Investors Flocking to Gold in light of Negative Rates and Brexit could be getting to the party late. Here’s how to take advantage of higher prices without betting against the rally

In case you haven’t noticed, if you’re an equities, currency or interest rate trader, you’re officially in uncharted waters. With roughly $12 trillion in global government debt now carrying negative yields, uncertain side effects of Brexit on everyone’s mind, and managers holding their breath and pouring ever more funds into a stock market that seems to be defying gravity, this isn’t your father’s investing landscape.

All of this anxiety has made Gold a hot market as of late. And why not? As Jason Zweig of the Wall Street Journal put it last week – Gold is insurance against chaos. Maybe. But as Zweig also astutely points out, there is no direct correlation between falling share prices and rising gold prices. In fact, in the major stock sell offs in 2008 and 2011, gold prices dropped further than equities prices.

So much for that theory.

That doesn’t make gold a bad investment. Market anxiety, Fed speculation and a weaker US dollar have driven gold prices up more than 29% since the beginning of the year.

New All Time Highs

They question is, after nearly a 30% climb in value, do you want to load up on gold now? When it comes to gold, I’m the first guy to recommend owning some. I own some physical gold. I like owning it. I like to hold it in my hand. It makes me feel good.

But when it comes to trading gold in the open market, I’m a pragmatist. And when it comes to trading, gold is no different from any other market. When the public starts scraping it up with both fists, I get a little skittish. And scraping they are.

The SPDR Gold Trust took in $3.3 billion in new money last month and a total of $12.2 billion in the first half of 2016 – more than all US stock ETFs combined during the same periods. The July 5 commitment of traders report for gold futures and options showed a record spec and fund long position in gold with 372,008 open contracts. That’s right – a record – as in largest in recorded history. Commercial traders, by the way, are heavily short and adding more shorts.

Contrarian traders take note.

Prices Headed Lower – or Not

I am not necessarily a contrarian –per se – and you might not be either. But you don’t have to be to make money from what is going on right now.

Bulls argue that fallout from Brexit and further stimulus from central banks will continue to drive gold prices higher. And they might even be right – at least for a while.

But the fact of the matter is that gold prices tend to outperform during inflationary periods. And with Japan stuck in a cycle of deflation, Europe potentially headed into recession territory and Chinese growth dragged down to 6.6% recently, inflation does not appear to be on the horizon. While the Fed acknowledged as much with its recent decision to stand pat, its effect on the dollar was minimal. Why? Because despite anemic growth rates in the US, we’re really the only show in town. That makes the dollar a winner by default.

Thus the fly in the gold bull’s soup. Despite some rational arguments for higher gold prices, a non-inflationary global environment and the table set for a stronger dollar could not only hinder future rallies, it could easily begin to drive gold prices lower in the second half of 2016 – especially given the already lofty levels gold prices have attained.

Am I certain of that? No. I only make market calls on TV.

When it comes to putting money on the line, I’m not nearly as bold. Nor do you have to be to make money in the gold market. Remember as an option seller, you don’t have to guess where the market is going to go. You only have to find a level where it’s not going to go.

The Smart Strategy: Gold

Recent strength in gold prices along with massive speculative (public) interest has driven volatility and thus premiums in gold call options to ripe and juicy levels. If you sell options as a core investment strategy, you can take premium from these types of options without ever venturing a guess as to what gold prices will do.

If gold breaks or even drifts lower into Q3 and/or Q4, these options expire worthless and you keep the premium. But even if gold continues to trek higher, it is our contention that the factors mentioned above slow its ascent enough to still see options expiring out of the money and worthless on expiration day.

