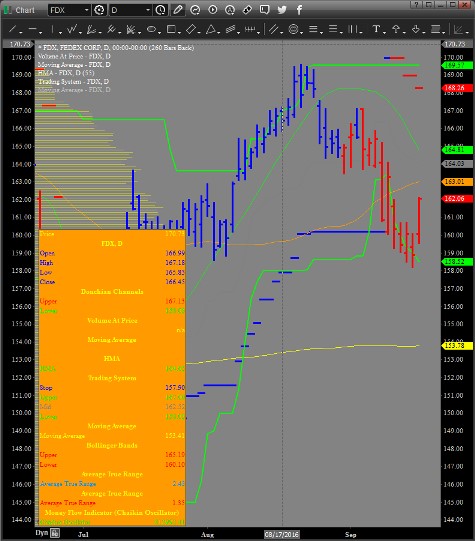

The logistics sector certainly has its share of headwinds as we move into the 4th Quarter 2016. We have a precarious world economy, a massive bankruptcy with South Korea’s largest shipper Han Jin and unpredictable global demand. This is not great news for a company who sole existence is based on the flow of goods around the globe. The chart seems to echo these concerns:

Couple that with bearish moves after the earnings report release five out of the last eight cycles and you have a very compelling bearish bias. We signaled the following:

9-19-16: Based on our methodology a signal has been generated:

Sell (opening) the FDX September 23rd WE 152.5 strike put

Buy (opening) the FDX October Regular Expiration 152.5 strike put

For a debit of $0.90 or less.

This signal is not GTC, is a DAY ORDER ONLY and is valid with FDX trading $160 – $162.50.

If we get the ideal measured move to 152.5, our model predicts a return on risk of 84.44%.