SHORT-TERM (today and 5 days out)

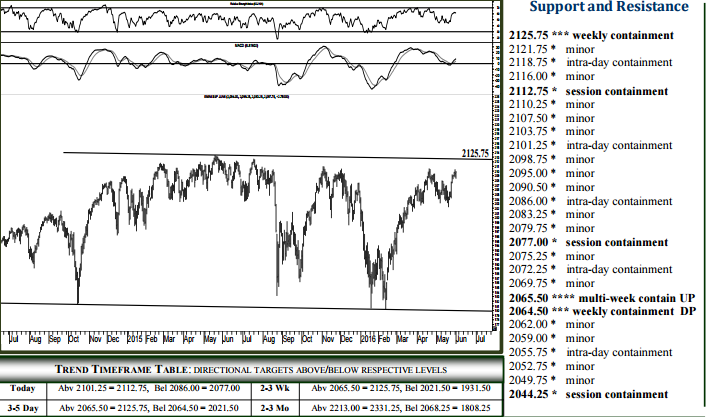

For Thursday, both 2086.00 and 2101.25 should firmly contain intraday activity, beyond which the next notable level becomes an intraday target. Downside today, breaking/opening below 2086.00 signals 2077.00, able to contain session weakness. Closing below 2077.00 signals 2064.50-65.50 tomorrow, able to contain selling through June activity and above which 2125.75 remains a 1-2 week target, the lower 2200.00 handle attainable by the end of July. Closing below 2064.50 reverses nearterm momentum, 2021.50 then becoming a 1-2 week target. Upside today, pushing/opening above 2101.25 signals 2112.75, likely to contain session strength. A settlement above 2112.75 indicates 2125.75 tomorrow, targeted resistance likely to contain strength through next week, possibly into later June activity.

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2064.50-65.50 region can absorb selling into Q3, above which 2125.75 remains a 1-2 week target, 2217.00 attainable by the end of July, 2331.25 into later year (page 2). Upside, 2125.75 can contain weekly buying pressures – possibly into later June activity – with a daily settlement above 2125.75 accelerating bullish momentum into later June, the targeted 2017.00 region then becoming a 2-3 week objective likely to contain monthly buying pressures when tested. A settlement above 2217.00 indicates 2331.25 within 3-5 more weeks, an ultra-long-term target able to contain buying into 2017 (page 2). Downside, a settlement below 2064.50 indicates a good June high, 2021.50 then expected within 1-2 weeks, able to contain selling into July and the level to settle below for indicating a 5-8 week collapse to long-term support at 1808.25.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE