SHORT-TERM (today 5 days out)

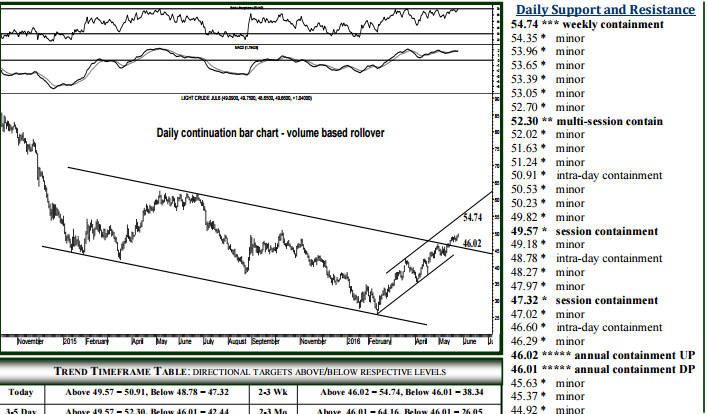

For Thursday, 49.57 can contain session weakness (assuming an open above), above which 52.30 remains a 2-3 day target. Upside today, 50.91 should contain initial strength, while pushing (especially opening) above 50.91 allows 52.30 intraday, likely to contain buying into early next week. Closing above 52.30 indicates the targeted 54.74 within several more days, likely contain weekly buying pressures when tested, quite possibly into later June activity. Downside Thursday, breaking/opening below 49.57 signals 48.78, likely to contain initial selling, below which 47.32 becomes an intraday target also able to contain session weakness. Closing below 47.32 indicates a test tomorrow of the 46.01-02 region, a range of long-term support able to contain selling not only through summer trade, but also the balance of the year.

MID (2-3 wks) & LONG TERM (2-3 ms )

Last week’s settlement above the 46.01-02 region (illustrated above and on page 2) indicates a good 2016 low, 54.74 now expected over the next several weeks, 64.16 within several months, the next 5-8 months likely to yield 69.77-75.09, the narrowing range of long-term resistance likely to contain annual buying pressures when tested (also page 2). On the other hand, a weekly settlement Friday back below 46.01 would be considered a failed long-term buy signal, essentially a valid sign of weakness into summer trade, 38.34 then considered a 2-3 week target, 34.03 attainable by the end of June, the February 26.05 low in reach by the end of summer.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE