Market players are thirsty for return and will look for it wherever they can get it. The last week of May saw a voracious appetite for buying equities, markets shot higher after May 19 from a swoon below a strong support level (2040 on the SPX 500). Early in May there seemed little interest in stocks, in fact a spillover effect from late April selling and the ‘sell in May’ psychological effect may have put equities far away from anyone’s eye.

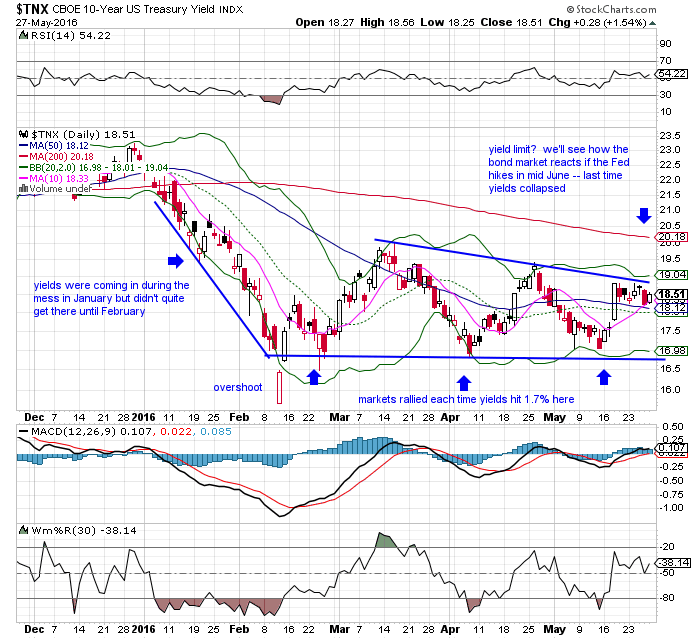

But that changed drastically, and similar to the early part of April and the February bottom/retest. What was the catalyst? Look no further than the bond market, specifically the 10 year bond. When bonds are strong and yields drop that has been a negative catalyst for equities, but when yields hit a certain level the shift occurs to buying stocks. As we see from the chart that level is 1.7% on the 10 year bond.

At this point it appears bond returns are far less attractive than stocks, and we see that flip occur. Look at the chart of bonds and then stocks and you’ll see how this occurs. It’s not magic, but a simple assessment of return and risk. The last three times with bonds down to 1.7% on this 10 year the stock market roared higher.

Now, there can/will be a certain yield on the bond where investors will switch back and dump equities, but that may be over 2%, so we’ll watch it. With the Fed believing strong GDP growth is upon us and a rate hike is coming in the near future, would bond investors stick with fixed income buying under this outcome? We’ll have to see how this dynamic plays out.