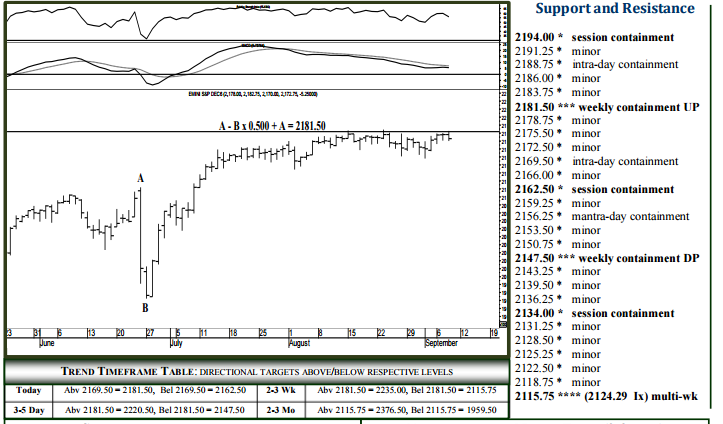

SHORT-TERM (today and 5 days out)

Please note this letter begins December 2016 contract analysis. For Thursday, the 2181.50 region can absorb weekly buying pressures, below which 2162.50 is attainable within 1-2 days, 2147.50 within 3-5 days. Downside today, 2169.50 should contain initial selling, while breaking/opening below 2169.50 signals 2162.50 intraday, able to contain session weakness. A settlement today below 2162.50 indicates 2147.50 tomorrow, able to contain selling through next week, once tested the market prone to recovering into the 2181.50 region over this time horizon. A settlement below 2147.50 indicates a good high into later September, long-term support at 2115.75 then expected by the end of next week (page 2). Upside Thursday, pushing/opening above 2181.50 allows 2188.75, possibly 2194.00 intraday, while closing today above 2181.50 maintains a bullish trajectory into later September, 2220.50 then expected by the end of next week, 2235.00 within two weeks, 2284.75 in reach by the end of October.

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2181.50 level can absorb weekly buying pressures, below which 2147.50 remains ripe for testing within the week, 2115.75 attainable within several weeks. On that note, a daily settlement below 2147.50 should yield long-term support at 2115.75 within 3-5 days, able to absorb selling through the balance of the year and above which 2284.75 remains a 2-3 month objective, 2376.50 expected over the next 5-8 months. A surprise settlement over the next several weeks below 2115.75 would be considered a failed longer-term buy signal, essentially a valid sell signal into October trade, then expecting 2035.50 within 3-5 weeks, 1959.50 within several months. Upside, a settlement above 2181.50 is considered a mere matter of time, and if this week 2235.00 becomes a 2-3 week objective, the targeted 2284.75 formation (page 2) expected within 5-8 weeks were the SP-500 should top out on a monthly, if not quarterly basis.