If I had a dollar for each time I’ve heard someone insinuate that trading should be as simple as identifying a trend then jumping on the bandwagon, I would be a wealthy woman. Looking at a chart of crude oil falling from $100 to $26 per barrel, or the e-mini S&P peaking near 1,500 in 2007 and reaching 660 before finding a lasting bottom a few years later, one would assume being short these markets were easy trades producing massive wealth to speculators. However, as they say—“The grass is always greener on the other side.” I would venture to argue that making money on those historical trades might have been more difficult for trend traders than meets the eye. Unfortunately, not everyone is properly prepared or equipped to implement a trend trading strategy successfully. That said, those trend traders who are, likely walked away with massive riches.

There is no getting around the fact that trading is a game of probabilities. In fact, ignoring transaction costs it is a zero sum game. For every winner, there is a loser and vice versa. Accordingly, each speculation carries the risk of loss as well as a probability of success. However, too many traders either disregard the prospects of an unfavorable trade, embellish the proposed odds of success, or simply allow a lack of patience to alter judgments as to what constitutes high probability trading.

Traders generally assume trend trading is the highest probability trading strategy. After all, the trend is your friend, right? Ironically, trend traders face dismal odds of success on any given venture; yet massive gains are possible for the few trades that do work out favorably. Those choosing trend trading must fully understand this, and proceed accordingly.

Because of the challenges of trend trading such as deep stop loss orders and hefty per trade risk, combined with the odds of losing 60% to 80% of trades, successful trend trading requires extremely deep pockets, nerves of steel, and an exceptional amount of discipline. As a result, what is often deemed to be a high probability trading approach is, in reality, a painful and expensive lesson for the average retail trader.

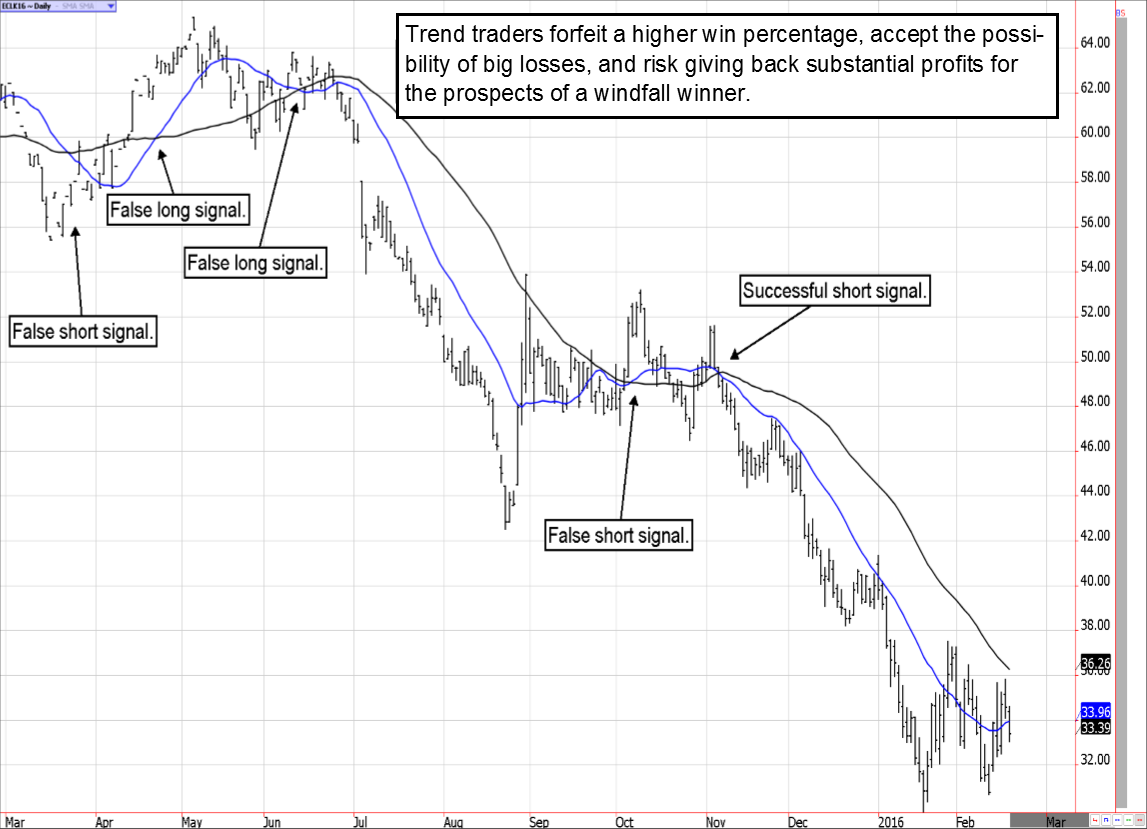

Not all traders are capable of successfully employing a traditional trend trading strategy. To put this into perspective, the notorious trend trading group “The Turtles” would have needed nearly $200,000 per one lot in the e-mini S&P to keep their funding and risk parameters intact. Further, even in some of the most compelling trends, profitable trend trading is gut wrenching. In the accompanying Figure 1, it is clear that a traditional trend trading system would have likely suffered multiple losses anywhere from $1,000 to $3,000 in crude oil futures, or $1.00 to $3.00 in price movement, before catching the “big” move.

Many trend traders might have run out of conviction, or money, before the strategy paid off.

