The Capital Market is a jungle, and everyone is on a hunt for yield. Every investor is trying to maximize the return and minimize the risk, that goes without saying. But what happens when the “safe” yields are at zero (or below)?

As investors, our goal is to earn the highest yield possible, given our risk appetite. The more risk-averse we are, the less yield we can get, as our scope of our investment will be narrowed down to the “safest” assets, such as High Graded Government Bonds (US, Germany, Canada, and Switzerland). The problem nowadays, is that most yields (in the developed countries) are either near or below zero, which means that we are better off putting our money under the mattress. The very abnormal loose monetary policy by central banks around the world sent investors seeking yields somewhere else, but that comes with at cost, a cost of high volatility and possibly, significant losses.

Generally speaking, in periods of calm markets and positive risk sentiment, investors will put Carry Trades. A Carry Trade is a very simple trade to comprehend: Investors will borrow money at a low rate and invest in an asset that will pay higher interest (either via Dividend, Coupon, or Interest Rate). Carry Trades are very common in Emerging Markets and commodity-exporting countries, where typically the interest rate is higher in these markets (due to inflation and political risks, which usually hover above these markets).

By now you are probably asking yourself: “That sounds like a no-brainer, why doesn’t everyone go and invest in Carry Trades?” Well, there are no free lunches in capital markets, that’s the harsh truth. Let me tell you a little story, about a very famous Carry Trade that was the darling of the hedge fund community back in the 1990’s – “Short Japanese Yen”. During the 1990’s the Bank of Japan cut its interest rate to near zero rate (something which is quite usual nowadays). But back in the 1990’s it was very unusual, which made the Yen a very good candidate to be a funding instrument. Investors would borrow in Yen, invest in high-yielding assets, and profit the spread between the yields that they earn compared to the interest they pay on the Yen loan. One doesn’t need to be a genius to understand why investors fell in love with the Yen Carry Trade – borrow for cheap, and invest in yielding assets (or, in other words : “buy low, sell high…”)

Hedge Fund started putting on huge carry trades in 1995, and that has worked amazingly, until it didn’t… In 1997-1998 the financial market experience was a very volatile period, which sent investors seeking shelter (in the form of safe-haven assets).The great fear of a market meltdown caused the funds’ investors to withdraw the money from their accounts. As investors sought the safe haven assets, they unwound the Carry Trades and liquidated their portfolios. This triggered a massive appreciation of the JPY.

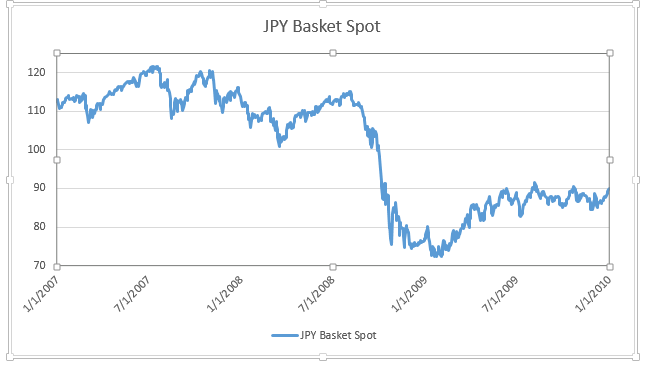

As we all know, the markets’ memory is sometimes short-lived, and greed usually overcomes fear. The following time investors began putting Carry Trades was in 2003, when the Federal Reserve cut its interest rate extreme low (relative to that period). The lack of alternative, in conjunction with stable markets, sent investors seeking yields elsewhere, and the easiest trade was again, the Yen Carry Trade. That trade, as it happens every time, ended with investors’ tears once the cracks in the US housing market started surfacing (and once the Federal Reserve raised its interest back to “normal”). During the years 2007-2009, the Yen appreciated about 40% against a basket of high-yielding G10 and Emerging Market currencies. Needless to say that the carry investors’ earnings did not compensate for the loss…

So we understand what happens when a Carry Trade goes wrong, but we need to ask ourselves: “why does this happen over and over again?

In Capital Markets, investors are always on a scale, ranging between “Greed” and “Fear”. The greedier we are, we will seek higher return (and take more risk). The more cautious we are, the safer investment we will seek. In quiet periods where volatility is low, investors will be inclined to seek risky investments. While in volatile periods, investors will most likely cash out of the market. This behavior of investors is the main risk factor of the Carry Trade. When things hit the fan, no one wants to earn yield, they all just want to run for cover.

How can we use Carry Trade in our portfolio, but still make it work?

- Firstly, we need to establish one thing – Carry Trade is NOT a bad investment. In most days it will be yielding profits, and it is a relatively easy investment (as easy as going LONG yielding currency, while going SHORT low-yield/funding currency).

- Secondly, when we analyze the return of a Carry Trade, we need to assess the “Risk Adjusted Return”. Meaning the return compared to the risk (or volatility). A good measurement of that would simply be to divide the return by the volatility (preferably using a 3-month historical volatility). Once you use that, you can compare different investments and rank them.

- Thirdly, set a portion of your portfolio to Carry Trades. That way, even if you experience a turbulent period, you will not suffer great losses and you can still can hold the position.

- Lastly, don’t get too GREEDY. Set your expectations with regards to how much you want to earn and stick with that. Timing the markets is extremely difficult, and as we saw, markets tend to be very brutal when it comes to steep declines. If you see that everyone around you is getting too comfortable and greedy, you should start planning your exit strategy….