UVXY, SPX and the FOMC

The ProShares Ultra VIX Short-Term Futures ETF (UVXY) is a popular vehicle for traders looking to play changes in volatility. With the FOMC meeting announcement later today, traders should be prepared for the SPX (and UVXY) to be on the move.

Click here to watch a video explaining how to read markets using volume at price.

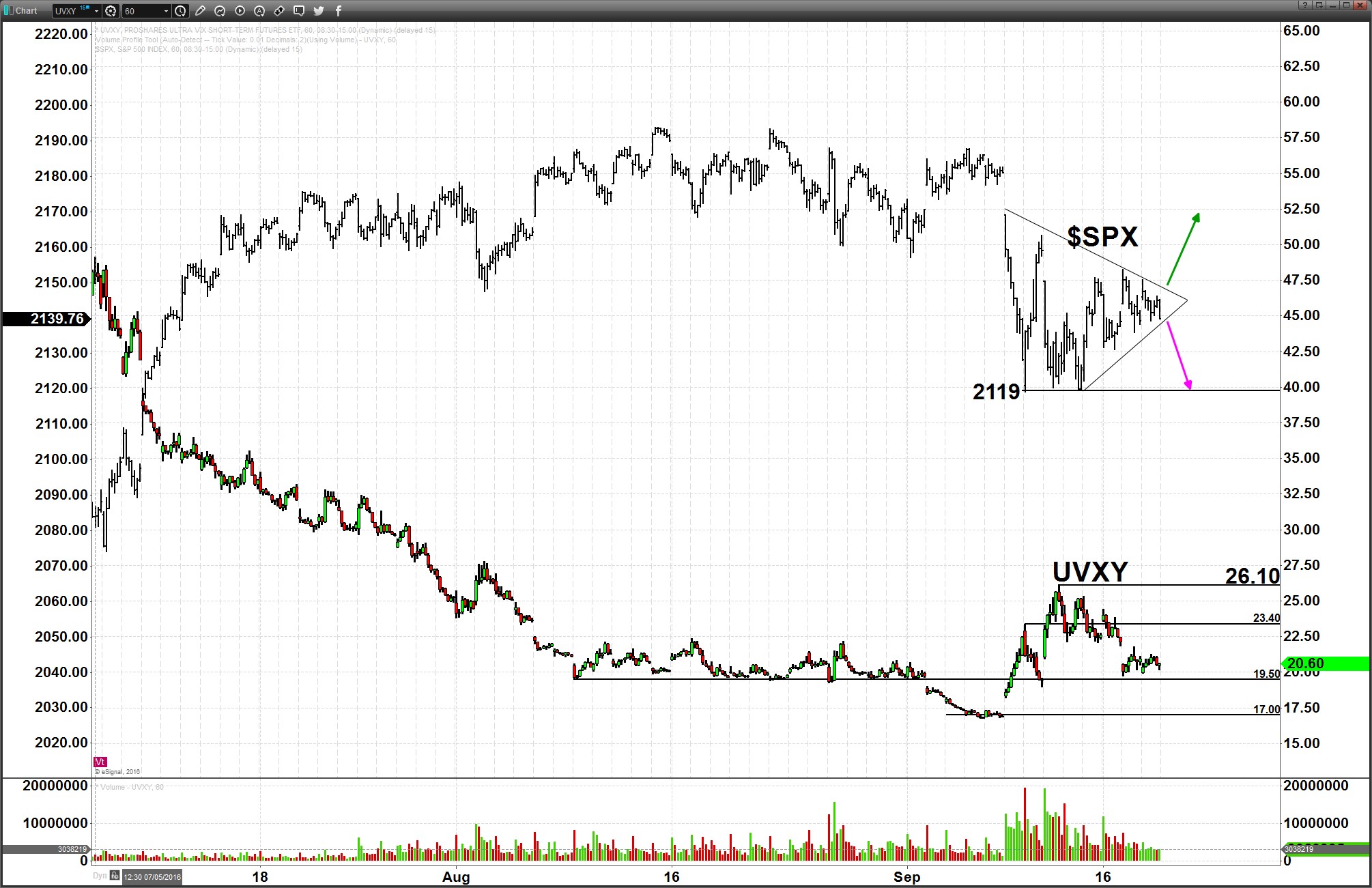

As you can see on the chart, the initial selloff in SPX down to the 2119 low saw UVXY trade up to 23.40. On the subsequent test of the 2119 low, UVXY pushed up to 26.10. Following the FOMC announcement, if SPX breaks lower from the contracting triangle it has been forming, look for UVXY to push to the upside. On another test to 2119, we could see UVXY push to 26.10 and higher, especially if SPX breaches 2119.

If the SPX breaks higher following the announcement, UVXY will decline back below the 19.55 level and head for the recent lows at 17.50 and 17.00.