Monitoring the U.S. Dollar Index gives us an edge in forecasting turns in paired currencies and sometimes even in precious metals and other commodities. Right now, our forecast is for the Dollar to climb impulsively into mid-2017 or later, which should make it difficult for other currencies and precious metals to advance by much. Based on the Dollar Index’s response to a recently tested support area, its climb appears already to have begun.

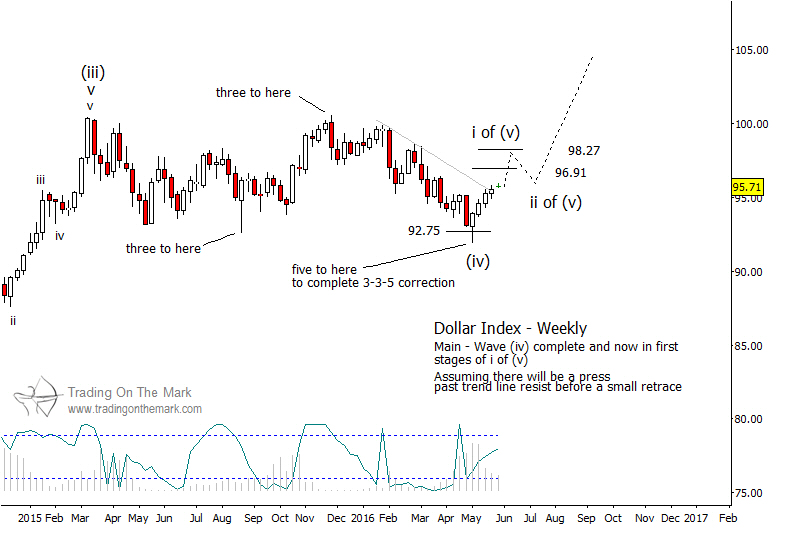

As context, we see the Dollar as having completed a year-long corrective pattern – a fourth wave in what should be a sequence of five waves. The next step should be a persistent rally, but keep in mind that the rally still needs to prove itself. When we last wrote about the Dollar in early March, we concluded incorrectly that the rally had begun from the 94.58 price level. In subsequent weeks, the index declined farther to test near a level we had identified earlier in January.

Now that the index has broken the downward-sloping trend line shown on the weekly chart, the next confirming test of a rally would be for the index to show a weekly close above resistance at 96.91. However, even without perfect confirmation, traders should consider opportunities to catch declines in other currencies, such as the one we charted last week for the Yen.

The first sub-wave in an upward impulse could test one or both of the resistance areas shown on the chart at 96.91 and 98.27. Timing the end of wave i and later the end of wave ii may be influenced by Fed meetings in June and/or July, the general trend should be upward through the rest of the year and beyond. Possible targets that the rally might eventually reach include 103.40, 106.50, and 110.50 – areas we derived on a monthly chart (not shown).

You can read about more currency setups in our forthcoming newsletter, coming out later this week. Request your copy via this link.