The volatility in London’s FTSE 100 Index after the Brexit vote has presented excellent trading opportunities in both directions. It also has led us to revise our analysis slightly from what we posted at TraderPlanet a month ago, although our forecast is still bearish from the present area.

After the United Kingdom’s vote to leave was tallied as a certainty, the FTSE led world equity markets downward for three days. At first, we were inclined to treat that as an impulsive wave downward, but the subsequent bounce and the new high for 2016 invalidated that interpretation. Markets rallied hard, perhaps based on an assumption that central banks are no longer in a position to raise interest rates this year. (We believe that is a shaky assumption.)

The net effect of the whiplash in FTSE was to create something that counts well as a corrective pattern that is somewhat larger than what we depicted in our previous post. However, that pattern is now encountering several types of technical resistance. If our interpretation is correct, FTSE should make a lower high this summer compared to its 2015 high, and it should then produce a strong decline.

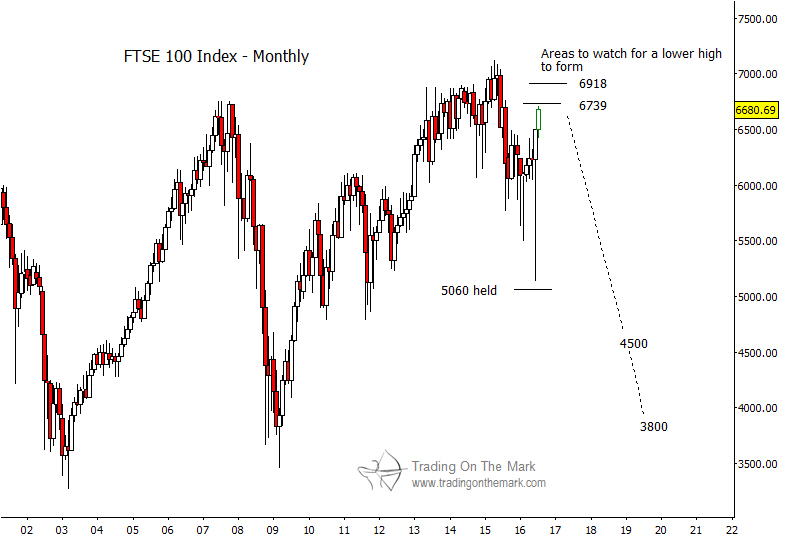

The monthly chart above shows two areas to watch for a lower high in FTSE in coming months – near 6,739 and near 6,918. The index is on the verge of testing the lower area now. If the index falls away from one of the areas shown, then its path should take it beneath 5,000 during the next two to three years.

Our July email bulletin will focus on European stock indices in the wake of the Brexit vote, including a much more detailed analysis of FTSE. You can request your copy via this link.