It’s been a tough year for investors. Returns have been difficult to come by which has forced market participants to take on increasing levels of risk in their search for yield.

One area that has seen a big influx of investment has been the energy space. Many investors believe oil has bottomed and that it’s safe to bet on energy companies and their high dividend yields.

Billionaire hedge fund manager David Tepper agrees. He’s got his eyes set on Energy Transfer Partners (ETP) and Williams Partners (WPZ), both of which are midstream master limited partnerships (MLPs).

To review, the energy industry can be broken into 3 segments:

- Upstream: Exploration and production (E&P) companies, including drillers. They find and extract energy products.

- Midstream: Transportation companies that move raw product through their pipelines. MLPs reside in this segment.

- Downstream: Processors of the raw product and distributors of the final product. Refineries are in this segment.

If you take a look at Tepper’s latest 13F filing, his top buys and most concentrated holdings are ETP and WPZ. Tepper is betting big on the MLP theme.

Energy Transfer Partners (ETP) is an MLP that started with natural gas pipelines, but later expanded into natural gas liquids (NGLs), refined products, and also crude oil. It currently has a dividend yield of 11.49% — exactly the type of yield investors are looking for.

Williams Partners (WPZ) is another MLP that’s focused on dry gas pipeline transport. It’s dividend yield is 10.82%, also pretty juicy.

With dividend yields like that, this may seem like an easy play, but there are actually significant risks. Both these MLP’s have credit ratings one level above junk status because both are leveraged and have debt servicing costs to take care of.

They’re exposed to energy prices. If prices drop too low, they’ll have a difficult time servicing their debt.

And being so close to junk status, another downgrade would have significant effects on their current cost of borrowing. A further increase in debt servicing costs would put pressure on their dividend, which would likely be first on the chopping block to pay off debt costs.

Tepper knows this. But the reason he’s still interested is that WPZ and ETP are currently in the middle of a merger. This merger would increase the odds that the combined company could maintain their dividend regardless of volatile energy prices.

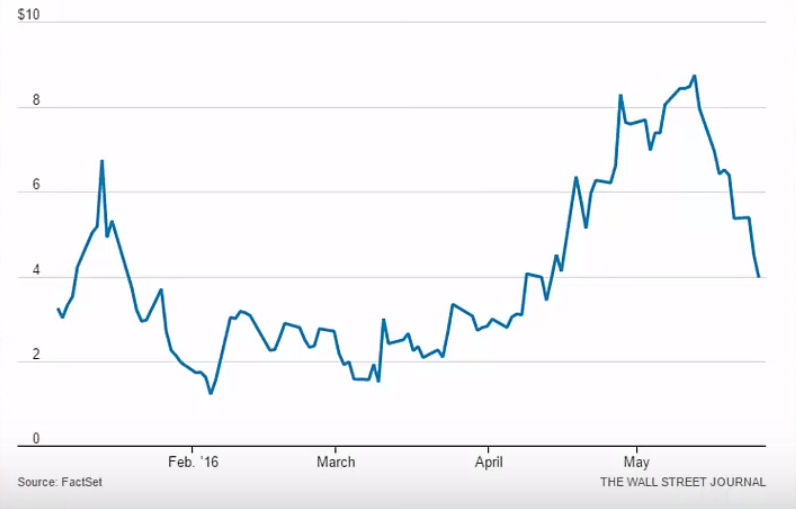

The probability of the merger completing has recently increased. You can see it in the graph below depicting the spread between the share price of WPZ’s parent company and the value of the deal. A higher reading indicates that investors are less confident in a successful merger, while a lower reading suggests that the market is more confident in the merger’s success.

Even though a merger may help these companies’ case, it’s still not the right time to enter this trade.

A big part of this MLP thesis rests on the idea that energy prices have bottomed. But we don’t believe this is true. The bullish US dollar trend is still in tact. And because commodities are priced in dollars, a stronger dollar means lower commodity prices.

