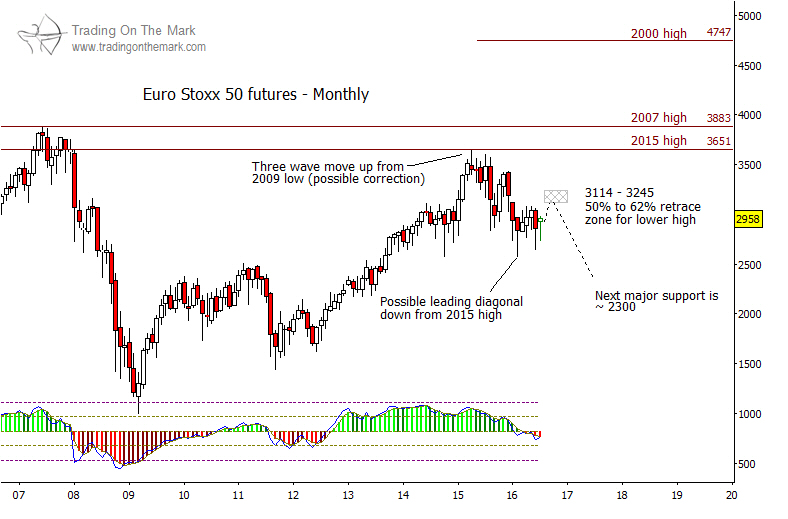

We have been watching for lower highs and signs of downward continuation in European stock indices this summer. Consistent with our recent forecasts for the London FTSE and the German DAX, we also see a potentially bearish pattern developing in the Euro Stoxx 50 Index. The index includes 50 of the most liquid stocks throughout the Eurozone and comprises a majority of the market capitalization in the Eurozone, making it a good barometer for the region as a whole.

Unlike the FTSE and the DAX, Euro Stoxx never broke above its 2007 high. We are provisionally treating the 2015 lower high as the end of a lengthy corrective move up from the 2009 low. The index should have an opportunity to confirm that view during the next few months, and the key will be in the index’s response to a resistance area around 3,114 to 3,245.

It is significant that the index showed negative momentum divergence in 2015 and that price has declined consistently since then. However, the downward move has not displayed the impulsive (non-overlapping) character that would justify a more firmly bearish interpretation. Instead, the decline has presented overlapping moves, leaving open the possibility of a downward leading diagonal – the more gentle way to start a reversal.

If the index tests and falls away from the resistance area shown on the chart, that would make the assignment of a leading diagonal more favorable. It also would suggest that the next move should be a strong, impulsive downward wave, which could perhaps test near 2,300.

Our July email bulletin shows more detailed Elliott wave counts on weekly charts for this and other European stock indices. You can request your copy via this link.