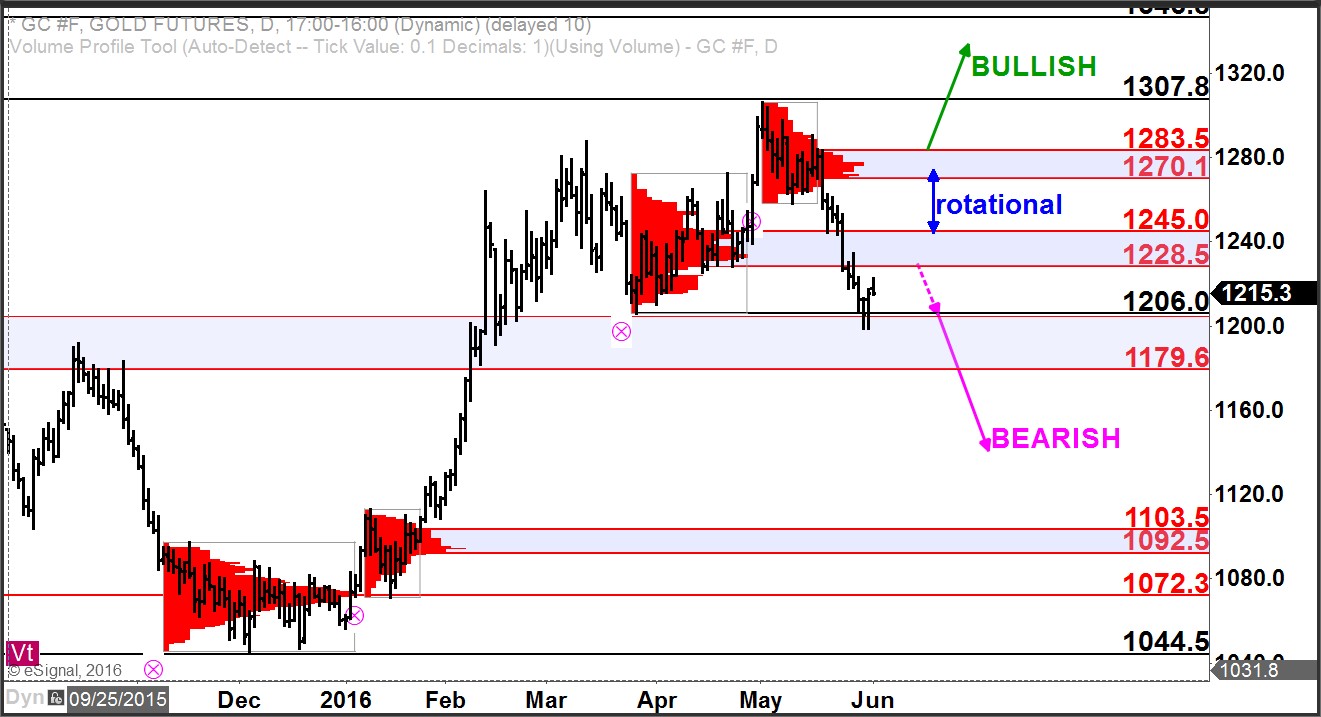

Beginning in January from below $1100/oz, gold started off the year with a big rally. The shiny metal was challenging $1300/oz coming into the month of May, up nearly 20%.

As we leave May behind however, gold has dropped $100/oz from the highs early this month and is now threatening a breach of $1200/oz.

So has gold lost its shine? A look at the volume-at-price analysis would suggest so.

Click here to watch a video explaining how to read markets using volume at price.

Gold’s uptrend was violated upon the breach of support, now resistance at 1228 – 1245. The near-term bias is pointed lower while below this zone.

There is nearby support at 1206 that has halted the decline at the moment but unless price can move back above the resistance zone at 1228 – 1245, the downside bias and pressure will remain intact.

Any breach of 1206 would next target 1179.6. Any move below 1179 would likely see price accelerate to the downside targeting the January high-volume area at 1092 – 1103.5.