Record US Inventories and a Bearish Seasonal Demand Cycle Present Opportunities for Shorts

As a serious option seller seeking to build asset value and potential income independent of stock market swings, honing in on a group of core positions can be a good way to ramp up cash flow.

Selling crude oil calls has been a cash cow for much of 2016

Good core positions based on solid fundamental reasoning don’t necessarily have to change often. Variety and new horizons are often pursued by the amateur – trading for fun and entertainment. But if you’re simply after the cash, you should think of yourself as a gold miner; Once you hit a vein, you keep mining it till it runs dry.

The same holds true in option selling. Selling crude oil calls has been a solid cash cow for most of the year for the portfolios I manage. The fundamentals of this market have not changed much during that time. Why go to another well if there is plenty of water left in this one?

Does this mean you should not diversify your short option holdings? Of course not. It means that you shouldn’t abandon a position simply because you get “bored” with it – as in “We’ve been selling these crude calls all year – lets go sell some Orange Juice premium!”

This isn’t entertainment. This is cash mining. And a core principle of cash mining is that you don’t abandon profitable mines. You keep mining and mining and mining for as long as the cash keeps coming.

That’s why we recommended selling crude calls this spring, this summer and now this fall. Here’s a recap of current fundamentals and why selling calls in crude should, in our opinion, continue to be a cash cow this fall.

Bear Fundamentals: Going Nowhere Fast

Saying a market can’t rally is like saying it can’t rain. It can always rain anywhere in the world – although certain weather conditions can make it more or less likely – depending on location.

The same is true in crude oil. Prices can rally at any time. In August, they did. By late summer, funds had built a record net short position in the crude oil market. When this happens, the market becomes very vulnerable to short covering rallies. When the Saudis began talk of a production freeze last month, it was enough to trigger some of these funds to cover shorts. This drove the market marginally higher (although not enough to concern deep out of the money option writers.)

But the current fundamentals should continue to serve as a drag on any price rally and eventually pull prices back down. This is why you want to sell options in the first place. Short options are custom made to absorb a certain amount of adverse movement while waiting for the fundamentals to do their thing. These kind of fundamentals are what we feel will hinder bulls this fall.

These include:

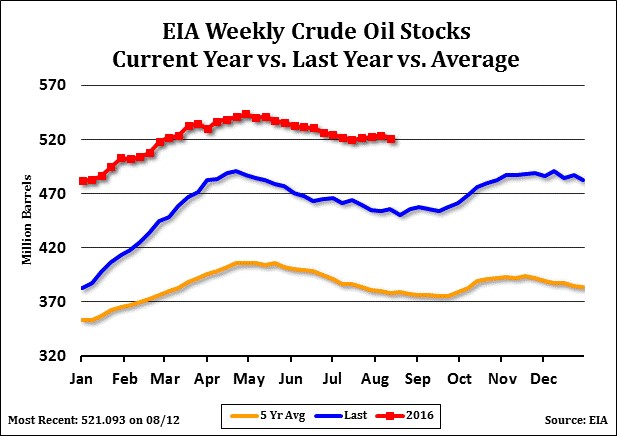

- 1. Record US Supplies of Crude. Oversupply is the proverbial Mammoth Gorilla in the room. No matter what the latest news story, its hard to ignore. And it doesn’t appear to be going away anytime soon. As of the August EIA report, Crude supplies in the US stood at 521 million barrels – an all time record for this time of year and 37% higher than the 5 year average for the same time of year and 14% higher than last year at this time.

Entering September, crude oil supplies remain at record levels in the US

News reports of outages and freeze talk are all fine and good. But at the end of the day, its hard for a market to sustain a rally with this big of a monkey on the market’s back.

