It is a common myth among novice futures traders that you buy natural gas at the beginning of summer because increased demand for electricity from US air conditioning needs will spur demand for the natural gas that fuels many electricity generating plants. While this is a massive over generalization of price forecasting (as is most trading folklore), it is grounded in fact.

The US does get a bump in natural gas demand in the summer as electricity use does spike and demand for natural gas does increase. But it’s a mild increase and represents a mere blip in comparison to the winter seasonal in which demand surges for natural gas heating needs.

But it is not the size of the demand jump that really matters to price. What matters most to price is where supply is in relation to that demand. It’s in this equation that the novices most often get it all wrong.

Despite common market “wisdom,” natural gas consumption in the summer is relatively light.

The Real Seasonals of Natural Gas

Common sense would seem to dictate that prices should rise as retail demand increases. But seasonal price forecasting is rarely so simple in commodities.

The fact is, seasonal price strength tends to occur in the Spring as distributors replenish inventories that have been depleted through the winter. This is high demand season on the wholesale level – from which commodities most often take their price cues.

By the time summer arrives in earnest, this accumulation phase is well underway. Prices will tend to begin falling as wholesale inventories start to build. Thus, in natural gas, prices will tend to peak when wholesale supplies are lowest (in late Spring) and bottom out when wholesale supplies reach a peak (in early Winter.)

