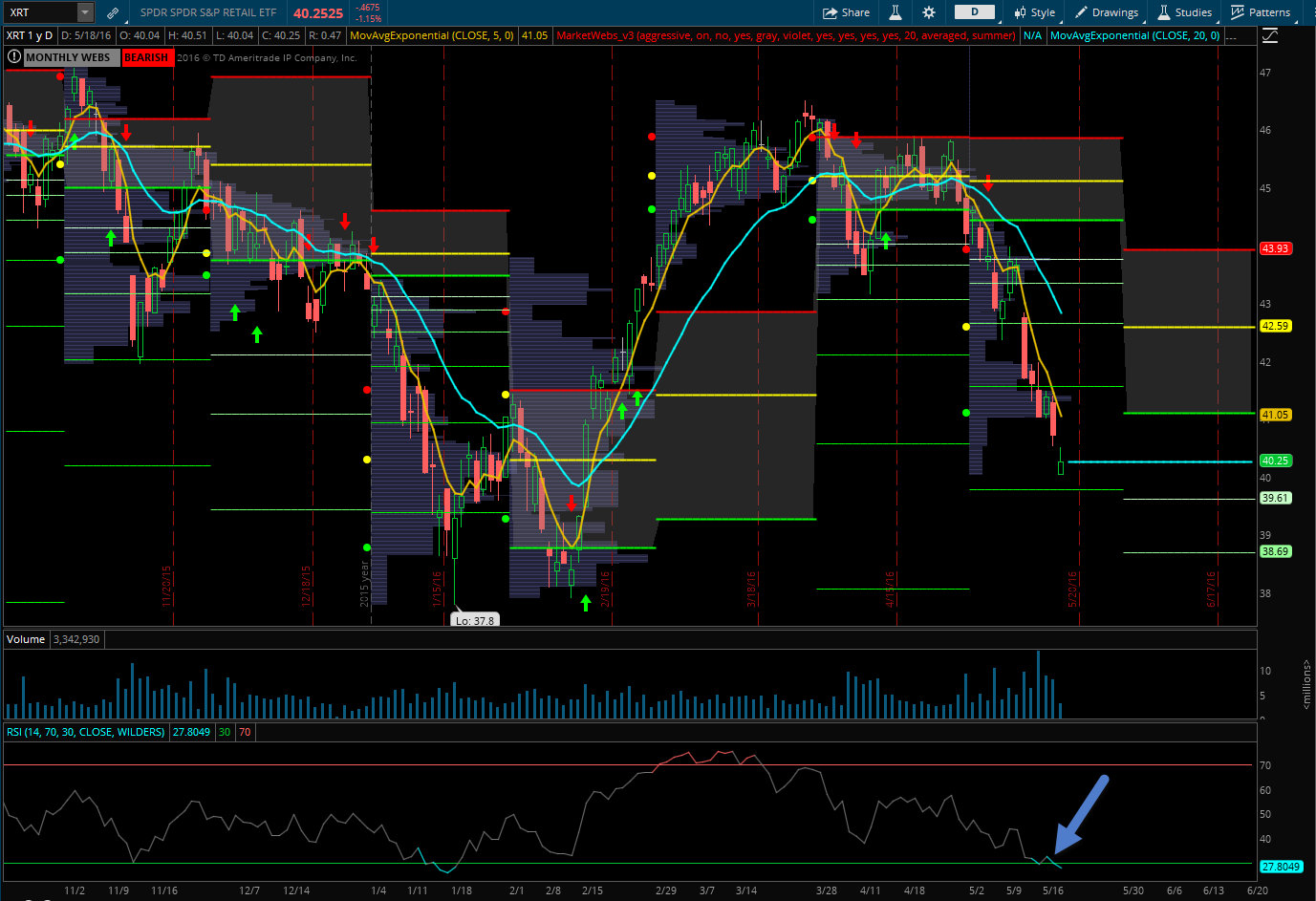

So, while a breakdown in BBY has not occurred yet, it has certainly occurred in the sector. The XRT ETF (SPDR S&P Retail ETF) has now reached oversold levels according to the RSI (Relative Strength Index) currently at 27.6 on the daily chart (see below). Typically a reading below 30 is considered oversold on the RSI.

XRT – Daily Chart

Source: ThinkorSwim

I personally like buying an oversold group and selling a name in the same group that hasn’t experienced a selloff. This is a market neutral type strategy.

Here is the Tribeca Trade Group Trade Idea

Using Options: Apply a “Limited Risk Reversal” style Pair Trade:

– Purchase the BBY May 27th 30 puts & sell the May 27th 31.5 / 33.5 call spread to help finance the cost of the puts

– Purchase the XRT May 27th 41 calls & sell the May 27th 38.5 / 40 put spread to help finance the cost of the puts

Disclosure: This is a complicated and high risk option strategy.

Or using stock

– Sell BBY stock

– Purchase XRT stock

Note the above type structure is thoroughly explained in the Tribeca Trade Group trading room. Follow @cfromhertz on twitter for more info.

Follow @cfromhertz on twitter for the latest trends in ETFs and Equity Options.