SHORT-TERM (today and 5 days out)

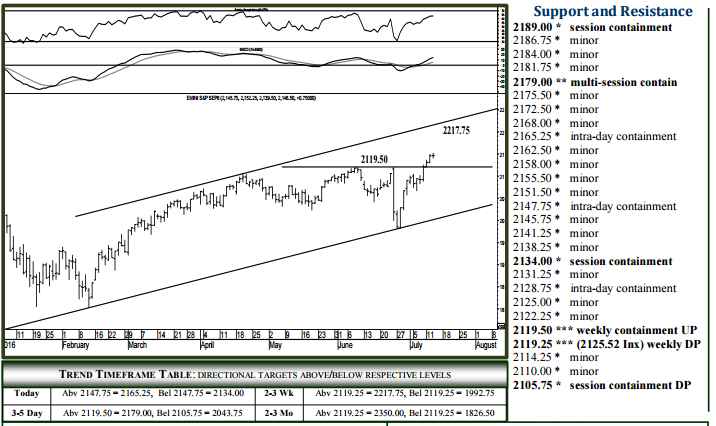

For Thursday, 2147.75 can contain initial strength, below which 2134.00 is expected intraday and able to contain session weakness. Breaking/opening below 2134.00 signals 2128.75, likely contain initial selling, yet below which the 2119.25-50 becomes an intraday target able to contain selling through July activity. Holding above the 2119.25 should yield 2217.75 over the next 3-5 weeks, while a settlement below 2119.25 would be considered a failed longer-term buy signal, essentially a valid sell signal over the next several weeks into the 1992.75 region. Upside today, pushing/opening above 2147.75 signals 2165.25, able to contain session strength. Closing above 2165.25 indicates 2179.00 within 1-2 days, able to contain buying into later next week and the level to settle above for yielding the targeted 2217.75 formation within another full week of activity

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2119.25 region (2125.52 Index) can absorb selling into later year, above which 2217.75 remains a 3-5 week target, 2350.00 attainable by the end of the year. Upside, 2217.75 should contain monthly buying pressures when tested, with a settlement above 2217.75 maintaining an accelerated upside pace into Q4, 2350.00 then expected over the following 5-8 weeks where the market can top out well into 2017. Downside, a daily settlement back below 2119.25 allows 1992.75 within several weeks, able to contain selling through August activity and the level to settle below for indicating a good Q3 high, 1826.50 then becoming a 3-5 week objective able to contain selling through 2017.