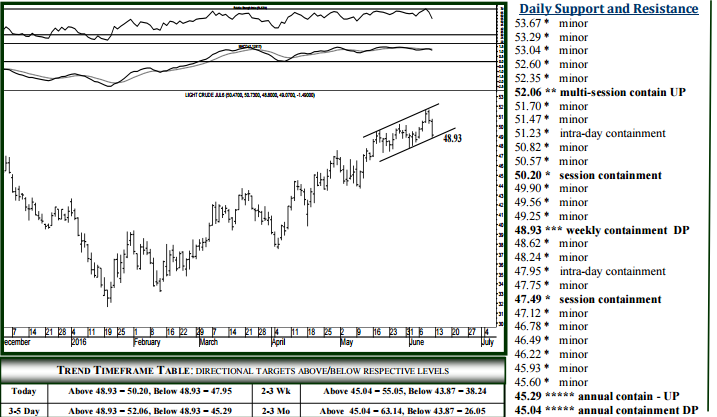

SHORT-TERM (today 5 days out)

For Monday, the 48.93 formation can contain weekly selling pressures, above which 52.06 is expected by Friday’s close, the 57.00 handle attainable within several weeks. Upside today, 50.20 can contain session strength, while pushing/opening above 50.20 allows 51.23 intraday. A settlement today above 50.20 indicates 52.06 within 2-3 days where Crude should top out through the balance of the week. Closing above 52.06 indicates 57.30 within 1-2 weeks. Downside today, breaking/opening below 48.93 indicates 47.95, likely to contain initial selling yet below which 47.49 becomes intraday target likely to contain session weakness. A settlement today below 48.93 maintains a heavy dynamic into later week, long-term support in the 45.04-29 region then expected by Friday’s close, able to contain selling through July and above which a long-term buy signal remains in effect,

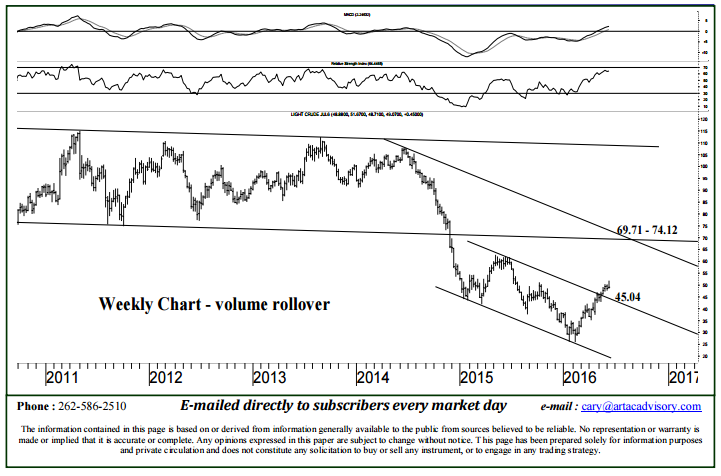

MID (2-3 wks) & LONG TERM (2-3 ms )

The 45.04-29 region can absorb selling through the balance of the year, above which a long-term buy signal remains in effect, 57.30 expected over the next 3-5 weeks, 63.14 within several months, the next 5-8 months likely to yield 69.71 – 74.12, a narrowing range of long-term resistance likely to contain annual buying pressures when tested (page 2). For those ‘big picture’ traders, 45.04 should be considered the start of a narrowing range of long-term support down to 43.61 able to contain selling through July. It would be a settlement below 43.61 that indicates a good high into later year, 35.94 then considered a 3-5 week target, last February’s 26.05 low expected over the following several months

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE