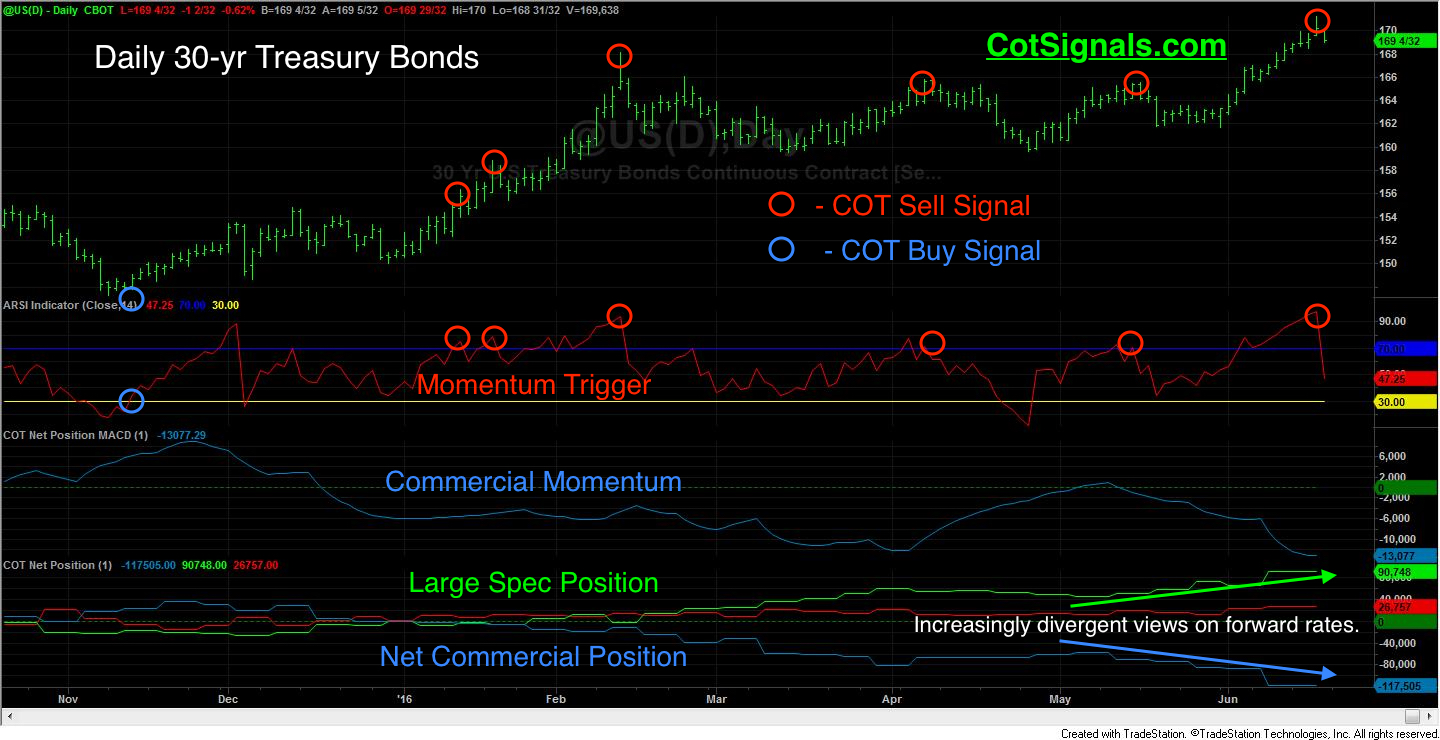

The last leg of this Bond rally began on June 3rd, when the jobless claims number came in horrifically low. This led to the belief that there was no way the FOMC would raise rates in their June 15th announcement. Obviously, the FOMC did not raise rates and Bond prices continued to climb after the initial announcement. However, the wicked reversal since reality set in is actually the clue we’ve been waiting for to short the 30-year Treasury Bond futures. The large speculators who had been front running the FOMC have finally gotten themselves caught with no one left to buy at the currently over-stretched prices as you’ll see on the chart below.

We began watching this situation over a month ago as speculative traders and commercial traders pushed their positions to levels not seen in years. But, as you’ll also notice, of previous reversals, while tradable, offered little in the way of compensation; a couple profitable opportunities but no homeruns. What isn’t shown on this chart is the deep history of the long bond and the interaction of the commercial and speculative traders. Commercial traders were HUGE buyers in ’07, ‘08 and 2010. These are the structural kinds of moves that record large commercial positions portend. Therefore, as this position has grown on the short side and its growth has accelerated, we are beginning to think this is about the last of the rally. Truly a case of, “hot potato,” and the specs are about to get burnt.

We noted on June 3rd, saying, “The commercial trader and large speculator net positions appear nearly equally distributed at long 72k contracts versus short 84k contracts. However, the total commercial position is nearly 75% larger than the speculative position. More importantly, the commercial total position size is less than half its recent maximum size. This means that commercial traders still have plenty of selling capacity left in reserve while the speculators are quickly nearing exhaustion.” Now, the speculative position has grown to more than 90,000 contracts. We believe this position is unsustainable.

The commercial traders tend to have their biggest positions on at the most appropriate times. This is exactly the opposite of speculative behavior. This is how we quantify the battle between value and froth. Based on the near record imbalance between the speculators and the commercial traders, we’ll side with the commercial traders and sell the September 30-year Treasury Bond and place a protective stop at Thursday’s high of 171^07. This reversal should be strong enough to pull us back below 164 and provide us with an opportunity to further evaluate the behavior between the market’s participants to determine whether we’re seeing another tradable pullback or, an actual reversal.

For more information, you can visit www.andywaldock.com.