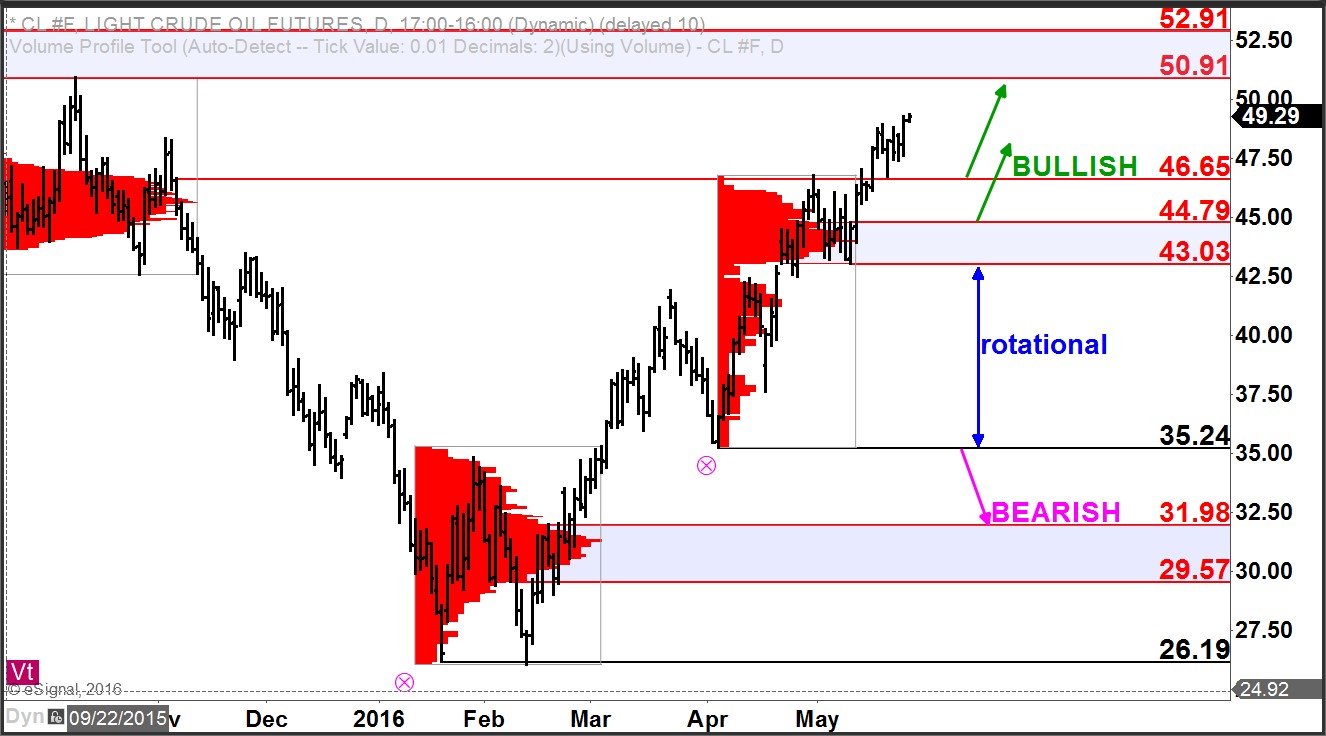

Crude oil spent time in both January and February this year trading below $30 per barrel. Price is now closing in on $50 per barrel. Where will this run higher end? What are the important price locations for traders to know? Glad you asked.

Click here to watch a video explaining how to read markets using volume at price.

Crude has nearby support established at 46.65 on any pullback with additional robust support at 43.03 – 44.79. The overall bias will remain bullish and pointed toward higher prices while above these supports.

The next upside target is a zone of resistance at 50.91 – 52.91. Any touch to this zone is likely to elicit a reaction to the downside but until and unless sellers are able to break below support zones, any reactions to the downside should be viewed as temporary profit-taking and buying opportunities.