SHORT-TERM (today and 5 days out)

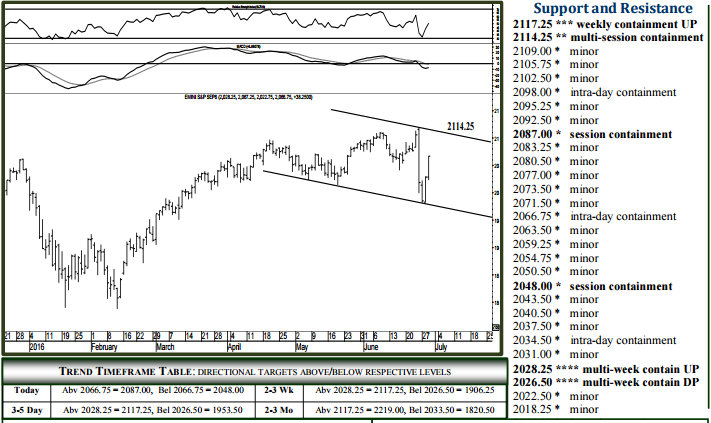

For Thursday, 2066.75 can contain initial weakness (assuming an open above), above which 2087.00 remains in intraday target able to contain session strength. Pushing through 2087.00 indicates 2098.00 intraday, while closing today above 2087.00 signals 2114.25 tomorrow, the start of a range of targeted resistance up to 2117.25 able to contain buying through next week and a meaningful upside continuation point into later Q3. Downside Thursday, breaking/opening below 2066.75 allows 2048.00, able to contain session weakness. Breaking/opening below 2048.00 should yield 2034.50, possibly 2026.50-28.25 intraday, able to contain selling through July trade and above which 2117.25 remains a 1-2 week target – higher trade expected into later July. A surprise settlement today below 2026.50 would indicate a good high into later July, 1906.25 and becoming a 2-3 week target.

The 2026.50-28.25 region can absorb selling through July trade, above which 2117.25 remains a 1-2 week target, likely to contain weekly buying pressures when tested yet nonetheless vulnerable to violation on the next approach (2125.81 underlying index – bottom of page 2). In other words, yesterday’s settlement back above ‘mid-term sell signal resistance’ represented a full-throated rejection of downside price activity into later Q3, 2219.00 now considered a 2-3 month target. A settlement above 2117.25 (2125.81 index) should yield 2219.00 within a mere 3-5 weeks where the broader market can top out on a quarterly basis. Downside, a daily settlement back below 2026.50 maintains a heightened volatility dynamic into later July, 1906.25 then becoming a 2-3 week target, long-term support at 1820.50 attainable by the end of August.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE