There are 6 Primary Market Conditions, one of which is Trading Range Market Conditions. It tends to be the most problematic for Technical and Retail Traders, mostly because few recognize this unique market condition.

Often times what happens is traders start to experience more whipsaw action, especially Intraday or Swing Trading but they do not know why. This results in trying to find something to blame, rather than focusing on how to recognize if the market is indeed in a Trading Range. A part of recognizing it is to understand what this condition means for Day, Swing, and Position Traders and how to adapt to this more skill demanding condition.

As a review Market Condition is the overall broad Stock Market Condition, and within each 6 of them are the day to day Trading Conditions.

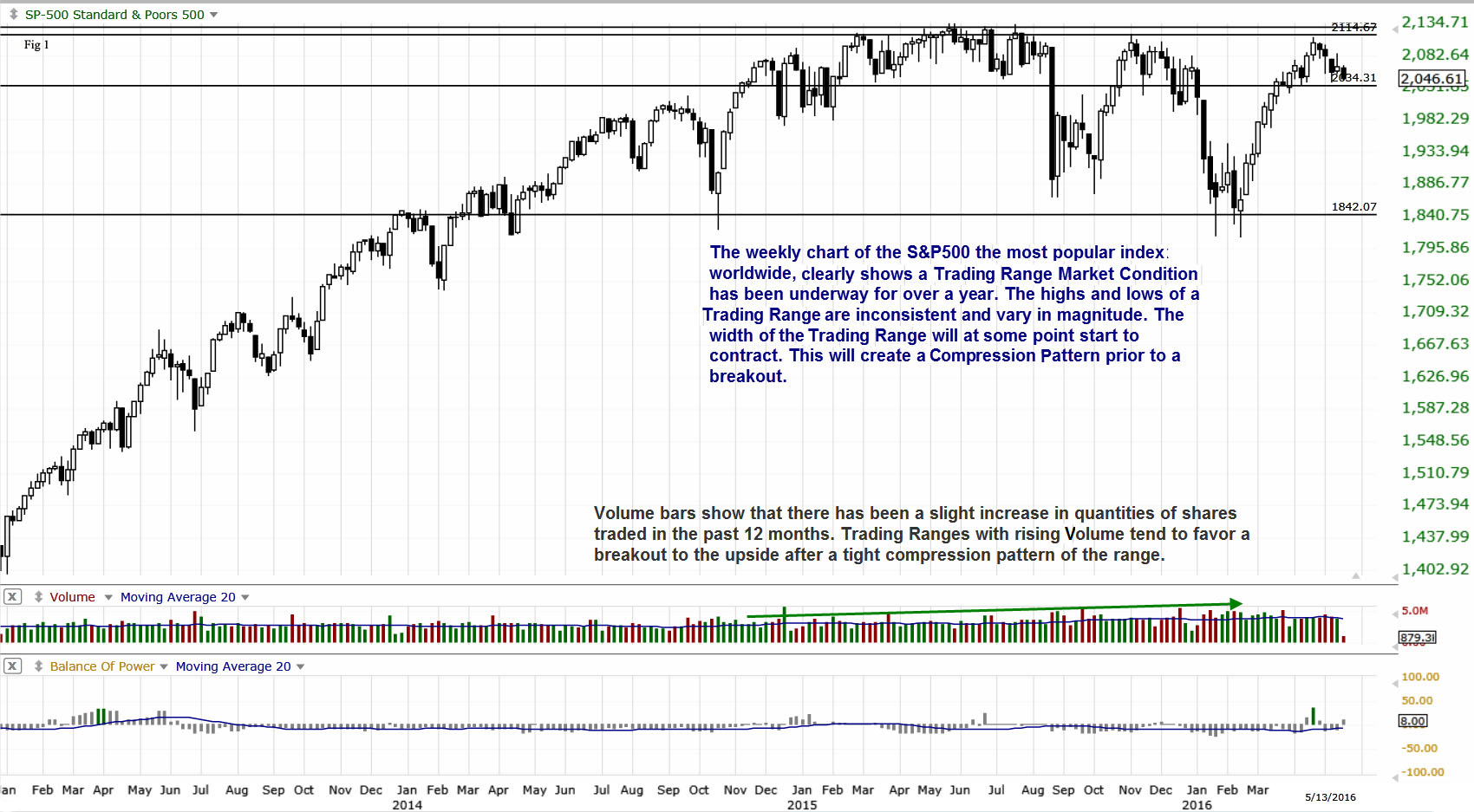

Looking at any major Index right now, its components and the broader group of Small Cap Stocks, it is obvious we are in a major long term Trading Range Market Condition. See the example below for the S&P500 Index with a weekly view chart.

A Trading Range is not just a wide Sideways Pattern. When the overall Stock Market is “range bound,” it means that every Sideways Pattern is present. This includes Sideways Bottoms, the new Basing Bottoms, Consolidations, Compression Patterns, Platforms, mid-sized Sideways action, full sized Trading Range Sideways action, and Topping Patterns.

The challenge for how to profit during Trading Range Market Conditions is to find stocks that will move sufficiently within the Sideways action to provide excellent point gain potential for strong Day, Swing, or Position Trading.

The root of the problem is most traders have poor Spatial Pattern Recognition Skills™ when reading a stock chart that is trending SIDEWAYS. Traders and Professionals tend to do very well when the market is moderately Up Trending to Velocity action, and tend to do moderately well in Downtrends IF they have a complete educational foundation on the Downside Trend and how to Sell Short.

However, the sideways action of a Trading Range Market is simply not something Traders learn how to trade. Most cannot determine whether the Sideways Pattern will break to the Upside or to the Downside. For Options Players when this happens they use Straddles, Strangles, and other sideways Multi-Leg Options often increasing their losses rather than lowering risk.

Basic Rules for How to Trade a Trading Range Condition:

