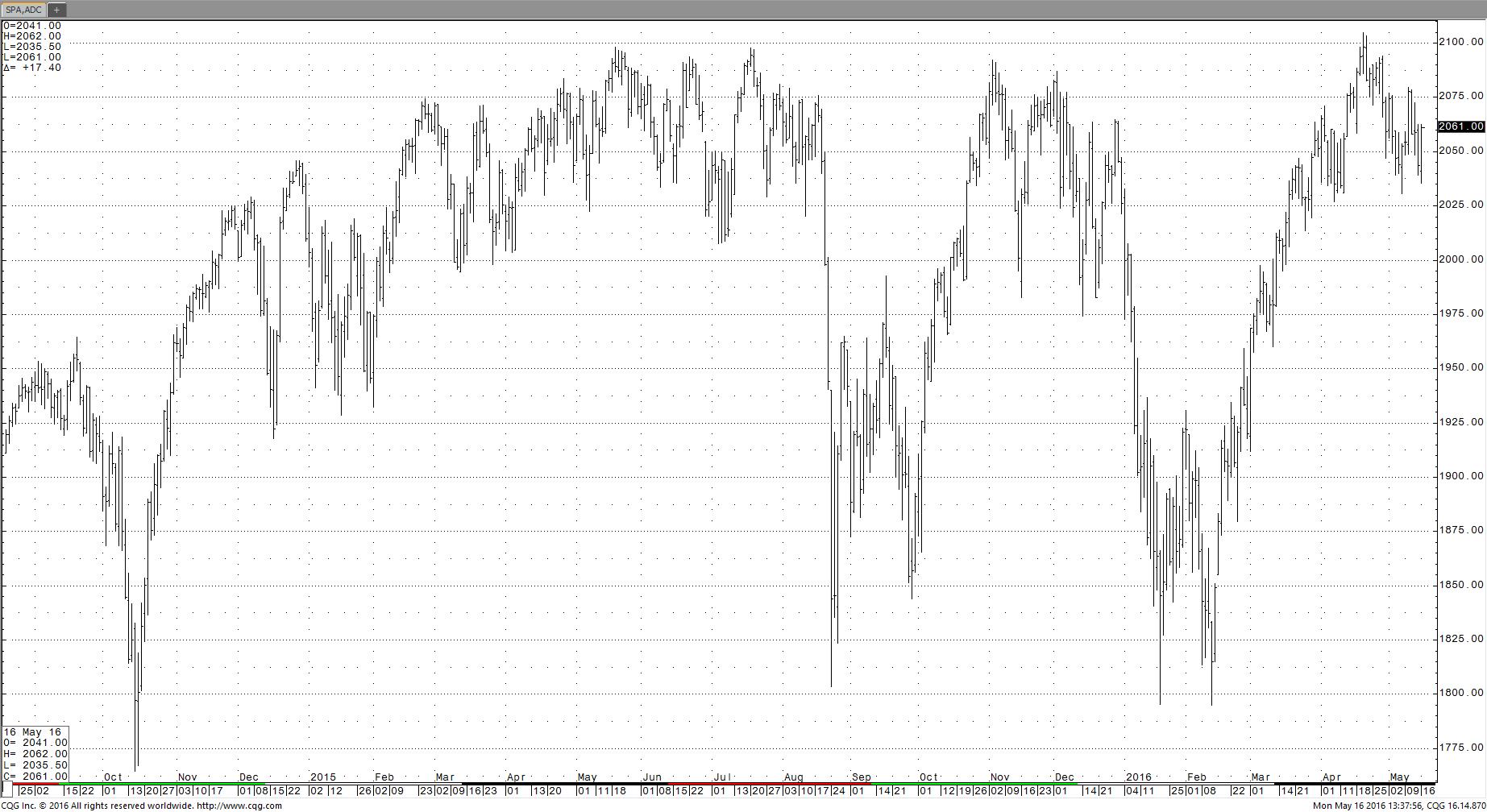

Stocks have gained back all of January’s losses. But some key indicators suggest today’s market is overvalued.

“Sell in May and go away.”

It’s one of those old axioms about the stock market that investors tend to chuckle at (albeit uncomfortably), and then continue on as usual.

I’m not a stock analyst and make no effort to hold myself out as one. However, I’ve seen this play out in the indexes too many times not to at least be wary of an early summer equity tailspin.

