The IPO market may still be soft, but, don’t tell that to Twilio (TWLO), which saw very healthy demand for its IPO today (6/23/16). Before the market opened, its 10.0 million share IPO priced at $15, above the $12-$14 expected price range, raising total gross proceeds of $150 million. Amazingly, TWLO is the first IPO of 2016 to price above the projected range.

Not only did it price strongly in the primary market, but, it also opened with a bang on the secondary market. Specifically, shares opened at $23.99, good for a 60% pop, making it the highest opening gain for any IPO this year.

The fact that there was a strong underwriting team behind the deal certainly helped, as Goldman Sachs and JP Morgan took the lead. But, as we discuss in more detail below, what certainly caught investors’ attention was TWLO’s impressive growth. As anyone who regularly follows the IPO market surely knows, high growth IPOs from the technology space have been rare commodities.

With pent-up investor demand, a relatively small float of 10.0 million shares, and some intriguing fundamentals, a recipe for a strong debut was in place.

A Next-Gen Communications Company

TWLO strives to be a modernized communications company that uses cloud software to market to developers that are interested in adding phone, messaging, and video services. Instead of relying on costly legacy communications infrastructure, application developers can simply implement TWLO’s software to add on various customized communication tools.

As an example, Uber has integrated TWLO to show when a driver has accepted a request and also enables drivers and riders to communicate with each other. Another example is that Facebook uses TWLO’s voice and messaging services to verify new and existing customers.

TWLO breaks it platform into three categories: Programmable Communications Cloud, Super Network, and Business Model for Innovators. Here is a closer look at each of those:

- Programmable Communications Cloud: This piece allows developers to incorporate the ability to make and receive phone calls, globally, and to add advanced voice functionality like text-to-speech, conferencing, recording, and transcription. Also included here is programmable messaging and programmable video. Messaging allows users to send/receive texts. emoji, picture messaging, and localized languages. Video enables developers to build mobile and web applications with embedded video, including for use in customer care, collaboration, and physician consultations.

- Super Network: The programmable communications cloud, discussed above, is built on top of this software layer, called Super Network. This network interfaces with various global communication networks, allowing its customers’ software to connect with devices globally. What is advantageous about TWLO’s network is that it doesn’t include any costly physical infrastructure, and, it breaks through geopolitical boundaries and scale limitations of physical network infrastructure.

- Model for Innovators: This part of its platform empowers developers by reducing friction and upfront costs, encouraging experimentation and enabling developers to grow. What this essentially means is, TWLO allows developers to begin building out their communications offerings with a free trial. Once developers sign on, they can then increase consumption and pay based on usage.

High Growth Ahead; But Profitability is Not

One of the more intriguing aspects of TWLO is the massive size of the addressable market it has in front of it. According to Gartner Research, about $1.5 trillion was spent on communications services in 2015, roughly five times the amount spent on enterprise software and nine times the amount spent on data centers. Over time, TWLO believes that a large portion of that $1.5 trillion will shift from existing hardware, and network-centric communications products, to software applications that integrate communications solutions.

The reason why the company feels that way is because legacy products have many limitations, and are unable to meet many of the ongoing trends in technology. For instance, networks tend to be geopolitically bounded and impractical to scale, which hinders innovation.

Another key going forward is to grow its enterprise business. Historically, TWLO has generated a vast majority of its revenue from small developers. But, it sees a major opportunity to expand into larger businesses and it is increasing its investment in sales and marketing to do so.

While its topline growth has been, and should continue to be impressive, the company also is not profitable and likely won’t be any time soon. TWLO is planning to aggressively invest in its sales team in order to expand into the large enterprise market.

Financials & Valuation

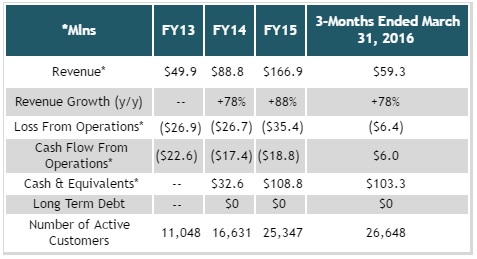

What clearly stands out — at least on the positive side — is TWLO’s strong revenue growth, coming in at high double-digit rates. What’s obviously driving that growth is the rapid increase in the number of active customers. Another plus is the solid balance sheet, showing plenty of cash and no long term debt.

It’s not all good news, though. TWLO has consistently lost money, and what’s more concerning, is that the losses are widening instead of shrinking. TWLO has been aggressively ramping up its research and development and sales and marketing spending, which has offset its robust topline growth.

Its 1Q16 results did show marked improvement, however, both in terms of operating losses and cash flow. Taking a closer look at those results, revenue was up 78% y/y to $59.3 million. This was driven by an increase in usage of all its products, but especially its programmable messaging and programmable voice products.

As mentioned above, TWLO has not been shy about spending in order to fuel growth, which has been the main hurdle to profitability. But, at least in 1Q16, it did do a better job managing costs. R&D was up 75% (vs. 95% in FY15) and sales and marketing expense was up a reasonable 36%. With the sharp increase in revenue, the bump in gross margin, and the slowdown in spending, TWLO’s operating loss narrowed to ($6.4) million compared to ($8.7) million in the year ago period.

Lastly, at $15, where the IPO priced, TWLO had an attractive valuation. Specifically, its trailing P/S stood at 7.4x FY15 revenue. Now, however, with the huge opening pop, the valuation has become much more expensive with a P/S north of 12x.

Conclusion

TWLO had many of the characteristics we look for in an IPO, including: high growth, strong underwriters, smaller float, and reasonable valuation (prior to its open).

And what’s especially encouraging about TWLO is that its revenue growth hasn’t really trailed off. Many times when a tech company goes public, its revenue growth rates will be decelerating. TWLO has plenty of opportunity and runway for future growth, and its strategy is to build out its enterprise customer base.

Not too surprisingly, TWLO is not profitable. This is, of course, a primary fundamental blemish. But, our main concern now is valuation, as noted above. Given the rich valuation, and the fact that IPO investors are now sitting on significant gains, the risk of a near-term pull-back must be considered.

From a longer term perspective, though, TWLO is a name that I am bullish on due to the compelling and easily identifiable growth catalysts ahead of it. Therefore, one trading strategy to consider is waiting for a meaningful profit taking pull-back in the stock, and then initiating an opening position.