A big part of successful investing and trading is knowing what matters. To make the game even harder, what matters changes from time to time. For stock traders, sometimes the stock matters. Sometimes it’s a stock pickers market and we want to focus on sector plays, deep value plays, finding and massaging entries, and trading the dynamics of each individual position. At other times, stock selection matters less because the broad market is the driver. In these environments, it almost doesn’t matter what stock you pick because you’re going to live or die based on the direction of the overall market.

This is where we are today—in this environment, stock picking matters less and it’s all about the direction of major indexes. So, I thought it would be useful to look at a few important factors in those major indexes, and to consider how price action might unfold over the next few weeks.

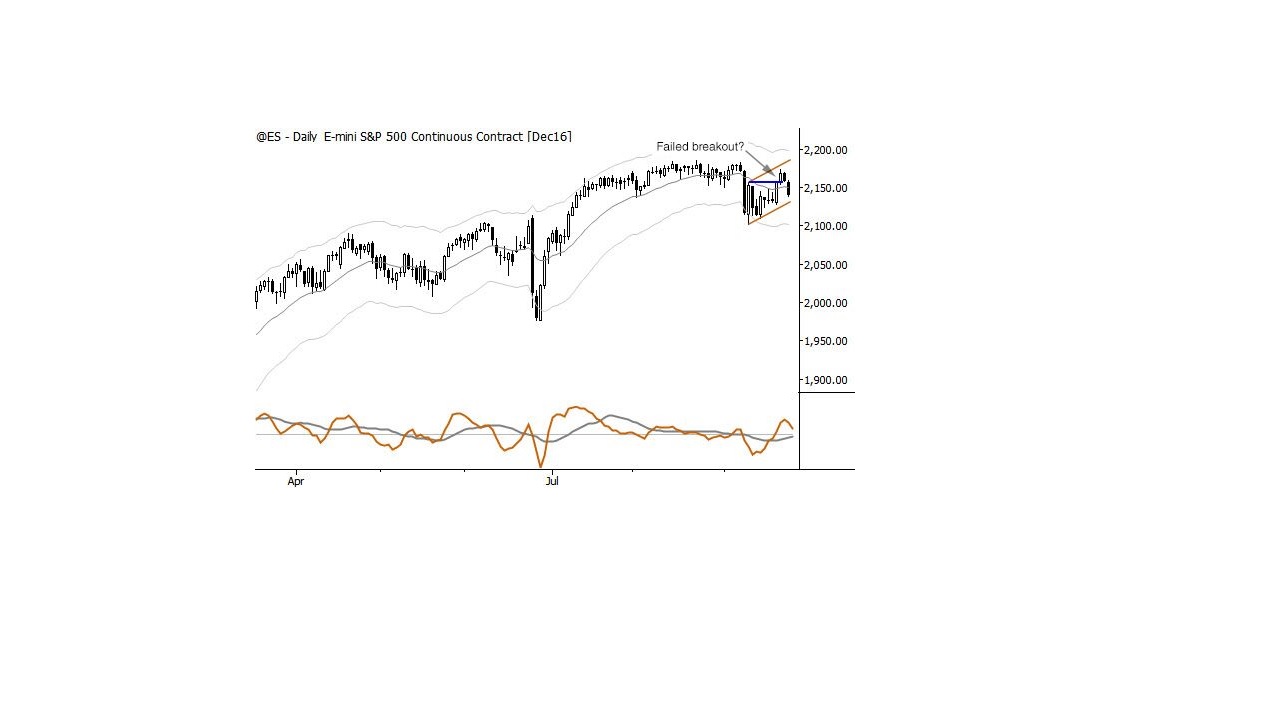

First, we have a situation in which most major indexes are painting “bear flags” in daily charts (outlined in orange on the chart.) This is a real and quantifiable pattern in which a sharp drop is followed by a quiet and reluctant bounce; when we see this, it often sets up another selloff, and sometimes a significant selloff.

Second, these bear flags appeared to be on the verge of breaking down last week, on the positive follow-through from the Fed’s no surprise decision. This breakout seems to have failed early this week, perhaps giving further teeth to bears’ argument. (The failed breakout is marked with an arrow on the chart.)

But we also need to consider the overall market environment: This is a market that sees nearly daily mood reversals—not mood swings—wholesale flip flops from despair to mania on a day to day basis. In recent weeks, you could have approached the market with the game plan that “today will be the opposite of yesterday” and probably made money! Furthermore, there’s not a lot of volatility and conviction behind any move, as the market likely waits for a catalyst.

So what does this mean? It means we cannot have high convictions. If you don’t have to trade, it might be a good time to step back or at least to reduce exposure. If you do have to trade (as many professionals do), then look to reduce risk and quickly admit when you’re wrong.

One scenario deserves attention: should the market break down out of the bear flag, with strong downward momentum, this could jeopardize any prospects for a near-term rally. Strong downward momentum could be defined as 30-50 point down days with no significant bounces. Such a decline targets a move into the low 2,000 (basis cash index), or perhaps even to the 2016 YTD lows. Also, such a decline could be very constructive and very healthy for the still-intact bull market, but that’s another story—that’s a longer-term story, and here, today, we need to be concerned with the short-term story of conflict, confusion, and, most important, risk management.