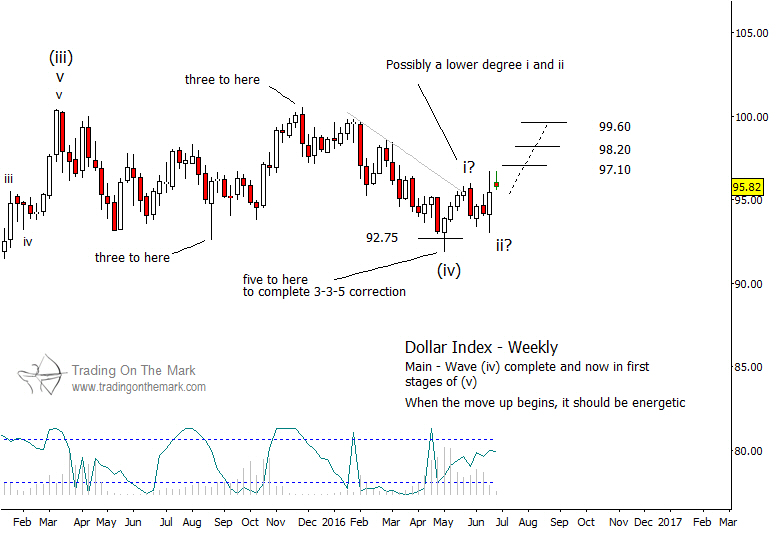

After last Thursday’s Brexit vote, the U.S. Dollar Index has offered some confirmation of the upward forecast we described in our June 2 post. Here we suggest some signals to watch as further confirmation of the upward trade, and we present some revised near-term targets.

The index found support several weeks ago at what we have been treating as the bottom of a corrective wave (iv). It is important that, even during the few hours last week when it was believed that the Brexit vote had failed, the index remained above its earlier low. From Friday onward, the bounce has been strong, just as the decline in the British Pound has been severe. The Euro also has declined somewhat too.

Looking forward, we expect the rally to behave as a third wave should – i.e., it should display persistence and strength as it moves toward the target zones. Specifically, we would want to see the low of each weekly candle print higher than the low of the prior week.

As the note on the chart indicates, the recent waves up and down – which we have labeled as ‘i’ and ‘ii’ – could actually be of a smaller degree. Thus, a five-wave move up from the May low might represent merely the first part of a larger five-wave move up into (v). Based on measurements of the swings, near-term targets include 97.10, 98.20, and 99.80, but higher may be possible later in the year.

Follow us on Twitter or facebook to get timely market alerts!