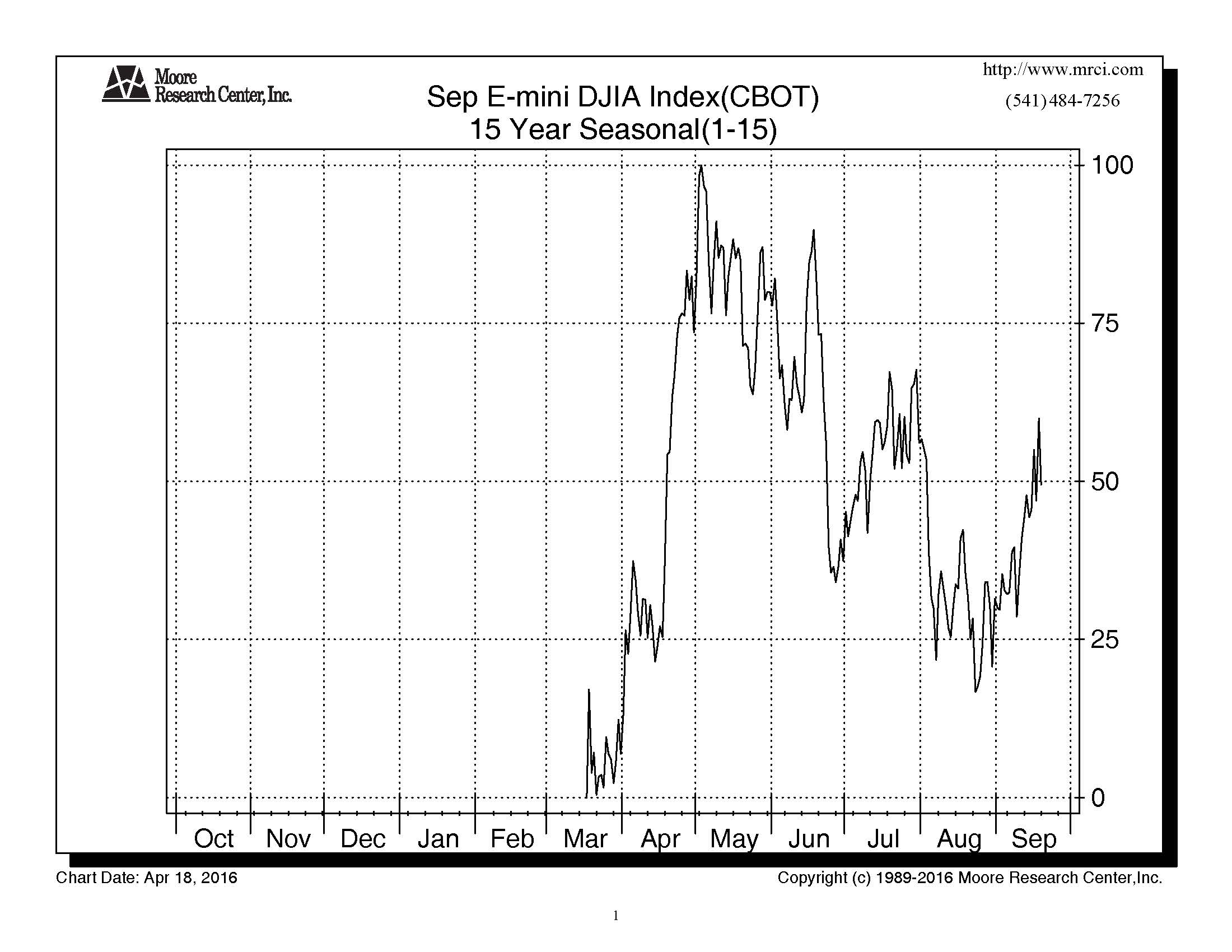

A look at the Dow Jones Industrial Average E-mini Seasonal tendency tends to confirm this wariness is more than just folklore.

Caption: Historical averages tend to confirm that “Sell in May and go away” is more than folklore.

But seasonal tendencies are not the only reason to be concerned about stocks these days. After an impressive rebound from January’s collapse, equities values, by some standards, are looking a little shaky – if not frighteningly overvalued.

———————————————————————————————-

Going back to 1964, the S&P’s market cap has been 57% of annual US GDP, on average. As of April, that number had surged to 99%.

———————————————————————————————-

Bank of America Merrill Lynch presented a report last month citing a bevy of statistics suggesting that “the market is expensive vs. history.” The most concerning of the statistics cited in this report was a comparison between the S&P’s total Market Cap and the US GDP. Going back to 1964, the S&P’s market cap has been 57% of annual US GDP, on average. As of the beginning of last month, that number had surged to 99%.

BOA Merrill says that, by this measure, stocks are currently overvalued by 72%.

Does this mean it’s time to bail on stocks? It is not my place to suggest that. First of all, I’m not a stock advisor. Secondly, we count coffee beans and bushels of corn here for our accounts – not P/E ratios. And finally, bulls point to other indicators that suggest everything is hunky dory.

However, the warning lights in my cockpit are starting to blink a little red when it comes to the stock index futures (which we do monitor closely.) If you have a big chunk of your net worth in stocks after this impressive rebound, taking some of those gains off the table in May could be historically prudent.

If you sell in May and go away from stocks, remember there are plenty of places to go away to – here on the commodities side.

To that end, be sure to catch our upcoming feature piece in our upcoming June Newsletter on the new volatility in commodities and how option sellers can benefit from it now (this will also be available on the blog.)

In the meantime, have a great month of premium collection!

-James