Fibonacci support and resistance will provide traders easy to read buy and sell areas. I am going to show you a few examples from Thursday June 2nd in the crude oil market that gave well over $1250 dollars per contract potential in just over 2 hours before lunch.

Your trading profits can be compounded when you apply a very logical approach to the Fibonacci areas by watching for this one simple “stop run trick” market makers love to fish for retail trader’s stops.

No matter what market you trade, you have probably been the victim of a stop run that inevitably continues to your target areas. This happens every single day in most heavily day traded markets.

A simple “pivot stop run” at Fibonacci areas is one of our most powerful trades in both range bound and trending markets. When you use Fibonacci support and resistance areas, you will now be able to easily identify and benefit from this daily occurrence. I will give you 6 trade examples we taught live in our classroom on June 2nd below.

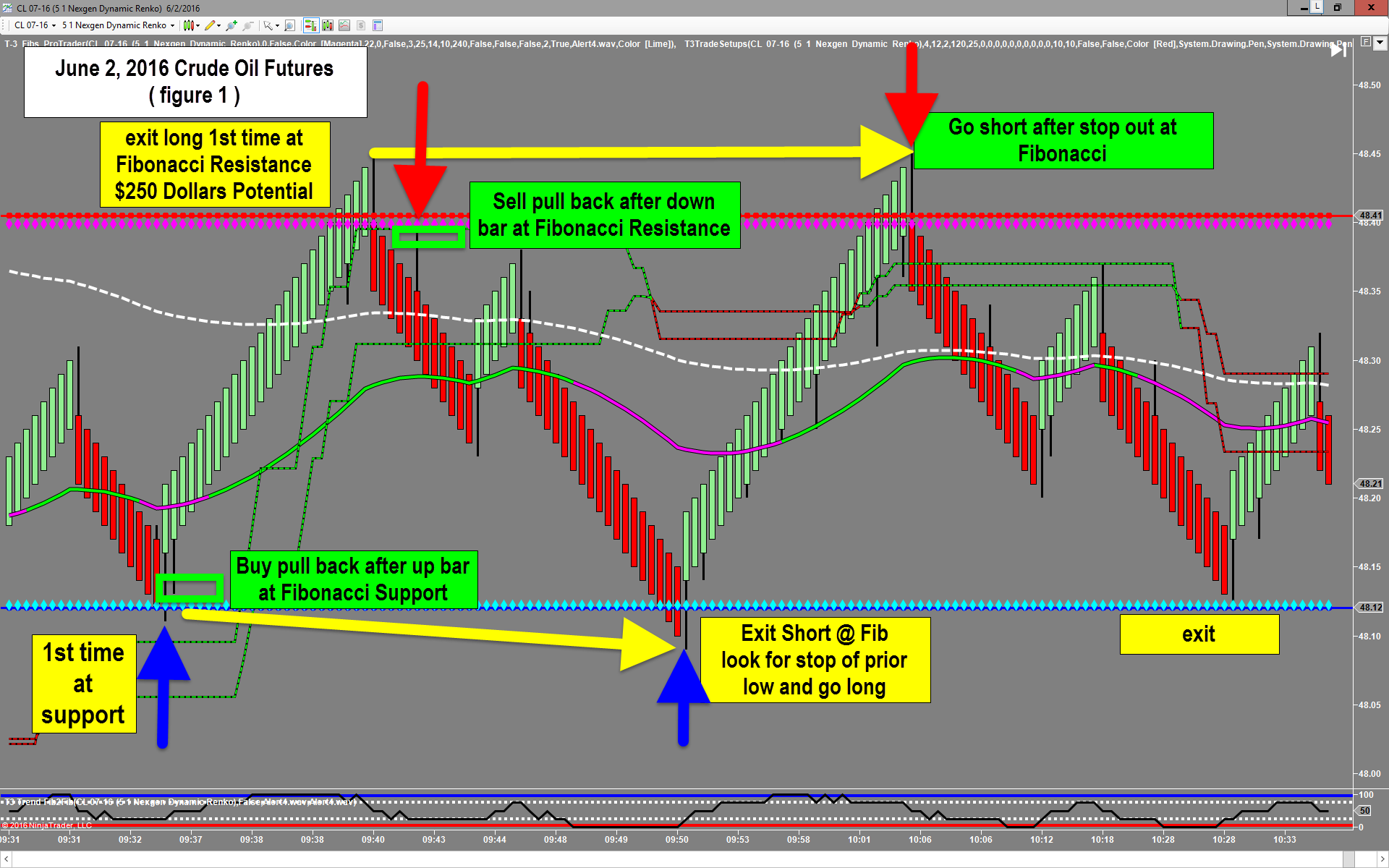

The following picture shows Nexgen’s T3 Fibs ProTrader automated Fibonacci support and resistance from 9:30 am through 10:30 am eastern time. (figure 1)

Rules are simple, long at Fibonacci support, exit at resistance. Sell Fibonacci Resistance exit at support. The bonus profit potential you have at multiple timeframe Fibonacci Support is when the “the market makers” run the stops at key Fibonacci areas.

Every day our traders look for this “pivot stop run at Fibonacci” and take advantage with counter tend trades. Each of these 4 trades had roughly 250 dollars in profit per contract.

This is true in range bound markets and is also true at Fibonacci areas in heavily trending markets. This same approach was used later in the day at 11:30 am as the market made a strong trend to the upside.

Notice each of these touches of Fibonacci support was after a prior pivot with the trend was “stopped out”. These areas are exactly where most traders get stopped out of a position, and where Nexgen’s Fibonacci traders are taught to initiate a new trades.

Using Fibonacci Support and Resistance as a guideline is critically important for which stop runs will be the potentially profitable trades. Applying these simple techniques you will now be able to easily and effectively trade “after” the stop runs have taken place.

Are you ready once and for all to stop missing out on profitable trading opportunities? For a free 10 day demonstration of our fully automated T3 Fibs ProTrader automated software and to spend a week with Nexgen in our live classroom as we discuss the setups, please fill out the form below.