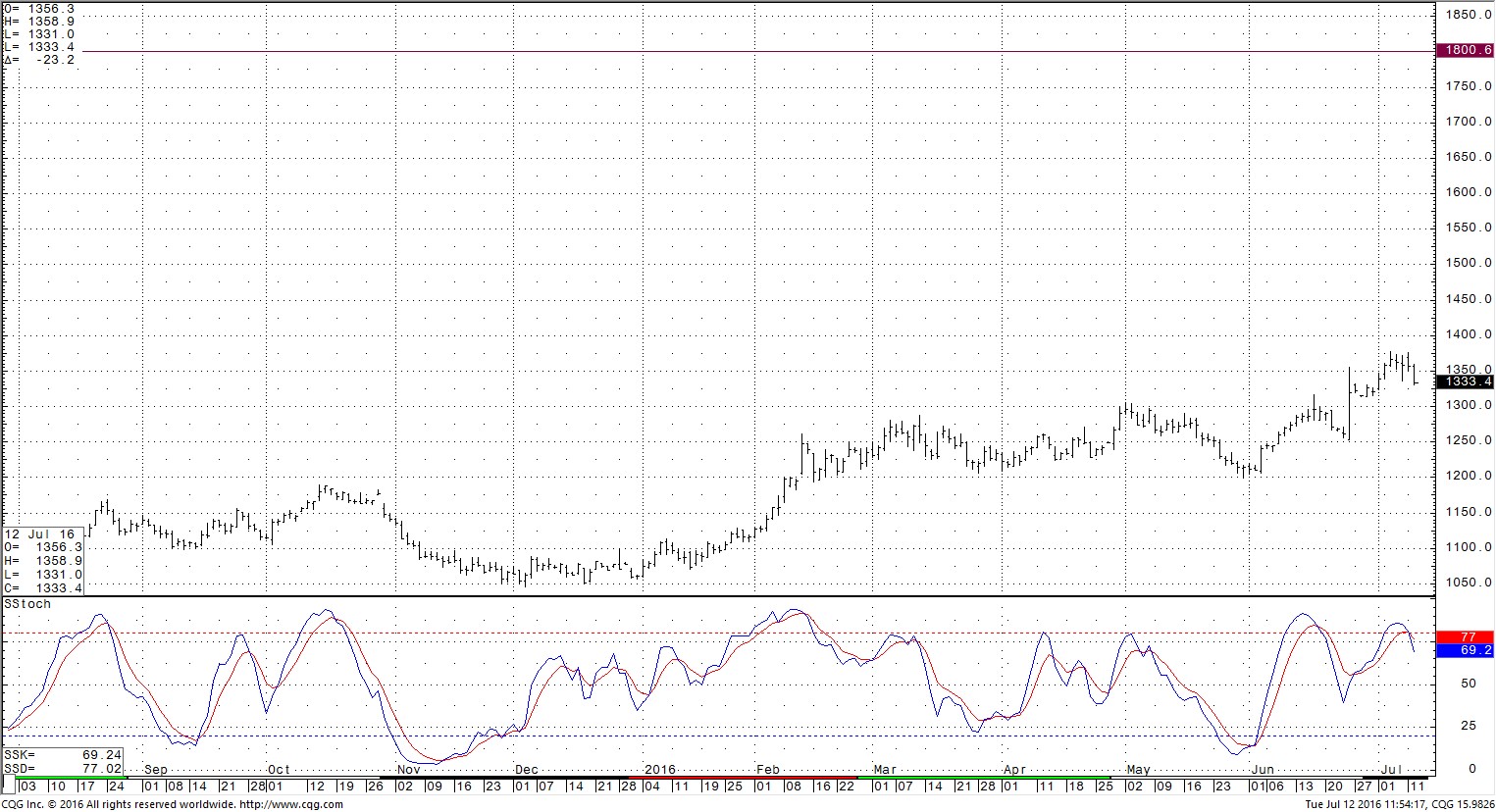

If you’re patient and willing to trade time for extremely high probability, we suggest considering selling the February (2017) Gold Futures 1800 calls. We’re currently pricing these for our managed portfolios. Premiums are running between $600-$650 each – after today’s pullback. We suggest “wading” into this position. Higher gold prices a week or two from now could bring fatter premiums for averaging up.

February 2017 Gold

Selling the 1800 Gold Call

If you seek faster time decay, you may prefer the December gold 1650 calls for premiums of $500. While we don’t pretend to know where gold prices will be 1, 2, or 5 years from now, we feel fairly confident that barring some unforeseen global catastrophe, gold will not be at $1800 per ounce 7 months from now.

Keep the coins in the safe or the bars in the deposit box, of course. But when it comes to generating steady (and potentially sizable) income in the gold market, following the herd has rarely been the optimum strategy. Better to stand aside and take donations as they all march up the hill.

James Cordier is founder and president of OptionSellers.com, a private equity management company specializing exclusively in selling commodities options. James latest book, The Complete Guide to Option Selling – 3rd Edition (McGraw-Hill) was published in 2015. For more information on accounts with James Cordier and OptionSellers.com, visit www.OptionSellers.com/Discovery