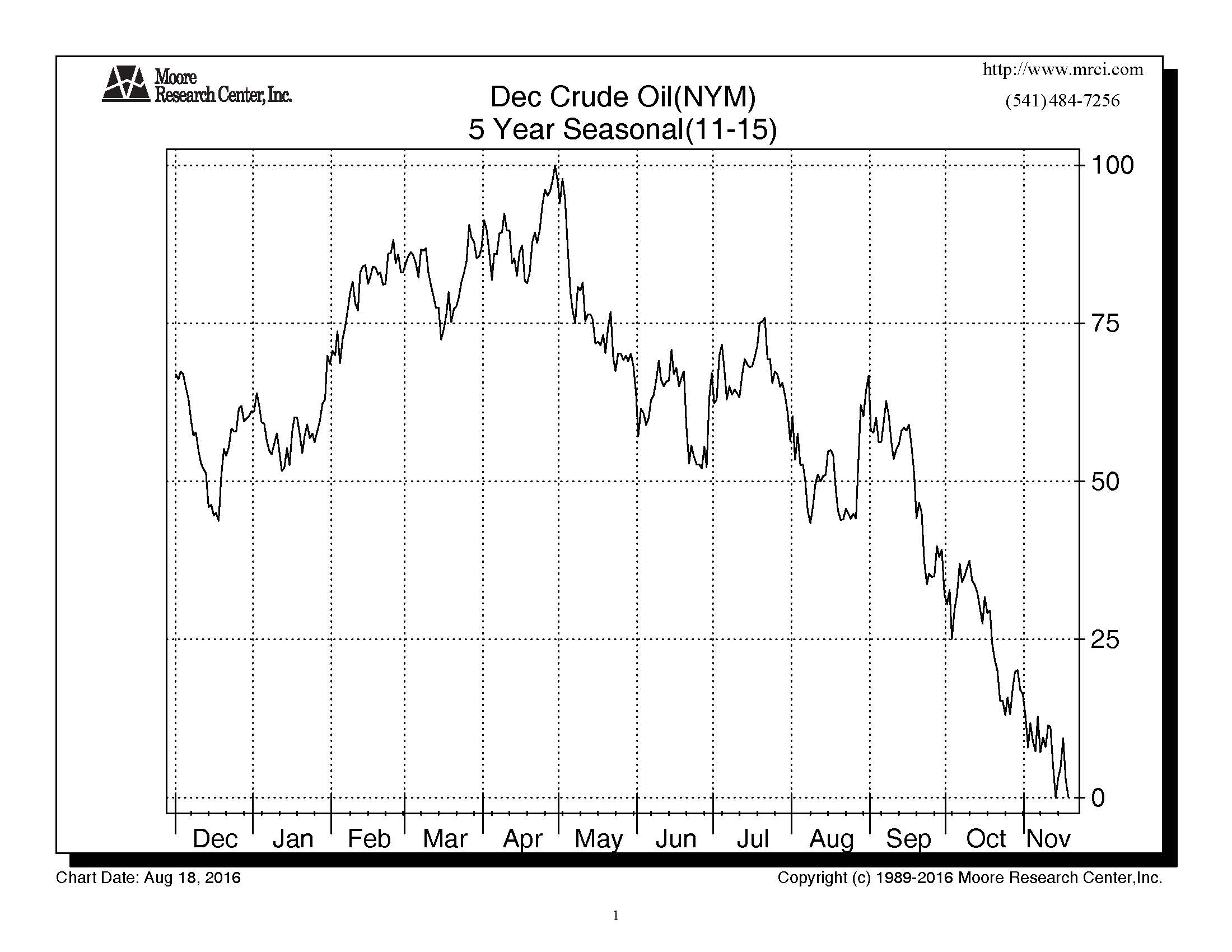

The Demand Cycle has now Shifted towards the Bears. September marks the beginning of “Shoulder season” in the US – a time of year typically characterized by weak demand.

Caption: Seasonally, crude prices have tended to decline in the fall.

As driving season has now ended but heating season has not yet begun, demand can find itself in a rut. This has historically often served as a weight on crude prices.

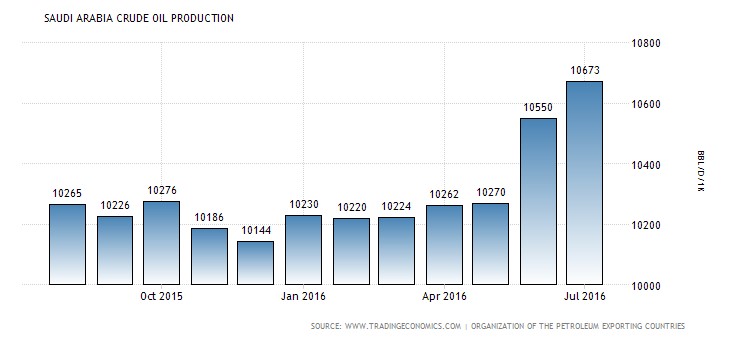

- 3. Freeze-Schmeeze: The Saudi’s have started talking production freeze a week after they announced record production of 10.67 million barrels per day in July. So now they want to freeze production? At all time record levels? It is our opinion that even if the Saudi’s do freeze production (a proposition that is questionable at best) “freezing” production at all time highs won’t have much impact on overall supply.

Ramp it up and then Freeze? The Saudi talk of freezing production at record levels would likely do little to dent crude’s longer term supply issues.

Conclusion and Strategy

With record supplies and bearish seasonal tendencies, we feel any rallies in the crude oil market will be of limited nature – at least into late 2016.

