Volatility is back. And it’s back in force. We can thank Brexit for getting the ball rolling.

A majority of investors get killed in markets like this. But it’s not because they have a bad investment strategy. It’s because they don’t stick to the strategy they have.

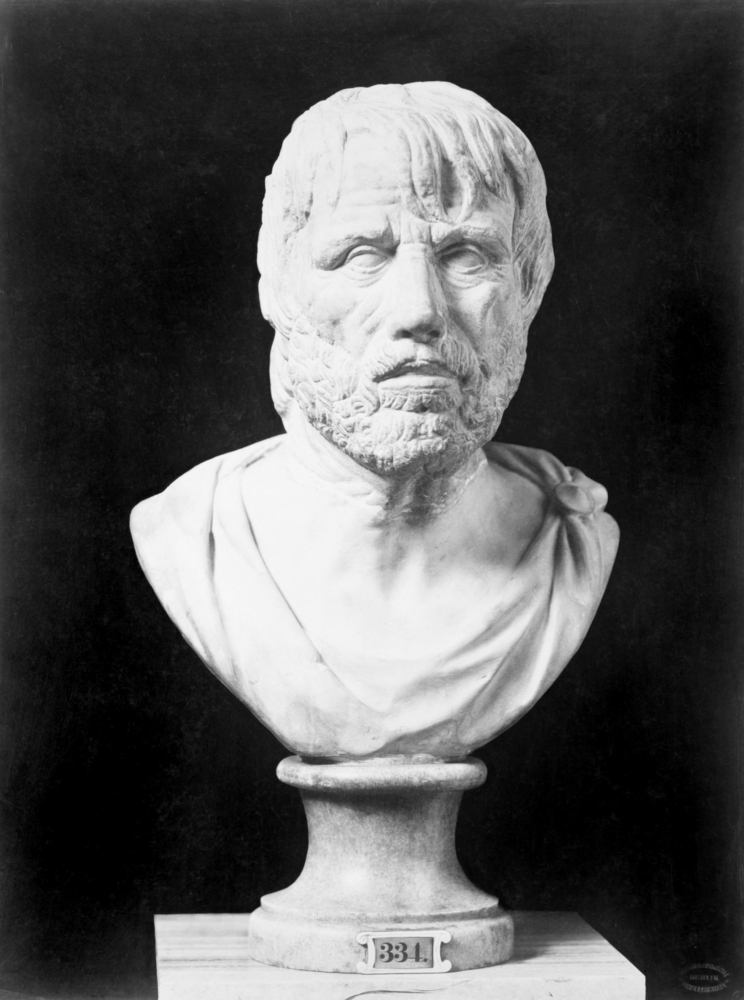

As Seneca explains in his Letter II:

“…nothing hinders a cure so much as frequent changes of treatment; a wound will not heal over if it is being made the subject of experiments with different ointments; a plant which is frequently moved never grows strong. Nothing is so useful that it can be of any service in the mere passing.”

“To be everywhere is to be nowhere.”

Seneca describes the importance of sticking to one pursuit at a time to truly reap its benefits. Constant switching, as Seneca says, is “symptomatic of a sick mind”.

This is wisdom every trader and investor needs to heed. Especially at a volatile time like this At Macro Ops, the number one problem we see with traders is their inability to stick with their trading strategy. They constantly want to abandon their old strategy and jump to whatever shiny new indicator they just read about in some forum. This is a recipe for disaster.

Markets move in cycles. And so do investment strategies. There will be periods of drawdown, and periods of profits. To truly see if a strategy works, you need to let it play out through the entire cycle. A full cycle can take a half a year or more to play out. Most don’t have patience to stay the course.

Too many traders want to switch strategies as soon as a single trade results in a loss. The loss makes them automatically think their strategy doesn’t work. Here’s the thing though. Every strategy will have trades that fail. There’s no holy grail out there.

But this doesn’t prevent investors from looking for one. They continue to switch and run into the same problem time and time again. This only leads to more losses and a dwindling trading account.

The trick to avoid this fruitless switching is to fully understand your strategy.

Understand the average number of winners and losers you’ll have, and also the average profit or loss from each.

Understand what type of market environment your strategy performs best in.

Understand which types of trades have a higher probability of paying out and which don’t.

Fully comprehending these aspects of your strategy will allow you to know if something is actually going wrong, as opposed to a negative result that’s just part of the total cycle. Then you can adjust and refine from there.

So think about the current swings in the market and the result on your P&L. Are they a sign that your strategy is off? Or is just a part of the full cycle of market movements? Think carefully before trying to switch your strategy.

For more information about using the proper investment strategy, please click here.