Energy stocks offer many challenges to investors and traders alike. There are many reasons that investors might be tempted to buy these names: there is the heroic challenge to bottom pick, the sense that anything that has sold off so long and so persistently must, somehow, be “on sale”, and the recent outperformance of recent weeks creates more emotional tension. All in all, this is an environment that encourages mistakes.

To be clear, our analysis suggests that it is far too early to look for wholesale heavy allocations to energy stocks. There will be a time when we can buy virtually any energy stock and receive enough support from the sector that it will be hard to lose money. That time is not now.

For now, we see significant directional challenges to crude oil, and a number of longer-term patterns that suggest a further selloff might be in the cards. Though energy stocks cue off of a mix of stock market beta, oil direction, oil volatility, and the crack spread (for refiners), none of these factors are particularly supportive for the sector.

There are, however, a few standout names that have patterns suggesting longer-term trend change may be underway. Chesapeake (NYSE:CHK) is one such name. For active traders looking to time entries, yesterday’s action and subsequent selloff may offer an attractive entry point. There are many reasons to discount the activities of activist investors, or at least to relegate their influence to a very minor factor in the analysis. We like to see stocks that decline on relatively insignificant news as this often highlights an opportunity to make money by fading the crowd. Furthermore, stocks tend to mean revert; selloffs are frequently reversed a few days later, so a disciplined program of buying declining stocks (with solid risk controls) can yield strong short-term gains. These gains can also be spun into longer-term entries, in the right types of names and patterns.

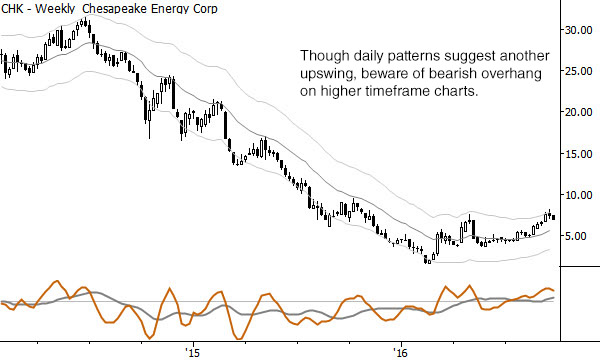

As far as specific entry points for NYSE:CHK, there are several possibilities. The formation on the daily chart is a two-legged bull flag, suggesting that any rally could lead to a much further advance—active traders can look to buy upside breakouts, using virtually any entry trigger. Longer-term (monthly and higher) timeframes do hold some bearish potential, so prudent traders will look to limit risk with active stocks.

In this case, we have a solid alignment of a selloff driven by narrative and insignificant news with a stock that shows leading price patterns in the sector. There is opportunity to make money by fading the crowd here, but, as always, risk control and trade management are essential.