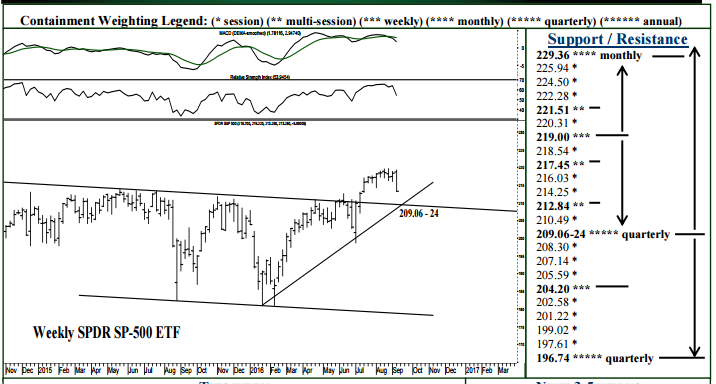

For the week ahead, both 212.84 and 217.45 can contain multisession (several days) activity, with a violation of either allowing the next notable level on an intraday basis. Upside, a violation of 217.45 allows 219.00 intraday, though a settlement may be needed above 217.45 to yield 219.00 the following day – 219.00 able to contain weekly buying pressures and below which the 209.06-24 region remains a 1-2 week target. A daily settlement above 219.00 signals 221.51 within the week, while closing the week itself above 219.00 shrugs off last week’s short-term sell signal, 229.36 then anticipated over the next 3-5 weeks where the SPY should top out into November. Downside this week, breaking/opening below 212.84 allows 209.06-24 intraday, significant support able to contain selling through the balance of the year and above which a bullish dynamic continues over this time horizon. A weekly settlement Friday below 209.06 indicates a good 2016 high, 204.20 then expected next week, 196.74 within 3-5 weeks where the SPY can bottom out through the balance of the year.