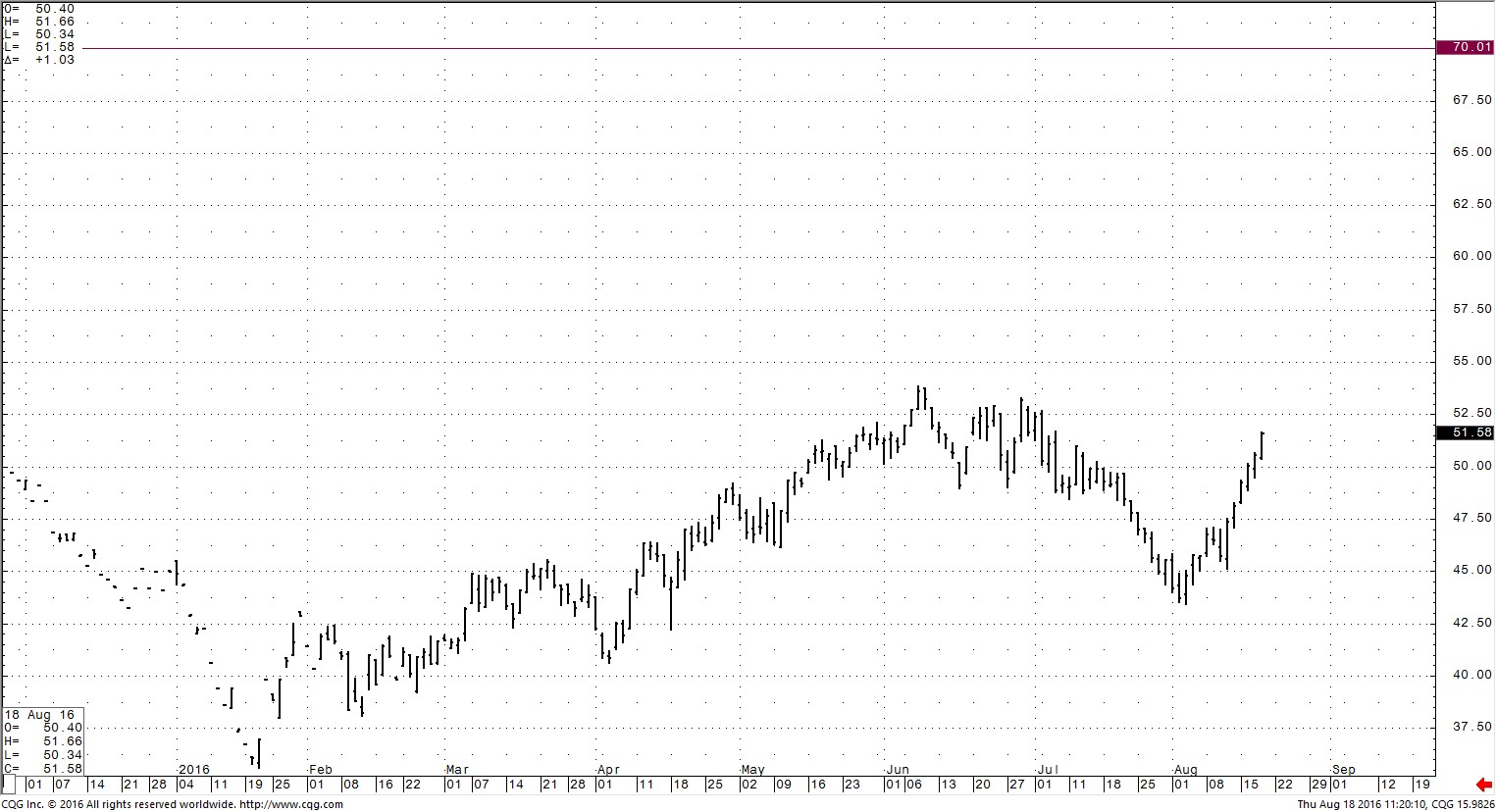

We’ll continue to position managed portfolios this month to take advantage of distant call premium in the crude market. Non-clients can consider selling the March Crude Oil 70.00 calls. At the time of this writing, these options are offering premiums near $600 each.

March 2017 Crude Oil

(CHART HERE)

Selling the March 70.00 Crude Oil Call leaves a wide cushion for the market to rally while still positioning for bearish fundamentals.

If crude prices do indeed see a seasonal decline into December, profits on these options could potentially be reaped by years end. Remember, one of the top lessons in option selling is this: for short calls to profit, the market doesn’t necessarily have to decline. It only has to stay below your strike – in this case, $70 per barrel.

Despite the Saudi rumbling, we simply don’t see that happening.

For more information on managed commodity option selling accounts with James Cordier, visit www.OptionSellers.com/Discovery for a free information pack.