Figure 1

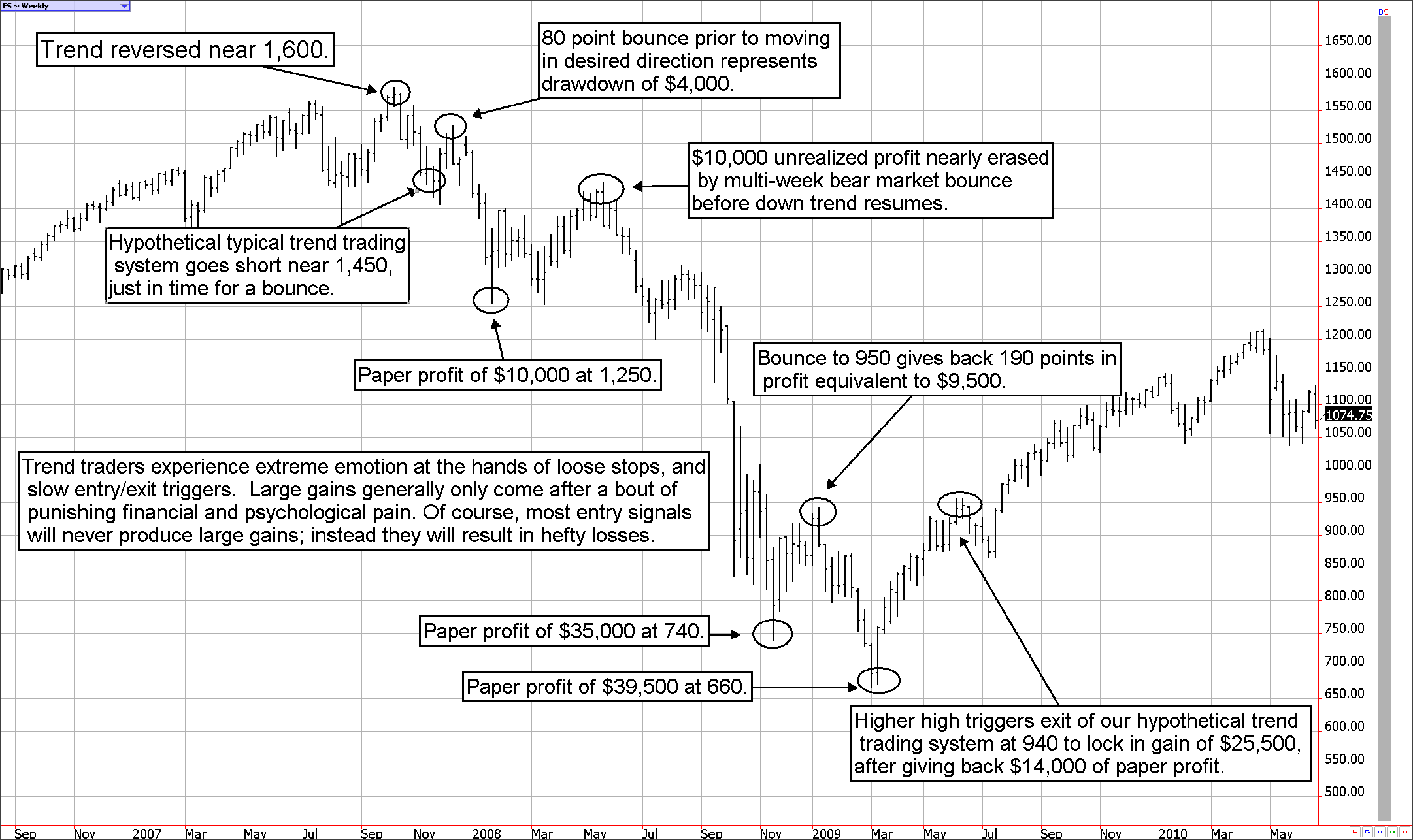

Even a trend trader having the foresight and ability to go short and hold it through the financial collapse would have endured substantial emotional turmoil before the fruits of his labor paid off. As Figure 2 depicts, accepting a short signal in the e-mini S&P near 1450 in 2007 and holding through the decline to 660, wouldn’t have been the easy money many might assume it was in hindsight. Specifically, the trade might have suffered a $4,000 drawdown immediately following the entry signal, and months later a $10,000 profit would have been completely wiped away before the real selling began. Finally, after one of the largest equity market sell-offs in history, the typical trend trading method might have given back nearly half of the gain before being stopped out of the trade. In short, the average trend trading system will reveal that the trend can be your foe just as much as it can be your friend. Massive drawdowns and mental suffering are a part of the game.

Figure 2

That said, traders working with five-figure trading accounts, as opposed to six or more, might find trend trading success through the use of smaller futures contracts such as the e-micro gold, mini grains, or even the e-micro currencies. These smaller contracts eliminate the need for several hundreds of thousands on deposit in a trading account necessary for a typical trend trading strategy to work in the long run.

To illustrate, a mini corn futures trader going long at $3.40 per bushel is in control of roughly $3,400 worth of corn with a required margin of about $300. If he has at least $3,400 on deposit he has essentially eliminated the leverage built into the futures market. In turn, the trader has dramatically increased the odds of being able to productively trend trade the market with appropriately deep stop loss orders and the ability to avoid emotional obstacles such as panicked liquidation. It also mitigates the probability of funding issues such as margin calls interfering with the end result.

In a nutshell, the best way to increase the odds of success is to practice a base hit strategy and leave the home run swings to those with extraordinarily large risk capital.

Carley Garner is the Senior Strategist for DeCarley Trading, a division of Zaner, where she also works as a broker. She authors widely distributed e-newsletters; for your free subscription visit www.DeCarleyTrading.com. She has written four books, the latest is titled “Higher Probability Commodity Trading” (July 2016)