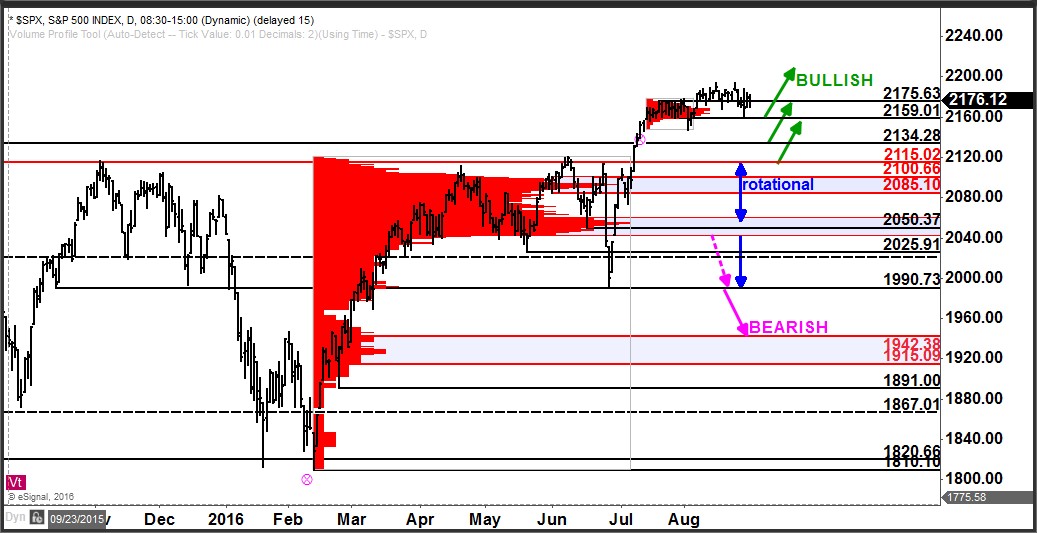

The S&P 500 index ($SPX) has failed to make any significant upside progress since breaking out to new all-time highs in mid-July. So is the SPX just stuck? Has it run out of steam?

Click here to watch a video explaining how to read markets using volume at price.

The S&P 500 index has spent a month and half in a period of consolidation, true. This consolidation however is amid a much larger uptrend. In the larger context, this consolidation is healthy for the on-going uptrend.

The bias remains bullish with near-term support in the SPX at 2159 and lower support at 2134 and 2115. The bias will remain bullish while above these levels of support.

Only a move below 2100 would shift the big picture bias and advantage away from the bulls.