Fibonacci support and resistance will provide traders easy to read buy and sell areas. I am going to show you some trade examples from Netflix and Apple stock from June 7, 2016.

Your trading profits can be compounded when you apply a very logical approach to the Fibonacci areas by watching for simple buys and sells from Fibonacci areas with the trend and one simple stop run trick market makers love to play with retail traders stops.

No matter what market you trade , you have probably been the victim of a stop run that inevitably continues to your target areas. This happens every single day in most heavily day traded markets.

A highly profitable trader understands when and where to look for trades from Fibonacci areas and when to profit from the stop runs. We teach traders daily how to recognize setups on any market including stocks, futures and Forex.

A simple ” pivot stop run” at Fibonacci areas is one of our most powerful trades in both range bound and trending markets. When you use Fibonacci support and resistance areas , you will now be able to easily identify and benefit from this daily occurrence

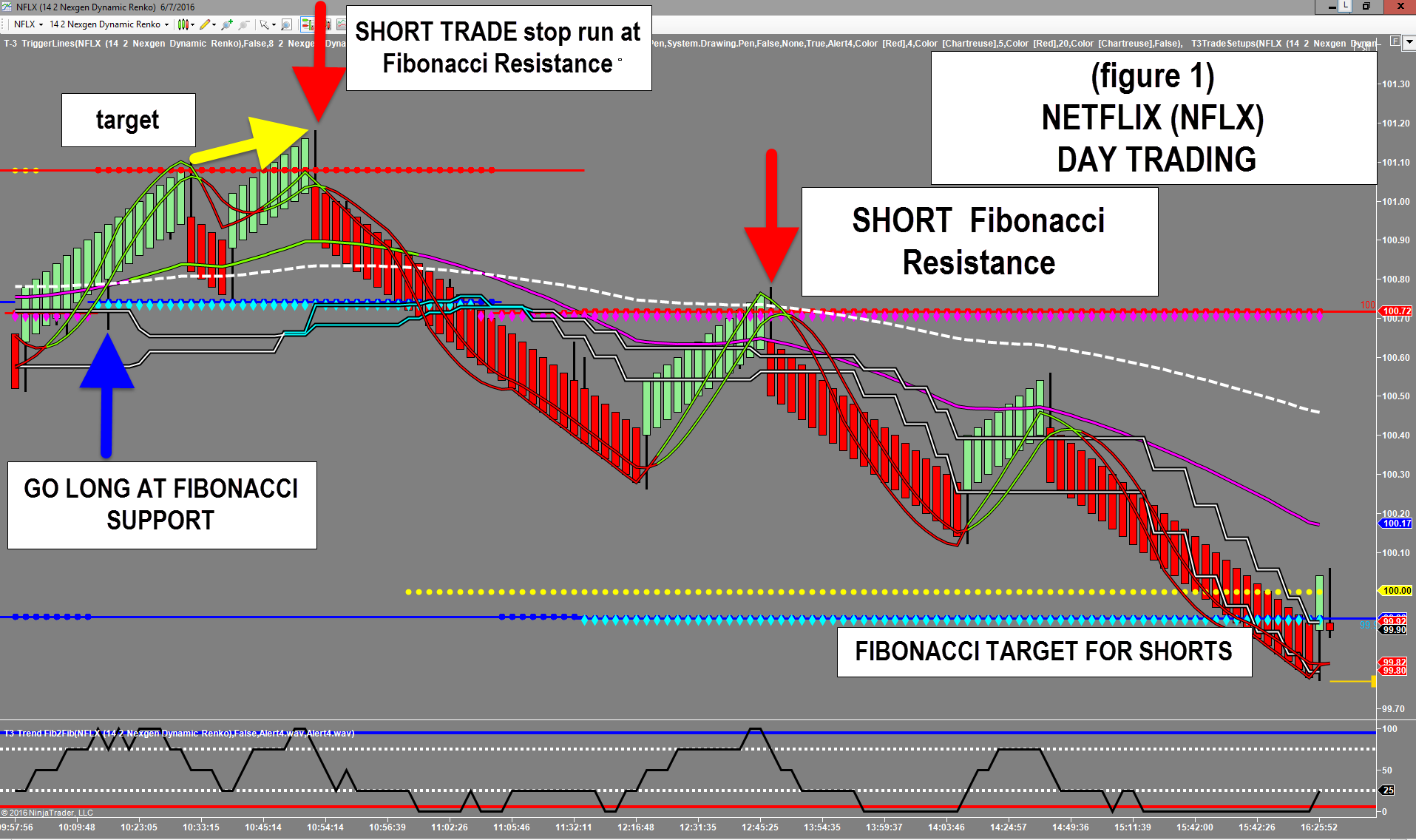

The following picture shows Nexgen’s T3 Fibs ProTrader automated Fibonacci support and resistance on Netflix (NFLX) stock(figure 1) . While not a very large range day, trading this market with a leveraged option you would have had a few very simple trades today.

Rules are simple, long at Fibonacci support, exit at resistance. Sell Fibonacci resistance after a pivot stops run exit at support. This simple rule called the top of the market in the morning before the turn and there is a very powerful short at 12:45 pm from Fibonacci resistance that made it down to its Fibonacci target.

One other very easy to see trade setup is a simple “Double Top ” in price at Fibonacci resistance to initiate a short trade.

This short trade can been seen on Apple stock today at the high of the day. Notice in figure 2 the double top at Fibonacci resistance and the lower moving averages at the time of the double top.

Fibonacci traders use this an entry signal simple binary options ,shorting the stock or any other method for taking a short position you currently use in your trading plan. Fibonacci targets are easy to read providing a very limited risk and maximum reward.

Using Fibonacci Support and Resistance as a guideline is critically important for which stop runs will be the potentially profitable trades. Applying these simple techniques you will now be able to easily and effectively trade ” after ” the stop runs have taken place.