Don’t look now but June is here – the long awaited month where the all-powerful Federal Reserve will answer the question of the year – will they or won’t they?

Just a few short weeks ago – investors and pundits seemed fairly confident that June’s Fed meeting would be a non-event. The dollar was weak, the “risk on” vibe was dominant.

Then a slew of economic data in May, followed by some suggestive comments from various Fed members threw a wrench into the mix. The message? Don’t count out a rate hike in June.

While economic output expanded at a mere 0.5% annual pace in the first quarter, industrial production surged in April. In addition, retail sales climbed to their highest levels in over a year. Strength in the US housing sector continues to build. This has certain Fed members suggesting that the time for a rate hike may be nigh.

——————————————————————————————————————————————

…taking an outright long our short position in stocks or a commodity heavily affected by the dollar (such as metals) is more or less, gambling on the Fed’s mood.

——————————————————————————————————————————————

All of this has introduced a gargantuan amount of uncertainty into financial markets. And investors, nor markets, like uncertainty.

The shift from “fairly confident” the Fed would not raise rates to “not so confident” has given a jolt to the sagging US dollar.

That in turn, put pressure on both equities and many commodities sectors – some of course, more than others.

Gold and Silver prices were especially weakened – which brings us to our opportunity of the month.

Will you be Gambling on the Fed?

If you watch our bi-monthly market updates, you already know that at the beginning of May, you could sell silver calls at double the price of silver. Since that time, Silver has fallen more than $1.60 per ounce.

From our prior commentary – we expressed doubt that dollar weakness would last much further into 2016. We made this projection primarily because we felt that positive rates in the US vs. negative rates outside the US would eventually curb the selling in the dollar. We did not anticipate additional “help” for the dollar from the Fed.

So far, that has just been talk. That has jolted investors to attention and given the dollar new life. But the Fed’s ultimate decision is still a mystery. A dovish announcement probably brings another sell off (in the dollar.) A ¼ point hike in June or an indication of a pending hike in July will likely bring another spike to the dollar value – pressuring stocks and markets like gold and silver.

Thus taking an outright long our short position in stocks or a commodity heavily affected by the dollar (such as metals) is more or less, gambling on the Fed’s mood.

So what is a flummoxed investor to do?

Uncertainty: The Option Seller’s Best Friend

Insurance companies don’t gamble. Casino’s don’t gamble.

And option sellers don’t gamble.

By raising uncertainty to an excruciating extreme, the Fed has done you a big favor.

Uncertainty and extremes create big option premiums. More importantly, they create big option premiums at deep out of the money strikes that the market is unlikely to approach – WHATEVER the Fed decides.

Thus your opportunity.

If you’ve read our book, follow our commentaries or watch our videos, you know I am big into fundamentals when it comes to commodities. But there comes a time where selling pure volatility can be a very attractive play – completely on its own.

The Silver market is just such an example at present.

At the time of this writing, strikes are available on both sides of the silver market at levels unlikely to be reached regardless of Fed decisions.

