When you’ve got nothing you’ve got nothing to lose.

–Janis Joplin

That was some ride Thursday and Friday. The markets had been making a nice little bump on the prospect of British voters deciding to remain inside the European Union. US equities were up, looking like they might finally make a new high. Gold was off a little, as you would expect when uncertainty was driven out of the market. USD was steady. All’s well with the world.

But as the first election returns started coming in from Britain after 6 p.m. Thursday (New York time) the bottom started to drop out and full-fledged panic took hold.

The British pound fell 12% and the USD soared, driving the oil market down. Gold, the usual safe haven in times of trouble, gained $110 an ounce in the futures contract. Bond yields (the reciprocal of prices) tanked.

And the only available surrogate for US equities, the S&P500 mini-futures (which were trading in the Globex market while the cash index was still closed) fell 120 points overnight, before rallying in a ‘dead cat bounce’ that was erased as soon as the day session opened.

All markets everywhere were in chaos, because British voters didn’t do what all the smart money wanted them to do, and assumed they would do.

So what happens now? After the bomb goes off, what’s next?

We don’t know. Nobody else does either. From this point the commentariat will flood the airwaves with guesses, but it would be wise to remember that is all they are: guesses. Here are some of ours:

n There is virtually no possibility of a rate hike from the Federal Reserve before the election. The possibility was pretty low before, but now it is extinguished. Instead the Fed will join central banks from around the world looking for ways to make money cheaper. Negative interest rates, quantitative easing, bizarre and outrageous financial stratagems will all come into play. In other words, expect more of the things that got us into this mess.

n The US will probably do alright in this crisis. Eventually, so will Britain. The US is still the cleanest dirty shirt in the closet, which means panicky investors around the world will be buying USD-denominated assets. There is nowhere else to go; the other ‘safe havens’ are miniscule in comparison to the amount of money that will be looking for someplace to hide. And after the dust settles Britain, with a lower pound sterling and lower prices for its exports, may enjoy a renaissance. Maybe. Over time, the damage to the EU – and the Euro – will probably be greater than the damage to Britain.

n The most important impacts of the British vote to leave are likely to be political, not economic. In effect the British voters successfully rebelled against a financial/political/media elite that was convinced it could maintain the status quo. But voters in Britain and in a host of other countries have shown they are willing to pull the whole enterprise down if that is the only way to change the existing order of things. As Janis Joplin once sang: when you’ve got nothing, you’ve got nothing to lose.

That sense of rebellion is not confined to Britain. At least eight other EU countries have large, active political campaigns to get out of the Union. The biggest fear in Brussels is that the contagion will spread … as it almost certainly will.

The same sense of rebellion is apparent in US politics too. The candidacy of Donald Trump and the unexpected and unprecedented success of Bernie Saunders are expressions of the same dissatisfaction with the status quo that won the vote in Britain.

And it explains the good cheer that accompanied a report from Bloomberg News that the 400 European individuals and families on its “Billionaires List” suffered the greatest losses in the stock market on Thursday. They lost a combined total of about $128 billion – with a ‘B” – from their market positions.

They’ll never miss it, however; it represents just a bit more than 5% of their total holdings.

This week

This is the end of the month, and the week closes with the beginning of a holiday weekend. Friday will have the trainees in charge of the terminals and nobody will be minding the store until a week from Tuesday.

The big question for today is whether the decline will continue once the European markets open about 2:00 a.m. Monday morning. By the time you read this you’ll know the answer. In early overnight trading prices gapped down, but held above important support levels.

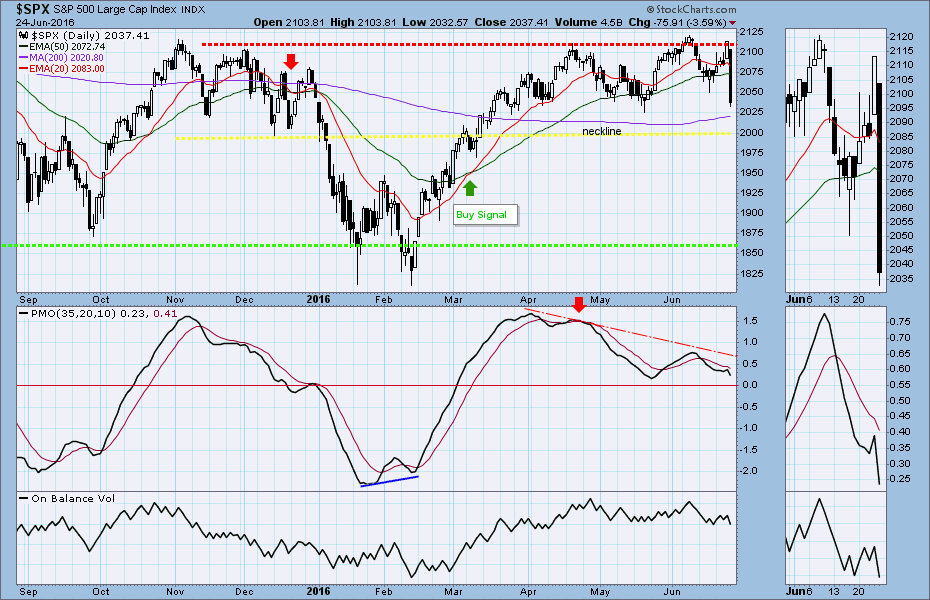

The long-term outlook for the S&P500 is still bullish, and Friday’s close at 2037.41 was only a 1.63% loss for the week. No apocalypse yet.

The important resistance levels are 2073 and 2093; in the absence of some substantial economic news – say the ECB announcing a major stimulus package – we expect those levels will hold the price down this week.

The important support is 2030-25 and the psychologically important level at 2000.

Overall the outlook this week is bearish; we could see a decline early in the week and a bounce into Friday’s close.

Today

For the S&P500 mini futures (ES):

ES is likely to stay in the low end of the range today and fight to prevent a move lower. 2065-75 is a major resistance zone. As long as the price stays below it, the sellers remain in control.

Buyers will have to spend lots of time defending the 2000 psychological support. A break below 1995-90 could trigger selling stops and send the price lower toward 1985-75.

Major support levels: 2000-1998.50, 1985-83, 1975-73, 1965.50-62.75

Major resistance levels: 2065-68, 2078.50-81.50, 2089.50-93.50, 2107.50-05.50

Visit Naturus.com to see detailed previews for gold and the ES for the week ahead. Free.

Chart: SPX Daily chart to June 24, 2016