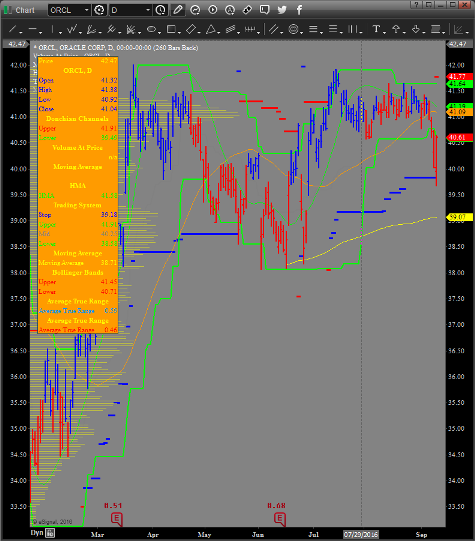

Going through a day like Friday for those traders who are not day trading can be tough to say the least. A 50+ point drop in the S&P will send shivers down traders old and new alike. But all is not lost. Pullbacks like this often give us opportunities we didn’t have before. Take Oracle (ORCLE), who report earnings Thursday after the close. The chart has been pretty darn strong since bottoming out shortly before the last earnings report and then continued north:

We see that Friday’s price action took ORCL along with it. Given its recent strong earnings performances and with their sector being very strong as well, we signaled the following call DIAGONAL:

“Based on our methodology, a signal has been generated:

Sell (opening) the September 42.5 call

Buy (opening) the October 42 call

For a debit of $0.25 or lower”

After modeling out where we see implied volatilities after earnings, we project approximately 100% return if the underlying goes to the ideal price of $42.50.