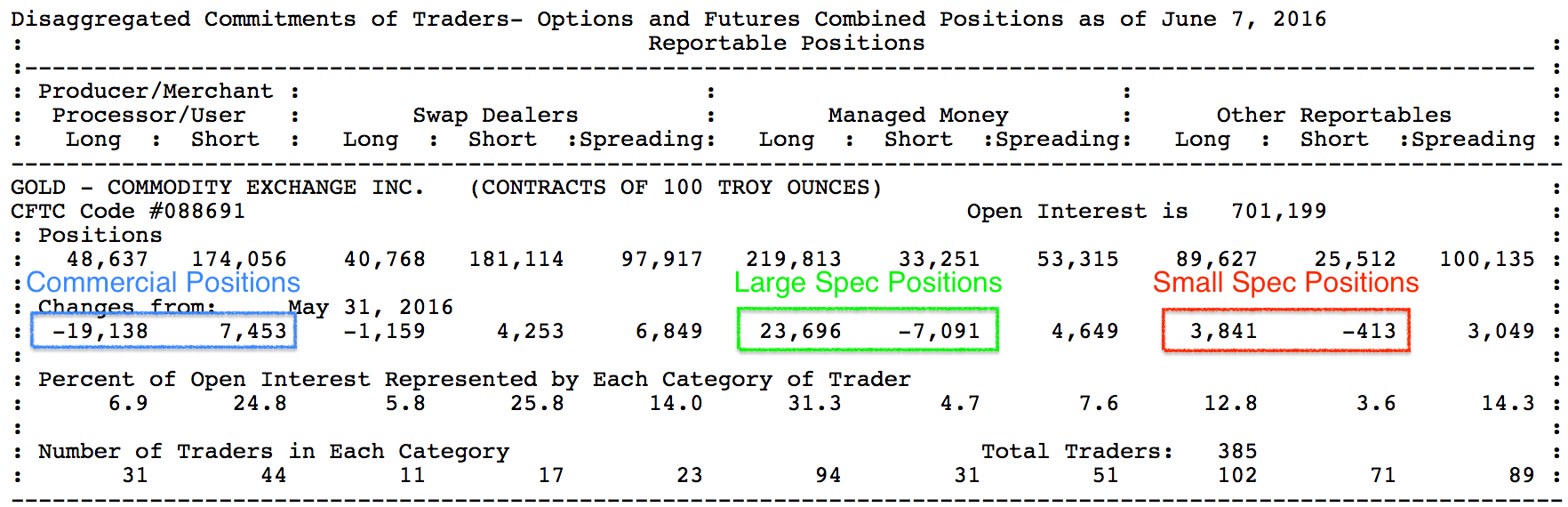

Our focus on the weekly Commitments of Traders report can usually be summed up in the Disaggegated Commitments of Traders (COT), Options and Futures Combined Positions report. This is the simple version of the Commodity Futures Trading Commission’s endeavors to provide transparency in our markets. This report breaks the market down into four categories, Producer/Processor, Swap Dealers, Managed Money and Other Reportables. Our focus lies with the interaction of the speculators (Managed Money and Other Reportables) and the commercial traders (Producer/Processor, Merchant/User). Today, we’ll look at the behavior of the commercial traders and the speculative traders in the gold futures on last week’s rally to determine if it has legs or, is just a blip in a downward trend.

We noted the diametrically opposed behavior between these two groups here, May 9th, when the speculators had built up a new net long record position. Furthermore, this led to gold producers selling the most forward production they’d contracted for since October of 2010. We knew that this was an unsustainable position and warned of an eminent decline in gold to $1,200 in, “COT Alert: New Record Speculative Record Position in Gold.” The more imbalanced the position, the greater the odds of the market resolving the conflict in the commercial traders’ predicted direction.

Now that we’ve gotten the rally off the bottom and we’re right back within striking distance of the highs, what do we see? Well, commercial producers have once again come pouring into the sell side. The COT report breaks the total positions down into longs and shorts. Therefore, looking at the snippet from last week’s report, we have to do a bit of calculation. Last week, commercial processors, the end users of gold, cut their long position by 19,138 contracts. Meanwhile, commercial producers (miners), contracted to sell an additional 7,453 contracts. Total long positions minus total short positions provides us with the commercial trader net position. The net positions of the commercial and speculative traders is what you’re used to seeing plotted on our charts.

Compare the commercial position to the Managed Money (speculative) position. They added 23,696 new, long positions while offsetting another 7,091 short positions. Further enforcing our point, small speculators also added 3,481 contracts to their long positions while offsetting 413 short positions. This means that speculators were the only net buyers on last week’s rally. In fact, if we combine the percentages controlled by the individual trader groups, we find that speculators control 54.1% of the total long open interest while commercial traders are net short 24.8% of the total open interest.

This is going to be a huge week in the markets with all eyes on the FOMC’s speech on Wednesday. Considering that the speculators are within spitting distance of their net long record, I’d conclude that upside in the gold market is limited at these levels. The gold market will simply have a tough time finding new buyers to push through the $1,300. Therefore, we think a gold rally on Wednesday’s FOMC action or, inaction creates an optimal rally from which to initiate new short positions, rather than entering the long side of an already fully funded rally.

Please visit CotSignals.com for more information on our approach as well as a 30-day free trial of our Discretionary Cot Signals.