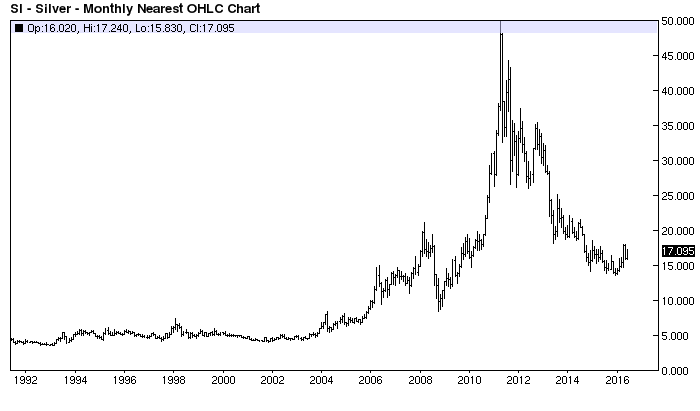

This month I will look at silver prices and how you can leverage your returns to this metal and profit from the next move up

Whilst US stocks markets have been fairly flat this year commodities have seen some big moves including Gold and Silver. Gold (GLD) is currently up 17% and Silver (SLV) is up 18% year to date. I still believe that both metals can move higher in 2016 and silver could outperform. If you’re looking to profit from Silver and are willing to take more risk then investing in silver mining shares or an ETF of mining stocks is the way to go especially the junior mining stocks.

Let’s look at the ETF that I have been using this year and that is GDXJ. VanEck Vectors ETF Junior Gold Mining Stocks (which includes some silver stocks) is a basket of smaller mining shares and currently holds 48 stocks with the largest holding being First Majestic Silver (NYSE:AG) Holding this ETF gives you gold and silver junior mining shares exposure without putting all your eggs in one basket. The ETF spreads the risk with the biggest weighting to any one stock currently just under 6%.

GDXJ is up nearly 100% YTD and the reason why mining stocks have done 5 times better than the actual metal price is down to leverage. Smaller mining stocks are highly leveraged to the gold and silver price and every extra dollar up move translates to a big gain to the company.

You can also look at buying individual stocks, of course the potential gains are even higher if you strike lucky however it goes without say you’re taking a higher risk but here are 3 companies which I think are worth looking at with silver exposure and can still move higher. Do remember when investing in mining stocks it’s not just the price of the metal that counts other factors like management, accidents – force majeure and strikes can all have an impact.

First Majestic Silver Corp (NYSE:AG)

As mentioned this stocks is held by the GDXJ and currently has a 6% weighting ETF. AG reported its cash cost was $5.00 an ounce in the first quarter of 2016 “Cash cost per ounce (after by-product credits) for the quarter was $5.00 per payable ounce of silver, an improvement of 17% from $6.04 per ounce in the fourth quarter of 2015 and 39% from $8.22 per ounce in the first quarter of 2015.” Source: http://www.firstmajestic.com/en/news/first-majestic-reports-first-quarter-financial-results-1

AG has had an amazing year with the stock up 250% however the stock would need to go up another 100% to get back to 2012/2013 levels and whilst this may be optimistic I can see shares move another 30 to 40% this year which is still worth having and that would see the shares trading at US$16 to $17.

Hecla Mining (NYSE:HL)

Hecla Mining Company offers unrefined gold and silver bullion bars to precious metals traders; and lead, zinc, and bulk concentrates to custom smelters and brokers. It owns 100% interests in the Greens Creek mine located on Admiralty Island in Southeast Alaska; the Lucky Friday unit located in the Coeur d’Alene mining district in northern Idaho; the Casa Berardi mine located in the Abitibi region of north-western Quebec, Canada; and the San Sebastian unit located in the state of Durango, Mexico.

Hecla is long established mining company founded in 1891 and have survived a few boom and busts in their time. It is also in the GDXJ ETF with a 4.5% weighting.

In the first quarter of 2016, the company produced an ounce of silver at a cash cost of $5.00. In the same period a year ago, it was $6.00 so the company is has reduced mining costs at the same time metal prices are going up. They also produced gold at a cash cost of $781 an ounce. Source: Hecla first Quarter 2016 Results May 5, 2016 http://ir.hecla-mining.com/file/Index?KeyFile=34189692

HL shares are up 130% but I still believe the stock can go further and from the current $4.50 level we can be at $6+ in the next 8 to 12 months.

Silver Standard Resources Inc (SSRI)

SSRI primarily explores for gold, silver, zinc, and lead deposits. Its principal projects include the Marigold mine located in Humboldt County, Nevada and the Pirquitas mine located in the province of Jujuy, northern Argentina. Shares are up 100% so far this year trading around the $11 level – back in 2011 they were trading at $35.

At the marigold project they are producing gold at the $690 to $740 an ounce cash cost. The Pirquitas silver mine has a cash cost of $8.93 and this was helped by a weak Mexican peso.

SSRI could trade up to $15 a share in the next 8 to 12 months.

Trading veteran Vince Stanzione has been trading for over 30 years and has produced a home-trading course at www.fintrader.net He stresses that before you try trading it’s worth getting some training. He is also the New York Times bestselling author of The Millionaire Dropout published by Wiley.