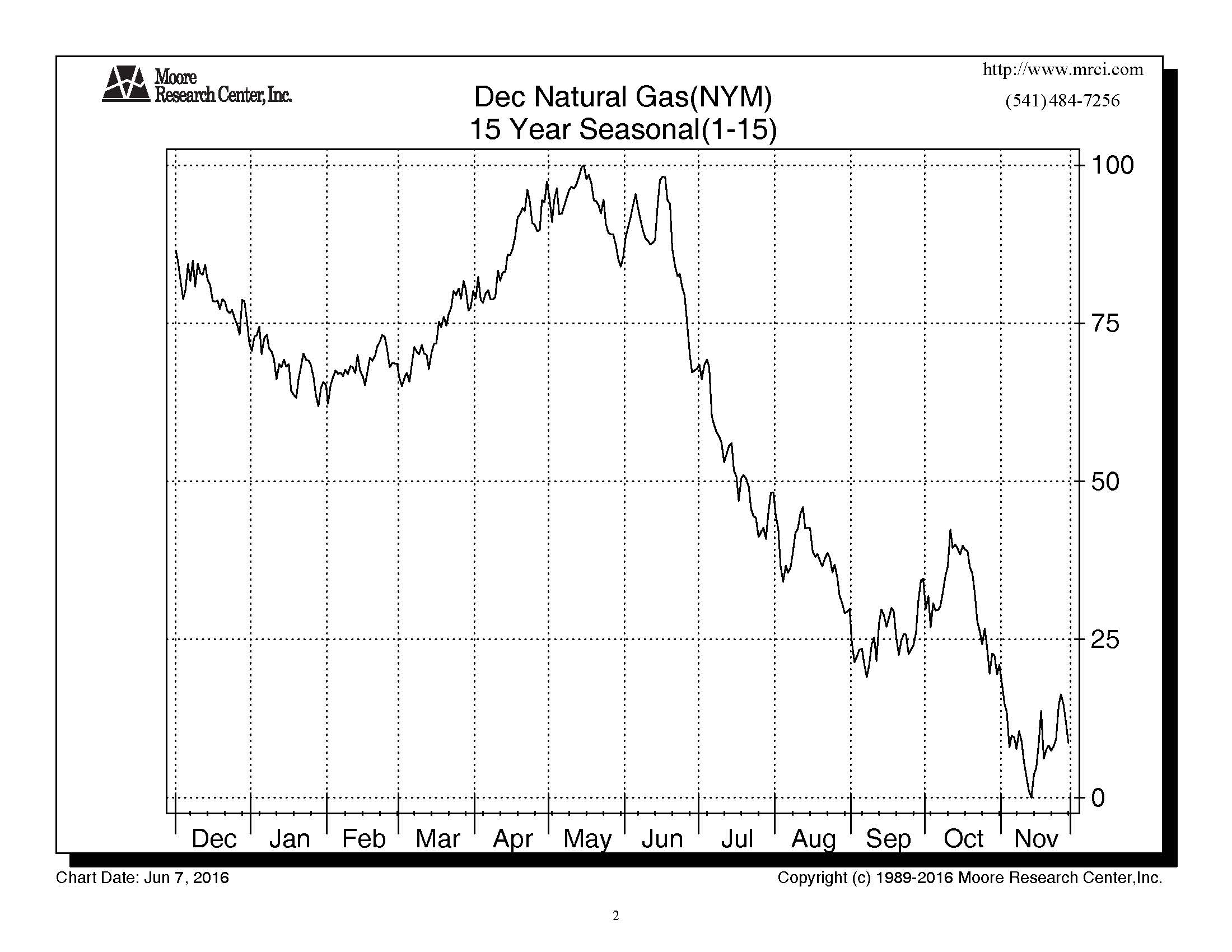

This is why it is not uncommon to see natural gas price weakness begin to enter the market in June and price strength appear in December. The seasonal chart below illustrates this tendency clearly.

Caption: Natural Gas Prices tend to peak in late Spring and decline as inventories build into winter.

The Fundamentals of 2016 Natural Gas

June of 2016 finds the Natural Gas market firmly in the grip of a supply glut. The latest IEA inventory report shows current inventories at 2.972 trillion cubic feet (tcf). This is a record high for this time of year. The chart below illustrates 2016 inventories in comparison to historical highs and lows for different times of year. Note also the cyclical trends in supply discussed previously.

