Like many commodities, grains have been subject to deflation as the U.S. Dollar has strengthened during the past four years. However, even though we think the Dollar can rise higher, the downward trend in grains might be nearly complete. As we turn our newsletter focus to grains this month, here we chart corn futures as one example of a contract that may be ready to bounce.

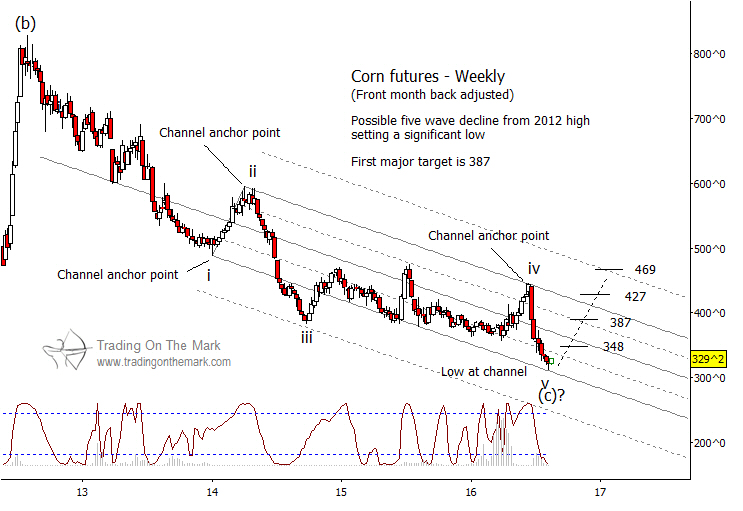

The larger structure since 2008 (shown in part on the weekly chart below) appears to be a three-wave (a)-(b)-(c) corrective move. Per Elliott wave rules, downward wave (c) should consist of five sub-waves, which we have labeled.

While it is too soon to be certain that corn futures have actually made a low, we favor the idea because of the presence of nearby channel support along with a cyclic low detected by the Lomb periodogram (the maroon indicator at the bottom of the chart). Note especially how well price has behaved within the channel that is anchored on sub-waves (i) and (ii). Wave (iii) tested a harmonic of the channel, and wave (iv) ended with a classic test of channel resistance.

Based on the recent low on the weekly chart, preliminary upward targets for a bounce include 348, 387, 427 and 469.

Our August email bulletin will focus on this and other tradable grain products and will explore possible timing for the expected rallies. Request your copy via this link.