December Silver

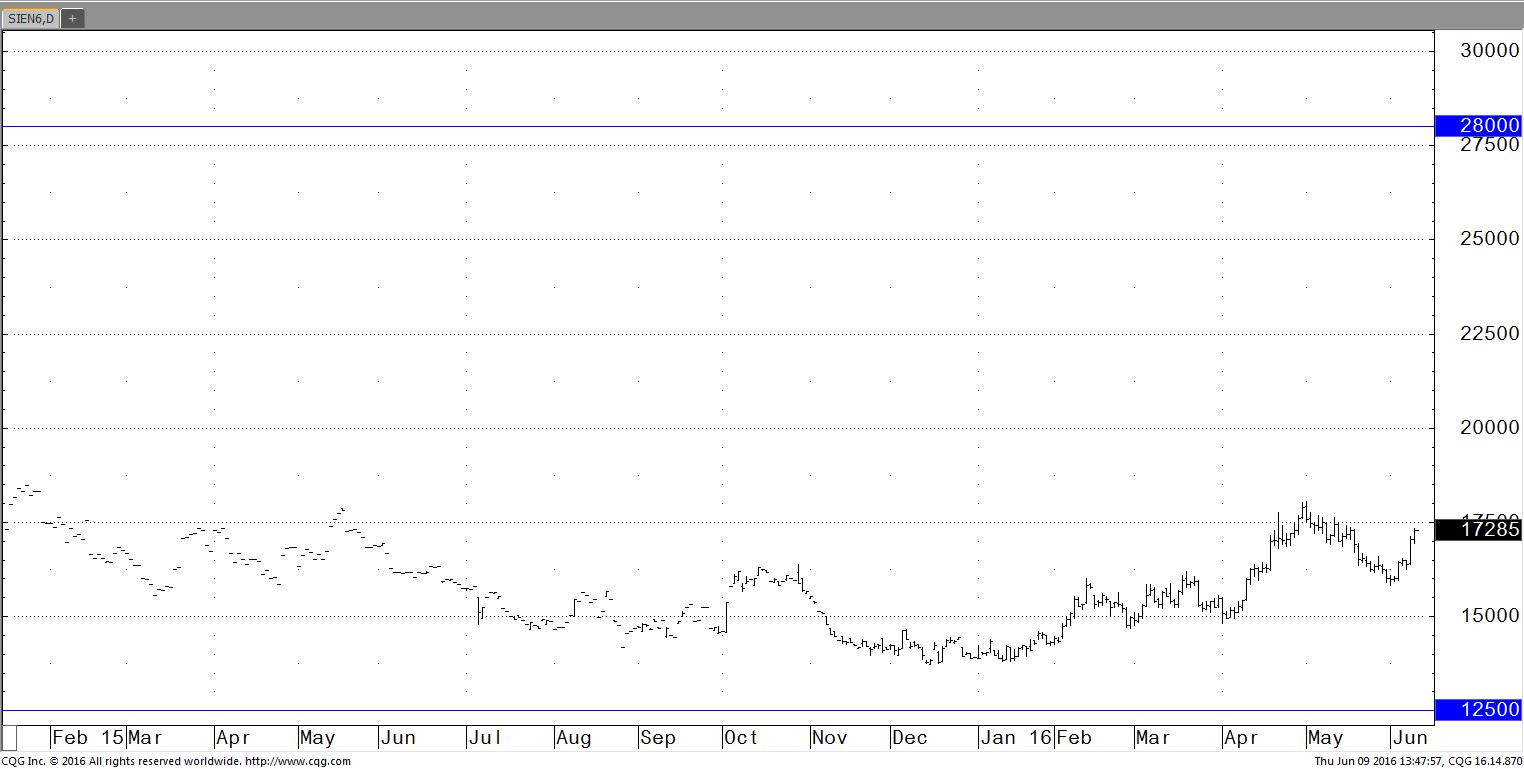

Selling the December Silver 12.50 put/28.00 call strangle

For the past 20 months, silver has traded in a well-defined $5.00 range between $13.50 and $18.50 per ounce. A ¼ rate hike (or not) is unlikely to change that.

And despite the recent pullback, call strikes are still available at levels nearly 75% out of the money.

Conclusion and Strategy

The direction of the dollar will be dominant fundamental in the silver market for the foreseeable future.

Yet the uncertainty over the Fed’s June decision has added fuel to an already high volatility level in this market.

Investors looking to take advantage of this volatility can sell options on both sides of the silver market and potentially benefit from either Fed decision. This is called an option strangle.

The day of the announcement, the market could spike either way. But expect this to be a short lived reaction – with neither strike likely to be threatened.

We suggest considering the December Silver 12.50 put/28.00 call strangle for premiums upwards of $1,000 each. Both strikes are well outside silvers trading range for the at least the past 20 months.

A more conservative strategy would be selling vertical credit spreads on both sides of the market. The December 25/30 bear call spread looks particularly attractive at this time with spread premiums currently available over $500.

Silver will be a market in flux in the time leading up to the Fed decision with every new economic report having the potential to move the market either way. For more active traders, “legging in” to these positions can be an advantage here (ie: selling the calls on big up days and selling puts on big down days.)

Regardless of how you approach it, the Federal Reserve has added a level of froth to already elevated option premiums in the silver market. Strikes are now available at levels far outside where the market is likely to move.

June is a good month to jump on some of it.

For more information on managed option writing portfolios with James Cordier and OptionSellers.com, visit www.OptionSellers.com/Discovery for a Free Investor Information Kit. Consultations for high net worth investors are also available on limited dates each month.