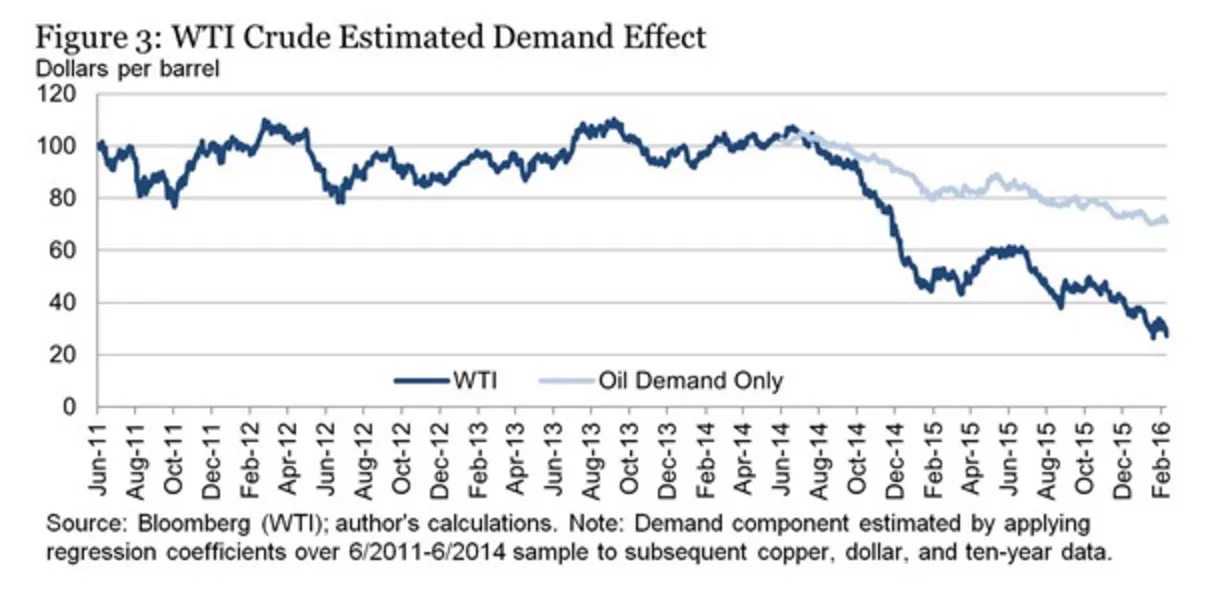

Just looking at the relationship between oil and the dollar, dollar strength has historically accounted for 30-50% of oil’s price movement. Take a look at the graph below. It isolates an estimate of the price of oil based only on demand. It then compares it to the real price of oil in the market. The gap you see between actual prices and demand exist because of the impact of USD strength.

As the dollar strengthens, commodities in general (including energy) will take another trip back to prior lows. The pain in the energy space isn’t over. The “blood in the streets” moment hasn’t happened. There were not enough defaults and there are still too many companies hanging on by a thread. There needs to be another washout once energy prices drop again.

Some may argue that these MLPs should be protected because most of their exposure is in natural gas instead of oil and their position as midstream operators is not directly affected by energy prices. These points may be valid, but they don’t matter. This reasoning didn’t save MLPs in the recent energy downturn, and it won’t save them in the next one either.

Regardless of these MLP’s position, they tend to fall victim to the classic case of the baby being thrown out with the bathwater. When energy prices drop again, investors will bail on anything energy related. All the selling in turn creates liquidity issues that force funds invested in these MLPs to also exit their holdings. Their margin level restrictions trigger and they have to sell. MLPs end up getting dumped in mass along with every other energy play.

MLPs will make a good play in the future, but not now. The dollar trend must play out and there needs to be a bigger washout in the energy space. Once these things happen, we’ll take a look at MLPs again.

For more information about MLPs and other topics, please click here.