2016 Natural Gas Supplies are at historic highs for this time of year.

Opportunity for Option Sellers

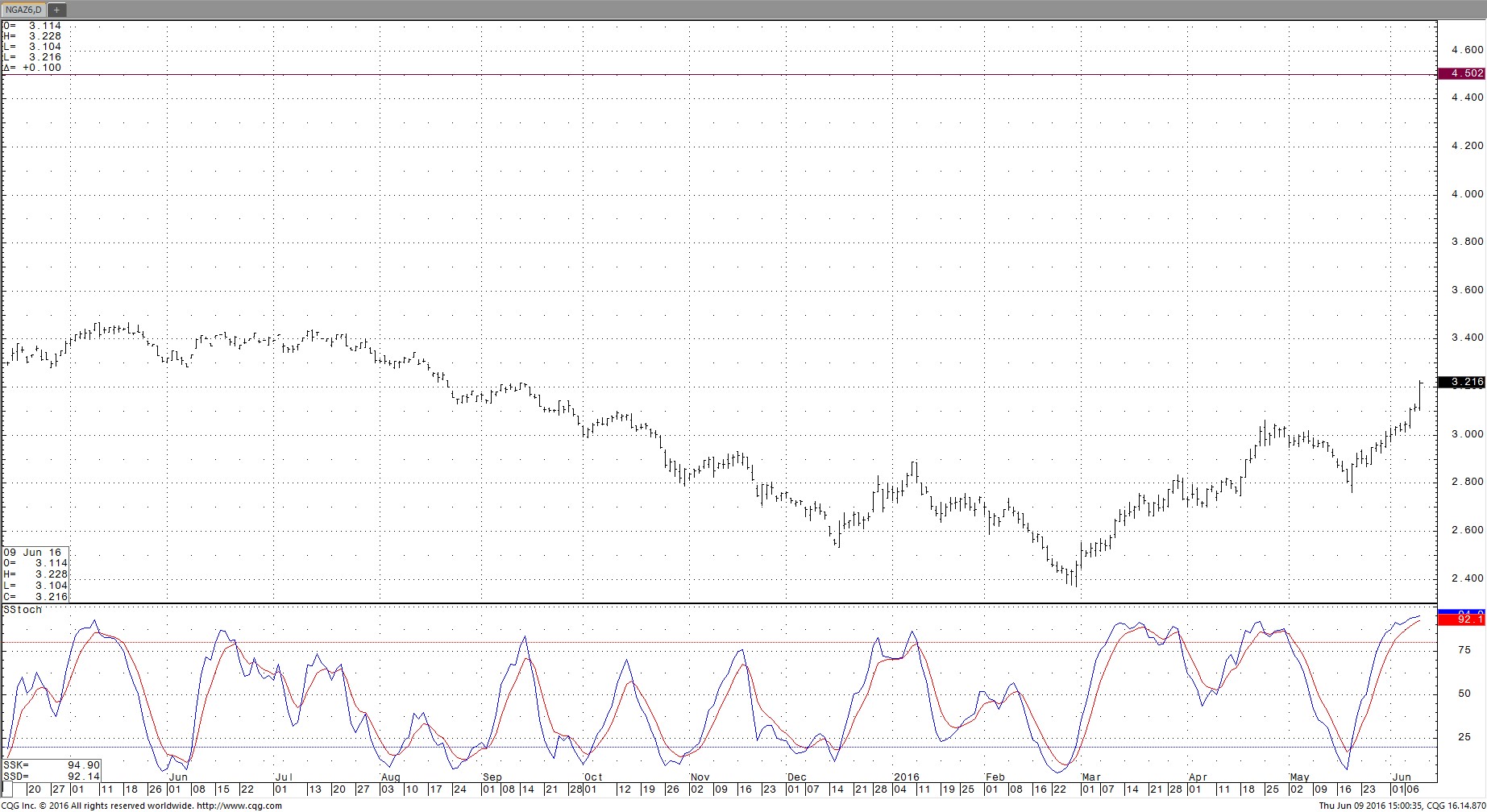

With supplies at historically high levels and a strong seasonal tendency for weaker prices during the summer months, natural gas have nonetheless spiked in the opposite direction in June. This could be the function of a late “last gasp” seasonal top. But it’s also likely due to speculators entering the market ahead of “air conditioning season.” 2016 has seen bouts of warm weather this Spring. And with temperatures predicted above normal for the remainder of June, buying into the air conditioning storyline gets easier for headline driven specs.

This week’s EIA storage report added an extra boost to speculative furor with a less than expected injections into storage. Injections were reported at 65 billion cubic feet (bcf). With expectations for a 79 bcf injection – the bulls took this as another sign that lower supplies and higher prices are ahead in the natural gas market.

But they are not looking at the bigger picture. Overall supplies are at record levels – 32.1% above the average for this time of year, seasonal tendencies overwhelmingly favor bears and the market appears to be perilously overbought.

Nonetheless, the latest spike upwards has brought a surge in both volatility and call option premiums. That makes selling call options an attractive and fundamentally sound strategy at present.

Natural Gas market volatility has helped increase call option premiums.

Fundamentals notwithstanding, there is nothing that says natural gas prices must turn and head lower tomorrow. Markets can remain irrational longer than you can remain solvent.

That is why we sell call options and don’t trade the underlying.

OptionSellers.com currently favors selling the December Natural Gas 4.50 call options. At the time of this writing, the call is valued at $450. Margin requirement per option is currently in the $1,000 range. A continued rally in gas prices should increase both premium and volume in natural gas calls and thus, make this market a candidate for building a larger position.

December 2016 Natural Gas (NGZ)

Selling the December Natural Gas 4.50 call option

The specs may be having their way with natural gas in the short term. But the odds are against them. The forces of fundamental gravity should, in our opinion, eventually pull prices back down. You can bide your time by getting paid to sit way up at the $4.50 strike and wait it out. Should prices follow a normal seasonal pattern, you could be buying back near worthless options within 90 days.

Of course, anything is possible in markets and losses are always possible. However, in an age of negative interest rates, a nervous stock market and George Soros positioning for economic meltdown, targeting a 40% return in 90 days by simply betting against the improbable seems to be a rational and potentially rewarding investment approach.

It’s a wonder more people don’t learn how.

James Cordier is author of McGraw-Hill’s The Complete Guide to Option Selling, now available in its 3rd Edition. James is head portfolio manager at OptionSellers.com, an investment firm serving high net worth individuals. For more information on option selling accounts with James Cordier and OptionSellers.com, a free Discover Pack is available at www.OptionSellers.com/Discovery.