- Choose the proper Trading Style for the Sideways Pattern that you intend to trade. All too often a Swing Trader attempts to Swing Trade a Platform, which results in chronic whipsaw action. This happens because Swing Traders have not been taught what a Platform Sideways action is, who creates the Sideways Pattern, the amplitude of the average Platform, and how to identify Pre-Breakout Set-Ups for Swing Trading.

- Learn all of the Sideways Patterns. Traders tend to learn Consolidations, or basic Sideways and Trading Range Strategies such as a Stop and Reverse Strategy SARs. The SARs only work if the Trading Range has sufficient amplitude, and if proper directional Indicators are also used. Most Traders have never heard of other Sideways Patterns for example the Compression, Platform, Basing Bottom, or Flat Top patterns.

- Choose the right Indicators for Sideways action. These should include a group of Indicators that are heavily weighted with Dark Pool Tracking, Volume Oscillators, Large Lot versus Small Lot value Indicators, and Accumulation/Distribution Indicators. Price Indicators alone are inadequate during Trading Range Conditions.

- Be able to identify the Market Participant Groups thatare creating the Sideways Pattern. Platforms and Basing Bottoms are the realm of the giant Institutions using Dark Pools, who are able to maintain price in a tighter Sideways action with their unique off exchange order systems. Wider Sideways action is frequently Retail Traders, rather than Professional Traders.

- Select the Sideways Patterns which are easiest for your personal Trading Style and Skill Level. Too often Traders attempt to trade a Sideways Pattern that requires more skill and experience than they have developed.

Summary

Learning how to profit during Trading Range Market Conditions is critical now since theseoccur more often, due to the 90% automation of the Stock and Financial Markets. Trading Ranges are caused by a fractured sentiment, when the major Market Participant Groups are in disagreement rather than harmony. To have a Strongly Trending Market Up or Down the Market Participant Groups, particularly the authorized Market Participant Groups must be in harmony with one another thereby driving price up due to heavy demand against a lower supply of stock.

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using TC2000 charts, courtesy of Worden Bros. Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.