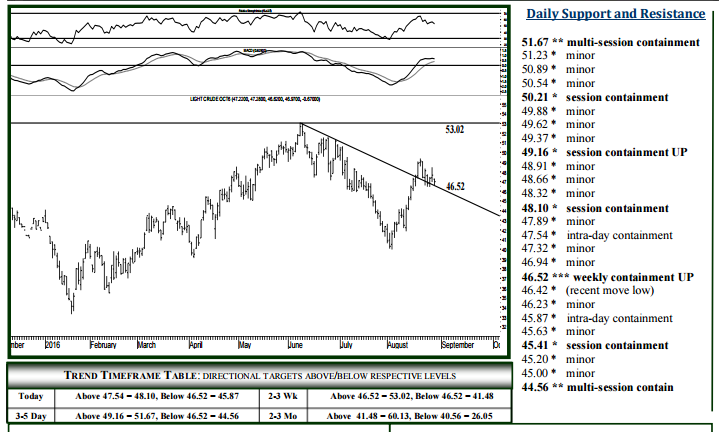

SHORT-TERM (today 5 days out)

For Tuesday, 46.52 can contain weekly selling pressures, above which 53.02 remains a 2-3 week target. Upside today, 57.54 should contain initial strength, while pushing/opening above 57.54 signals 48.10 intraday, able to contain session strength. Closing today above 48.10 indicates 49.16 tomorrow, also able to contain session highs when tested and the level to settle above for sustaining a bullish dynamic into later week; 51.67 considered a 3-5 day target above 49.16. Downside today, breaking/opening below 46.52 allows 45.87, possibly 45.41 intraday, while closing today below 46.52 (and for technical clarity below last week’s 46.42 low) indicates a heavy dynamic into midSeptember, 44.56 then expected by Friday’s close, the 40.56- 41.48 region within several weeks.

MID (2-3 wks) & LONG TERM (2-3 ms )

The 46.52 level can contain selling into later September, above which 53.02 remains a 2-3 week target, 55.82 in reach over the next 3-5 weeks where the broader complex should top out through October activity. A daily settlement above 55.82 indicates 60.13 within several more weeks, longer-term resistance likely to contain strength through the balance of the year – possibly well into 2017. Downside, a daily settlement below 46.52 indicates a good high through September, the 40.56 – 41.48 region then considered a 2-3 week target, a narrowing range of support (41.48 page 2) able to contain through October and a meaningful downside tipping point into later year.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE