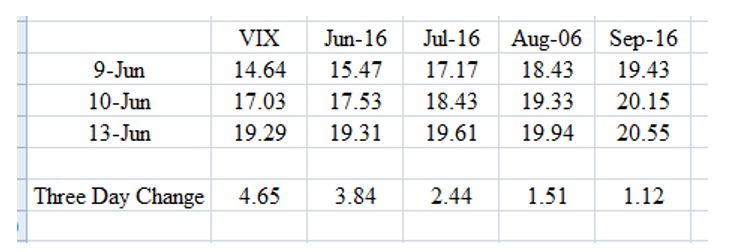

VIX. Many traders, both retail and professional, love to trade it. It’s a very appealing instrument. But, many do not entirely understand it. If you are going to trade VIX and its related products, you have to do your homework. The VIX options are European exercise. That means you can’t exercise them until the day they expire. There is no effective limit on how low or high the prices can go on the VIX options until the exercise day. You can certainly trade in and out of VIX options positions, but you cannot exercise (nor be assigned) before expiration. The expiration or “print” amount when VIX options expire is typically given under the ^VRO symbol or $VRO. This is the expiration value, not the opening cash VIX on the Wednesday morning of expiration. VIX options expire at market open on expiration day, so they are not tradable on that day. VIX options do not expire on the same days as equity options. It is almost always on a Wednesday. But most importantly, you are not trading the VIX per se; you are trading the VIX future coincident with the option expiration. The VIX futures can vary quite a bit at different points in time. This is known as time structure. Take a look at how the time structure changed last week.

So you can plainly see why calendar trading in VIX can be quite a slippery proposition. Your options are priced off the futures, not off of the VIX itself. This time structure dynamic is very typical of what happens when there is a price spike in VIX. You will experience a “flattening” of the curve from the normal contango relationship. In rare cases, you can even see a backwardation relationship where the front expirations are over the back expirations.