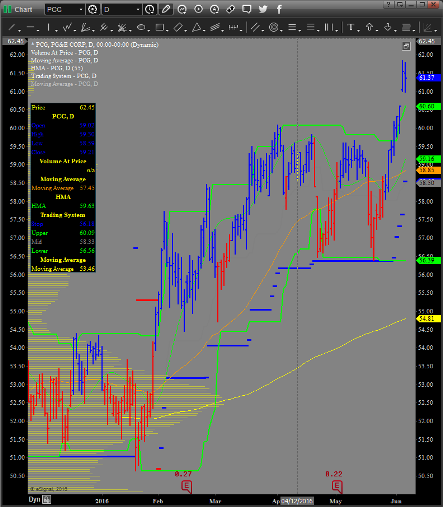

They always fill the gap! That’s a common mantra you used to hear if you ever spent any time on a trading floor. The gap is just what it sounds like. When you have a stock make a big jump or fall off from one day to another there is a price area that is not trading; a gap. Once a gap is breached it is common for that gap to be filled and then act as support and resistance. This is called a gap fill entry. The thing is, if you wait for the gap to be filled you miss out on opportunity. When you are dealing with a TRENDING stock, you can be more aggressive and employ what’s called a GAP BAR entry. Let’s take the example of a gap up entry. The stock makes a discrete move to the upside creating the gap. There is then a retracement to the low of the gap bar. That is your entry. Look at PG&E Corp. (PCG):

k is in a very obvious uptrend with the 50 and 200 day moving averages moving up, the Donchian Channel moving up and the gap on Friday. Friday’s low was 61.00. Monday it opened up 61.51, put in a low at 60.98 and that was our entry:

6-6-16: Based on our methodology a signal has been generated:

Buy (opening) the PCG July 60 call

Sell (opening) the PCG July 65 call

For a debit of $1.70.

This signal is not GTC and is valid with PCG trading $60.75 or higher.